If you run a business, protecting your team is not just smart—it’s essential. That’s where a workers comp policy online comes in.

Imagine getting the coverage your employees need without the hassle of long paperwork or endless phone calls. You want a simple, fast, and reliable way to secure workers’ compensation insurance that fits your business and budget. You’ll discover how to find the best online workers comp policies, what to look for, and how to get started today.

Keep reading to learn how easy it can be to protect your business and your people with just a few clicks.

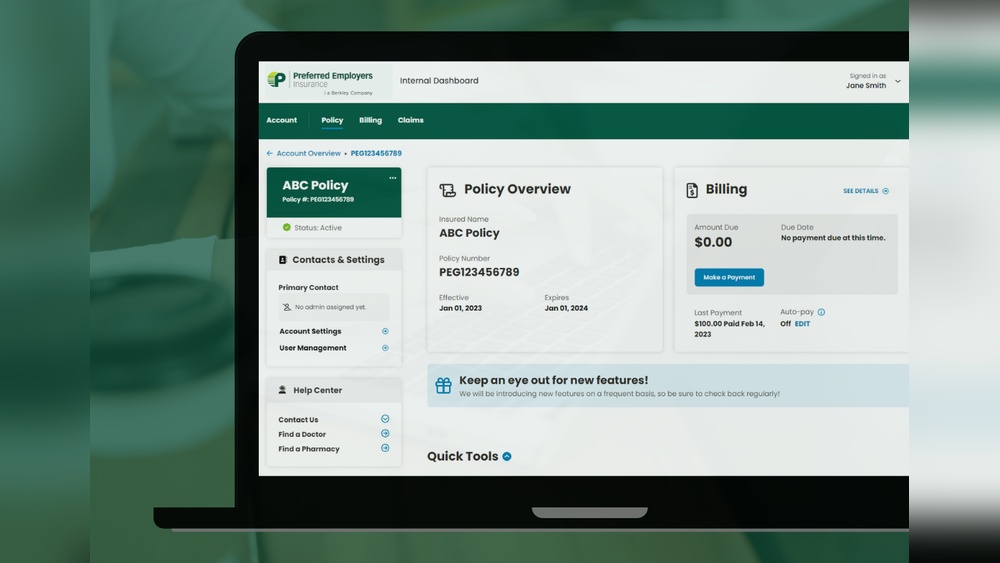

Credit: www.employers.com

Benefits Of Online Workers Comp Policies

Online workers comp policies offer many advantages for businesses. They simplify managing insurance and claims. Companies save time and money by choosing digital options. Easy access to policy details helps employers stay informed. This section explores key benefits of online workers comp policies.

Faster Claim Processing

Submitting claims online speeds up the entire process. Digital forms reduce errors and missing information. Claims reach insurers immediately, cutting wait times. Quick reviews mean injured workers get support sooner. Faster claim handling helps businesses avoid long delays.

Cost Savings Opportunities

Online policies often cost less than traditional ones. Insurers save on paperwork and office expenses. Savings are passed on to policyholders through lower premiums. Automated tools help find the best rates. Businesses can manage payments and renewals easily to avoid extra fees.

Convenience And Accessibility

Access your workers comp policy anytime, anywhere with internet. Online portals allow easy updates and document uploads. Employers can track claims and coverage details in one place. No need to visit insurance offices or mail forms. This convenience saves time and reduces stress.

Choosing The Right Online Provider

Choosing the right online provider for your workers comp policy is crucial. The right choice ensures your business and employees stay protected. Many providers offer different plans and services. Picking a provider that fits your needs saves time and money.

Comparing Coverage Options

Look closely at what each provider covers. Some policies include more benefits than others. Check if the policy covers medical bills and lost wages. Consider additional services like legal support or injury prevention programs. Choose a plan that matches your business size and risks.

Evaluating Customer Support

Good customer support is essential for quick help. Check if the provider offers phone, chat, or email support. Fast responses reduce stress during claims or questions. Read reviews about their support quality. A helpful team makes managing your policy easier.

Checking State Compliance

Workers comp rules vary by state. Make sure the provider follows Texas laws if your business is in Austin. Verify that the policy meets all state requirements. A compliant policy protects you from fines and legal trouble. Confirming compliance is a smart step before buying.

Steps To Purchase Workers Comp Online

Purchasing a workers comp policy online simplifies the entire insurance process. It saves time and helps you find the best coverage quickly. The process involves three main steps that anyone can follow. Understanding each step ensures a smooth purchase experience.

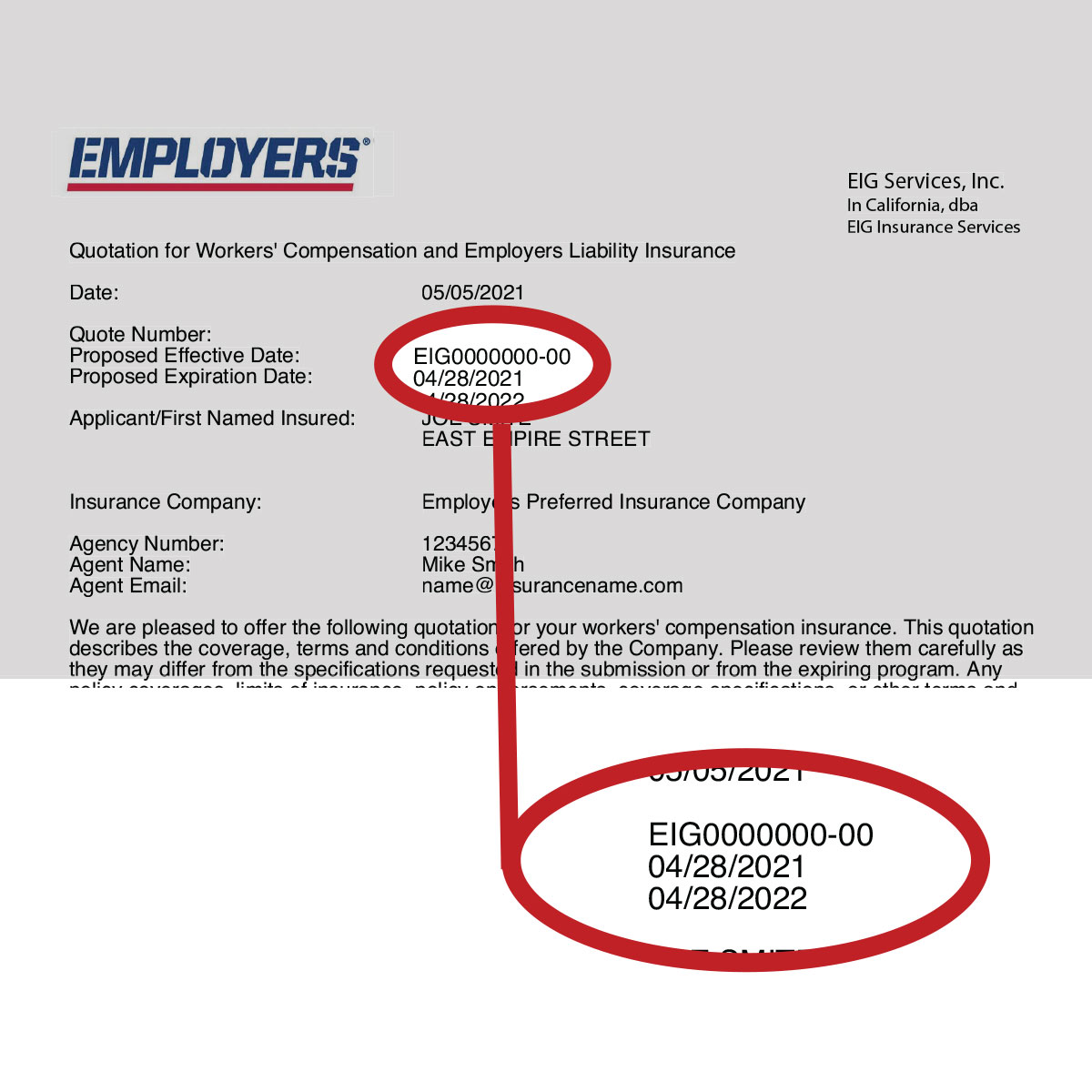

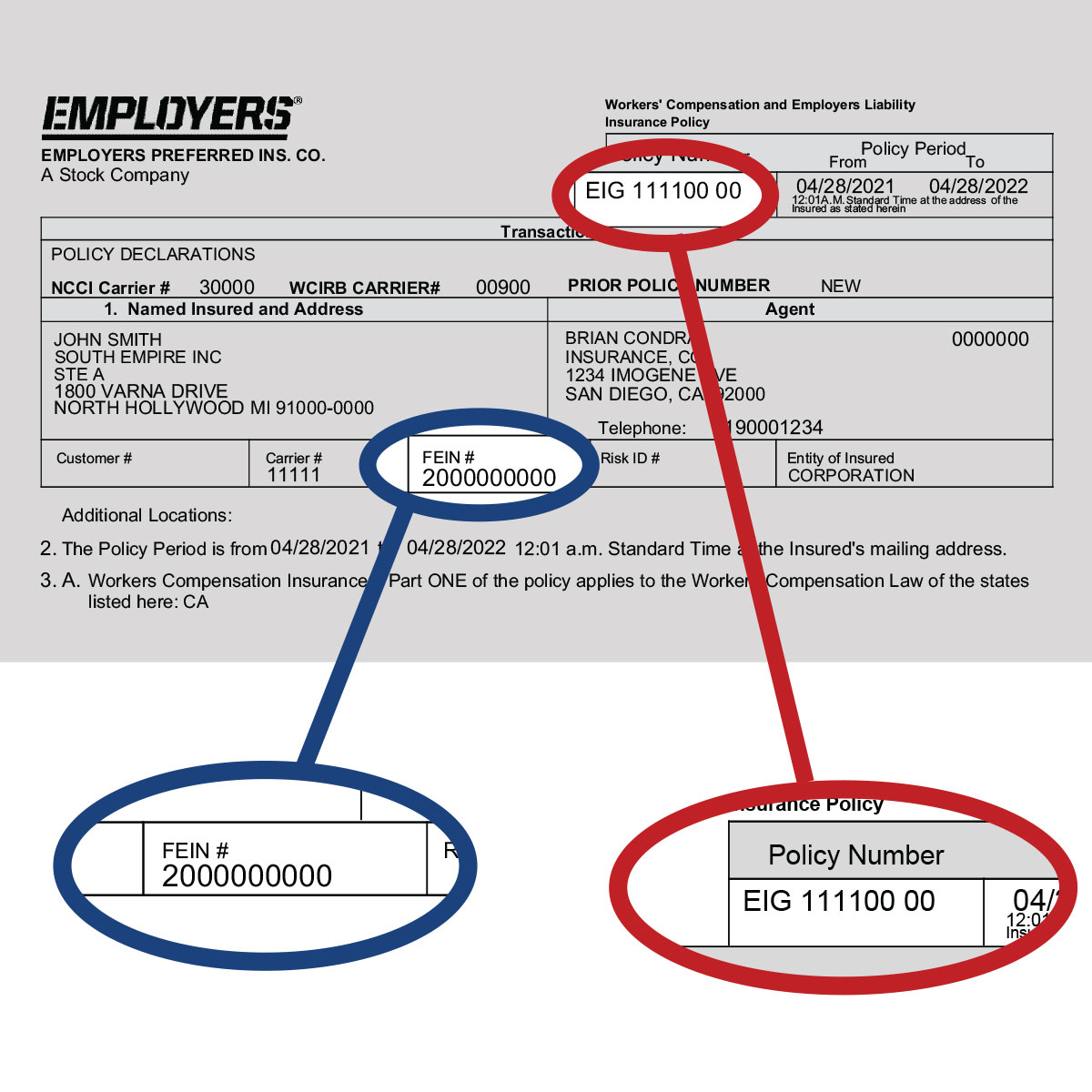

Gathering Required Information

Start by collecting all necessary business details. You will need your business type, number of employees, and payroll data. Prepare information about your work environment and job risks. This data helps insurers calculate accurate quotes. Having these details ready speeds up the process.

Getting Instant Quotes

Use online tools to get workers comp quotes instantly. Enter your gathered information into the quote form. The system will compare different insurance providers and plans. You can review coverage options and prices side by side. This step lets you choose the best policy for your needs.

Completing The Application Process

After selecting a policy, proceed to fill out the full application online. Double-check all your information for accuracy before submitting. Some insurers may ask for additional documents or verification. Once approved, you can pay for your policy securely online. Your workers comp coverage starts right after payment confirmation.

Simplifying Workers Comp Claims

Workers comp claims can feel complex and slow. Moving these claims online makes the process simpler and faster. Digital tools reduce paperwork and speed up communication between employers, employees, and insurers.

Online systems give clear instructions and help avoid common mistakes. This ease helps injured workers get the support they need without delay. Employers also save time and effort managing claims.

Filing Claims Electronically

Submitting claims online saves time and cuts down errors. Forms are easy to complete and submit from any device. The system guides users step-by-step to ensure all details are correct.

Electronic filing reduces lost paperwork risks. It also confirms receipt instantly, giving users peace of mind. Employers can upload medical reports and other files quickly.

Tracking Claim Status Online

Online portals let users check claim progress anytime. This transparency reduces phone calls and uncertainty. Workers and employers see updates about approvals, payments, and needed documents.

Real-time tracking helps spot delays early. Users can respond faster to requests from insurers or medical providers. This keeps the claim moving smoothly.

Tips For Faster Claim Approval

Complete all forms carefully and honestly. Double-check that all required documents are attached. Submit medical reports promptly to avoid hold-ups.

Respond quickly to any insurer questions. Keep clear records of all communications and receipts. Following these steps speeds up approvals and payments.

Saving Money On Workers Comp Insurance

Saving money on workers comp insurance is important for every business. Lower costs help improve profits and keep your company safe. Smart steps can reduce your insurance premiums. These steps protect your workers and reduce risks.

Understanding how to save money on workers comp insurance helps your business stay competitive. Focus on safety, discounts, and claims management. These areas offer real savings and better coverage.

Implementing Safety Programs

Good safety programs lower workplace accidents. Fewer injuries mean fewer claims and lower costs. Train employees on proper safety practices. Use protective equipment and regular safety checks. A safe workplace shows insurers you manage risks well. This can reduce your insurance premium over time.

Taking Advantage Of Discounts

Many insurers offer discounts for small businesses. Discounts reward companies with low claims history. Some policies give savings for paying early or bundling coverage. Ask your insurance agent about all available discounts. Taking these discounts lowers your workers comp insurance costs.

Managing Claims To Reduce Costs

Handle claims quickly and fairly to control costs. Report injuries immediately to avoid penalties. Work with medical providers to ensure proper care. Help injured employees return to work as soon as possible. Proper claims management prevents higher premiums and legal issues.

Credit: www.employers.com

Workers Comp Rules In Texas

Understanding the workers comp rules in Texas is important for every employer. Texas has specific laws that protect workers injured on the job. These rules help ensure employees receive medical care and wage benefits. Employers must follow these rules carefully to stay compliant and keep their workforce safe.

Coverage Requirements

In Texas, most private employers are not required by law to carry workers compensation insurance. However, if an employer chooses to provide coverage, they must follow state rules. Public employers and certain industries must have coverage. Workers comp covers medical bills and lost wages for injured employees. It also protects employers from lawsuits related to workplace injuries.

Employer Responsibilities

Employers must report workplace injuries promptly. They should provide injured workers with information about their rights and benefits. Maintaining a safe work environment is mandatory. Employers who have workers comp insurance must cooperate with insurance carriers. They must keep records of injuries and any claims made. Timely communication helps avoid penalties and legal issues.

State Resources And Support

The Texas Department of Insurance offers guidance and support to employers and workers. It provides resources to understand workers comp laws clearly. Employers can find help with claims and insurance questions. The state also offers online tools to manage workers comp policies. These resources help businesses comply and protect their employees effectively.

Common Challenges And Solutions

Managing a workers comp policy online brings unique challenges. These challenges can delay claims, cause errors, or increase costs. Understanding common issues helps employers act fast and keep the process smooth. Practical solutions reduce stress and improve outcomes for all parties involved.

Handling Disputes Online

Disputes over claims arise often. Online platforms must offer clear communication tools. Timely responses help resolve issues quickly. Use video calls or chat features to clarify facts. Keep all conversations logged for transparency. This reduces misunderstandings and speeds up decisions.

Avoiding Fraudulent Claims

Fraud can raise costs and harm honest businesses. Online systems should verify claims carefully. Use data checks and cross-reference medical reports. Train staff to spot unusual patterns or false information. Prompt investigation deters fraud and protects the insurance fund.

Maintaining Accurate Records

Accurate records support smooth claims processing. Digital tools help store and organize data securely. Update records immediately after each claim step. Ensure easy access for authorized users only. Good record-keeping reduces errors and speeds up payouts.

Credit: berkleynet.com

Frequently Asked Questions

What Is A Workers Comp Policy Online?

A workers comp policy online is insurance bought through a website. It covers employee injuries and related medical costs. It offers convenience and quick access to coverage information and quotes.

How To Buy Workers Comp Insurance Online?

Visit an insurance provider’s website, fill out your business details, and request a quote. Compare plans, select coverage, and complete payment to buy your policy instantly.

Who Needs Workers Comp Insurance Online?

Employers with employees must have workers comp insurance by law. It protects workers injured on the job and helps businesses comply with state regulations.

Can I Get Instant Workers Comp Quotes Online?

Yes, many insurers offer instant online quotes. You enter your business info, and the system generates price estimates immediately. This speeds up policy purchasing.

Conclusion

Choosing a workers comp policy online saves time and effort. It ensures your employees get proper care after injuries. Online options provide clear pricing and easy comparisons. You can find coverage that fits your business needs. Keep your workplace safe and meet legal requirements too.

Start the process today to protect your team well.