Are you finding it harder to navigate your health insurance options? You’re not alone.

Health insurance today is facing serious challenges that can affect your coverage, costs, and access to care. From rising expenses to workforce shortages, and from complex regulations to growing mental health needs, these obstacles impact your experience more than you might realize.

Understanding these top 5 challenges will help you make smarter decisions about your health coverage and protect what matters most—your health and peace of mind. Keep reading to discover what’s behind these issues and how they could affect you.

Credit: www.netsuite.com

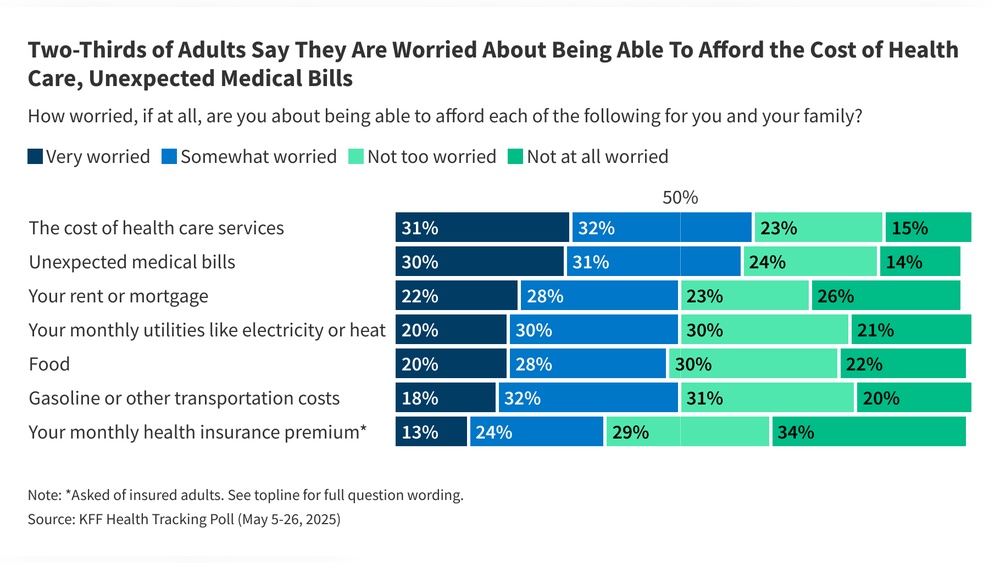

Rising Costs And Financial Pressure

Rising costs and financial pressure remain critical challenges in health insurance. These issues affect insurers, providers, and patients alike. The increasing expenses strain budgets and limit access to necessary care. Understanding key factors behind these rising costs helps explain the financial pressure facing the industry.

Inflation And Drug Prices

Inflation pushes up prices across the healthcare sector. Medical supplies, hospital stays, and labor costs all rise due to inflation. Prescription drug prices climb faster than many other healthcare expenses. New and specialty drugs often come with very high price tags. Patients and insurers struggle to keep up with these growing costs. Drug price hikes directly increase insurance premiums for everyone.

Claim Denials Impact

Claim denials have become more common among health insurers. When claims are denied, providers face delays in payment. This creates cash flow problems for hospitals and clinics. Providers must spend more time and money appealing denials. Administrative burdens grow heavier with frequent claim disputes. These challenges add financial stress to healthcare organizations and insurers.

Budget Constraints In Healthcare

Healthcare providers operate under tight budget limits. They must balance quality care with cost control. Investing in new technology and hiring skilled staff requires funds. Many organizations cut corners to save money. This can reduce patient care quality and increase provider burnout. Budget constraints also limit innovation and expansion of services. The financial pressure forces difficult choices in healthcare delivery.

Credit: billyforinsurance.com

Workforce Shortages And Burnout

Workforce shortages and burnout create serious challenges in health insurance. Staff numbers are dropping just as demand for care rises. This gap affects patient care quality and increases costs. Healthcare workers face intense pressure, leading to exhaustion and turnover. These issues strain the entire health system and insurance providers.

Nurse And Physician Deficits

The shortage of nurses and physicians is a major problem. Fewer professionals are entering the field, while many retire or leave early. This decline limits patient access to timely care. Insurance companies must manage higher costs due to delayed treatments. Rural and underserved areas suffer the most from these deficits.

Stress And Burnout Effects

Healthcare workers experience high levels of stress daily. Long hours and emotional strain cause burnout. Burned-out staff have lower productivity and make more errors. This reduces patient satisfaction and increases risk. Insurance plans face higher claims due to complications from rushed or inadequate care.

Administrative Burden Challenges

Healthcare providers spend too much time on paperwork. Complex billing and insurance rules add to their workload. This administrative burden reduces time for patient care. Staff burnout increases as they juggle clinical and clerical tasks. Insurers must find ways to simplify processes and support providers better.

Health Equity And Access Gaps

Health equity and access gaps remain a pressing issue in the health insurance sector. Many people face barriers that prevent them from receiving quality care. These gaps lead to unequal health outcomes and higher costs over time.

Addressing these challenges is crucial to create a fairer healthcare system. It requires focused efforts on care availability, mental health support, and managing chronic diseases.

Disparities In Care Availability

Access to healthcare varies widely by location and income. Rural areas often lack enough doctors and clinics. Low-income populations may struggle with insurance coverage or transportation. These disparities cause delays in treatment and worsen health conditions.

Insurance plans sometimes do not cover all needed services. This limits options for many patients. Closing these gaps demands policy changes and better resource distribution.

Mental Health Crisis

Mental health issues are rising rapidly across all age groups. Many insurance plans offer limited mental health benefits. Stigma and lack of providers add to the problem. People often avoid seeking help until conditions worsen.

Expanding mental health coverage and increasing provider networks are vital steps. Early intervention can reduce hospitalizations and improve quality of life.

Chronic Disease Management

Chronic diseases like diabetes and heart disease affect millions. Proper management needs regular check-ups and medications. Insurance gaps can cause interruptions in care. Patients without consistent access face more complications and hospital stays.

Health plans must support ongoing care and education. This helps patients control their conditions and lowers overall healthcare costs.

Regulatory And Policy Uncertainty

Regulatory and policy uncertainty remains a major challenge for health insurance providers. Frequent changes in laws and regulations create confusion and risk. Insurers struggle to adapt quickly while maintaining compliance and profitability.

Policy shifts affect coverage rules, pricing, and reimbursement methods. This unpredictability disrupts the planning and operations of insurance companies and healthcare providers. It also impacts patient access and costs.

Changing Healthcare Policies

Healthcare policies often change due to political shifts and economic factors. New rules can alter how insurers cover treatments or manage claims. These changes sometimes happen with little warning. Providers and insurers must stay alert to remain compliant.

Policy changes can also affect premiums and benefits. Insurers may need to redesign plans or adjust pricing. This creates uncertainty for both companies and customers. Consistent changes reduce trust in the health insurance system.

Impact On Provider Planning

Unclear regulations make it hard for providers to plan long term. Hospitals and clinics face challenges in budgeting and staffing. They must prepare for shifting reimbursement rates and coverage criteria. This leads to financial stress and operational inefficiencies.

Providers may delay investments in technology or expansion. They risk losing revenue if policies reduce payments unexpectedly. The constant change also burdens administrative staff with compliance tasks. Planning becomes reactive rather than strategic.

Cybersecurity And Technology Integration

Cybersecurity and technology integration remain critical challenges for health insurance providers. Protecting sensitive patient data while adopting new technologies demands careful balance. The rapid growth of digital tools offers many benefits but also brings risks. Health insurers must secure information and improve systems without disrupting services.

Data Breach Risks

Health insurance companies hold vast amounts of personal data. This makes them prime targets for cyberattacks. Data breaches can expose sensitive medical and financial details. Such incidents harm patient trust and lead to costly legal issues. Constant vigilance and advanced security systems are essential to prevent breaches.

Electronic Health Records Adoption

Switching to electronic health records (EHR) is complex and costly. Many providers struggle with software compatibility and data migration. Staff training requires significant time and resources. Despite challenges, EHR improves data accuracy and access. Successful adoption enhances care coordination and claims processing.

Patient Engagement Challenges

Engaging patients through digital platforms faces many obstacles. Not all patients have easy access to technology or internet. Some find online portals confusing or hard to use. Clear communication and user-friendly designs help increase patient participation. Better engagement leads to improved health outcomes and satisfaction.

Credit: www.drugpatentwatch.com

Frequently Asked Questions

What Are The Major Challenges Facing Our Health Care System?

Major challenges in healthcare include rising costs, workforce shortages, employee burnout, health inequities, limited access, mental health crises, regulatory changes, cybersecurity risks, and technology integration difficulties. These issues impact care quality, increase financial strain, and strain healthcare professionals.

What Is The Biggest Challenge Facing The Insurance Industry?

The biggest challenge in insurance is adapting to digital transformation while managing rising costs and evolving customer expectations.

What Are The Top 5 Health Concerns In The Us?

The top 5 health concerns in the US are heart disease, cancer, chronic respiratory diseases, diabetes, and mental health disorders. These conditions cause significant illness and death, demanding urgent attention and improved healthcare strategies.

What Are 5 Or More Factors That Increase Your Health Insurance Premiums?

Age, smoking habits, pre-existing conditions, high-risk occupations, and claim history increase health insurance premiums. Lifestyle choices and location also affect costs.

Conclusion

Health insurance faces many tough challenges today. Rising costs make coverage more expensive for many people. Staff shortages and burnout reduce the quality of care. Unequal access causes health problems for underserved groups. New rules and cyber risks create uncertainty for providers.

Solving these issues requires clear plans and teamwork. Everyone benefits when health insurance works well and fairly. The future depends on smart actions to improve this system.