Choosing the right health insurance company can feel overwhelming. You want a plan that fits your needs, offers good coverage, and won’t break the bank.

But with so many options out there, how do you know which companies truly stand out? This article will guide you through the top 20 health insurance companies in the USA, helping you find the best fit for you and your family.

By the end, you’ll feel confident about your choices and ready to make a smart decision that protects your health and your wallet. Keep reading to discover which companies lead the market and what makes them a great option for you.

Credit: www.healthpopuli.com

Top Health Insurers In The Usa

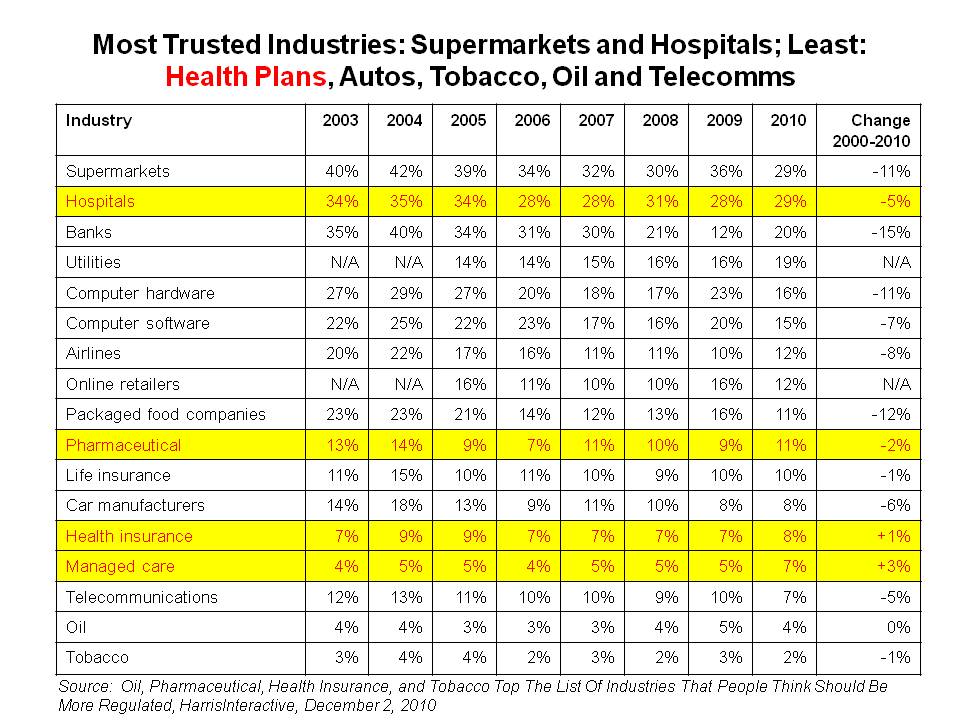

Health insurance is a vital part of life for millions in the USA. Choosing the right insurer can affect access to care and financial security. The top health insurance companies offer wide coverage, strong networks, and reliable customer service. They serve millions across the country, meeting diverse health needs.

Here are some of the leading health insurers in the USA, known for their size, service, and reputation.

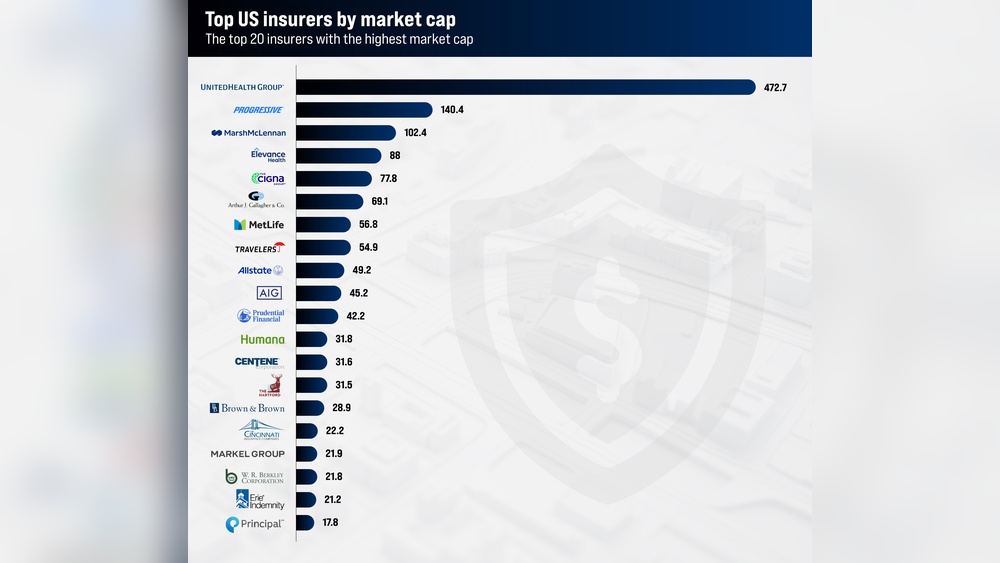

Unitedhealth Group

UnitedHealth Group holds the largest market share in the U.S. health insurance industry. It provides a variety of plans for individuals, families, and employers. Its network includes many hospitals and doctors nationwide. The company focuses on innovation and data-driven care solutions.

Elevance Health

Formerly known as Anthem, Elevance Health ranks second in market share. It offers plans in many states, including Medicaid and Medicare options. The company emphasizes preventive care and personalized health programs. Elevance Health works to improve health outcomes for its members.

Centene Corporation

Centene Corporation specializes in government-sponsored health programs. It serves millions through Medicaid, Medicare, and the Health Insurance Marketplace. Centene focuses on underinsured and vulnerable populations. It aims to provide affordable, quality care to diverse communities.

Humana

Humana ranks fourth in direct written premiums. It offers Medicare Advantage plans and other health insurance products. The company promotes wellness and healthy living programs. Humana uses technology to improve member engagement and care coordination.

Kaiser Permanente

Kaiser Permanente combines health insurance with healthcare delivery. It operates hospitals and medical offices in several states. Members benefit from integrated care and electronic health records. Kaiser Permanente is known for high-quality care and patient satisfaction.

Popular Plans And Coverage Options

Health insurance companies in the USA offer a wide range of plans to meet diverse needs. These plans vary by coverage, cost, and eligibility. Understanding popular plans helps consumers choose the right coverage. Most providers offer options for individuals, families, employees, seniors, and special cases.

Individual And Family Plans

Individual and family plans cover medical expenses for one person or a household. These plans include doctor visits, hospital stays, and prescription drugs. They often offer different levels of coverage and premiums. Many companies provide flexible options to fit budgets and health needs. Some plans include wellness programs and preventive care benefits.

Employer-sponsored Plans

Employer-sponsored plans are offered by companies to their workers. These plans usually cover employees and their dependents. Employers often share the premium cost with employees. These plans can provide extensive coverage and additional perks. Many employers choose plans from top insurers to attract and keep staff.

Medicare And Medicaid Options

Medicare and Medicaid are government programs for specific groups. Medicare serves people over 65 and some younger individuals with disabilities. Medicaid helps low-income families and individuals. Many top insurers offer Medicare Advantage and Medicaid managed care plans. These plans include hospital, medical, and sometimes prescription drug coverage.

Specialized Coverage

Specialized coverage targets unique health needs or conditions. Examples include dental, vision, and mental health plans. Some insurers provide plans for chronic illnesses or high-risk groups. These options help fill gaps in regular health insurance. Specialized plans often improve overall care and reduce out-of-pocket costs.

Market Share And Financial Strength

Market share and financial strength are crucial indicators of a health insurance company’s performance. These factors reflect the company’s ability to serve a large number of clients while maintaining financial health. Companies with strong market share typically have more resources to invest in technology and customer service. Financial strength ensures the company can pay claims reliably and stay stable during economic shifts.

Understanding these elements helps consumers choose trustworthy health insurance providers. It also highlights which companies lead the U.S. health insurance market in size and stability.

Revenue Rankings

Revenue shows how much money a company earns from its services. The top health insurance firms in the U.S. generate billions in annual revenue. UnitedHealthcare leads with the highest revenue, followed by Elevance Health and Centene Corporation. High revenue often means a company has a wide range of products and a large customer base.

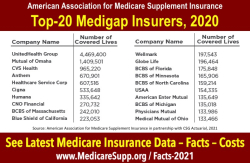

Customer Base Size

The customer base size indicates how many people rely on a company for health insurance. Large customer bases show trust and extensive coverage networks. Kaiser Permanente has one of the largest covered lives in the industry. Companies with more customers can often offer better pricing and more plan options.

Claims Processing Efficiency

Claims processing efficiency measures how quickly and accurately companies handle claims. Efficient claims processing improves customer satisfaction and reduces delays in payments. Top companies invest in digital systems to speed up claims handling. Fast and accurate claims services are a sign of a well-managed insurer.

Company Stability Ratings

Stability ratings come from independent agencies that assess financial health and risk. High ratings mean the company is financially secure and likely to meet its obligations. AM Best, Moody’s, and Standard & Poor’s provide these ratings. UnitedHealthcare and Humana consistently receive strong stability ratings.

Credit: medicaresupp.org

Customer Satisfaction And Service

Customer satisfaction and service play a vital role in choosing a health insurance company. Good service ensures members get the help they need quickly. It also builds trust and loyalty. Health insurers that focus on customer service stand out in a crowded market. This section covers key factors affecting member experience and satisfaction.

Complaint Rates

Complaint rates show how often members report issues. Low complaint rates indicate fewer problems. Top insurers maintain complaint rates well below industry averages. They resolve issues before they escalate. Monitoring complaint data helps companies improve service quality constantly.

Member Support Quality

Member support quality reflects how well staff assist customers. Friendly, knowledgeable representatives make a big difference. Leading insurers offer multiple support channels like phone, chat, and email. Quick response times and clear communication improve member satisfaction. Support teams trained in empathy handle sensitive health issues better.

Digital Tools And Accessibility

Easy-to-use digital tools enhance member convenience. Mobile apps, online portals, and virtual ID cards simplify health management. Top companies invest in user-friendly platforms with 24/7 access. Features include claims tracking, provider search, and appointment scheduling. Accessibility for all, including those with disabilities, is a priority.

Network Size And Provider Access

A large network offers more choices and better access to care. Members prefer insurers with wide coverage of doctors and hospitals. Top health insurers partner with many providers nationwide. This ensures members find care close to home. Expansive networks reduce out-of-pocket costs and wait times.

Cost And Affordability Factors

Cost and affordability play a major role in choosing health insurance. Many factors affect how much you pay and what you get in return. Understanding these factors helps in picking the best plan within your budget. Each health insurance company offers different pricing and benefits. This section breaks down the key cost elements to consider.

Premium Comparisons

Premiums are the monthly fees paid to keep insurance active. They vary by company and plan type. Some insurers offer lower premiums but charge more later. Others have higher premiums with better coverage. Comparing premiums helps find a balance between cost and benefits.

Deductibles And Copayments

Deductibles are amounts you pay before insurance starts to pay. Plans with low deductibles often have higher premiums. Copayments are fixed fees for doctor visits or prescriptions. Lower copays reduce out-of-pocket costs during care. Consider both to avoid unexpected expenses.

Out-of-pocket Limits

Out-of-pocket limits cap your total yearly spending. Once reached, insurance pays 100% of covered costs. Plans with low limits provide financial safety in emergencies. Higher limits might mean lower monthly premiums. Knowing your limit protects against large bills.

Discounts And Wellness Incentives

Many insurers offer discounts for healthy habits. Wellness incentives reward activities like gym visits or screenings. These programs can reduce premiums or copays. Taking advantage of discounts lowers overall health costs. Check what each company offers to save money.

Credit: www.forbes.com

Regional Availability And Reach

Health insurance companies in the USA differ greatly in their regional availability and reach. Understanding where these companies operate helps consumers choose the best plan. Some companies provide coverage nationwide, while others focus on specific states or regions. Accessibility varies between urban and rural areas. Many companies are also expanding their networks to serve more customers.

Nationwide Coverage

Several top health insurers offer plans across all 50 states. These companies provide consistent service no matter where members live. Nationwide coverage benefits people who move frequently or travel. UnitedHealthcare and Cigna are examples of insurers with broad national networks. They connect members to many hospitals and doctors everywhere.

State-specific Plans

Some companies concentrate on certain states. They tailor their plans to meet local needs and regulations. Kaiser Permanente is known for strong presence in California and a few other states. Centene focuses on Medicaid and Medicare plans in select regions. State-specific insurers may offer better pricing and care options locally.

Urban Vs Rural Access

Access to health insurance varies between cities and rural areas. Urban zones usually have more providers and hospitals in network. Rural areas often face fewer choices and longer travel distances. Companies like Humana work to improve rural healthcare access. They partner with local clinics to serve remote communities better.

Expansion Initiatives

Top insurers invest in growing their service areas. Many are entering new states or increasing rural coverage. Elevance Health expanded its footprint by acquiring smaller regional firms. Expansion helps companies reach underserved populations. It also creates more options for consumers nationwide.

Innovations And Future Trends

Health insurance companies in the USA are evolving quickly. Innovations shape how they serve customers. Future trends focus on improving access, care quality, and patient experience. These changes bring new hope for better health management. Understanding these trends helps consumers make smart choices.

Telehealth Integration

Telehealth services have grown rapidly. Many insurers now cover virtual doctor visits. This saves time and reduces travel needs. Patients get care from home or work. Telehealth helps manage chronic diseases and urgent issues. It also expands access in rural areas. Expect more insurers to add telehealth options soon.

Value-based Care Models

Insurers are shifting from fee-for-service to value-based care. This means paying for health results, not just visits. Providers focus on preventing illness and improving patient health. Better coordination between doctors reduces hospital visits. Value-based models encourage teamwork and efficient treatments. This trend aims to lower costs and raise care quality.

Personalized Health Programs

Health plans now offer programs tailored to individual needs. Data and analytics help create custom plans. These programs support diet, exercise, and medication adherence. Personalized coaching improves patient motivation. Insurers use health data to prevent problems early. Future programs will be even more specific and helpful.

Technology-driven Services

Technology plays a big role in health insurance innovation. Mobile apps let members track claims and find doctors. Artificial intelligence helps detect fraud and predict health risks. Wearable devices share real-time health information with providers. Blockchain increases data security and transparency. These tools make health services faster and simpler.

Comparing Top 20 Companies

Comparing the top 20 health insurance companies in the USA reveals key differences. Each company offers unique plans and benefits. Understanding these features helps find the best fit for your needs. This section breaks down plan details, strengths, and who they best serve.

Plan Features Side-by-side

Many health insurers offer plans with varying coverage levels. Some focus on low premiums, others on broad networks. Benefits like prescription coverage, specialist visits, and telehealth services differ. Check deductibles, copays, and out-of-pocket maximums carefully. Look for plans that match your health and budget priorities.

Strengths And Weaknesses

UnitedHealthcare leads in network size and customer service. Kaiser Permanente offers integrated care with strong preventive services. Humana excels in Medicare Advantage plans. Some companies have limited coverage areas. Others may charge higher premiums or have complex claim processes. Balance strengths against your personal needs.

Best Picks For Different Needs

For families, companies with broad pediatric care work well. Seniors benefit from firms with strong Medicare options. If you want wellness programs, choose insurers with health coaching. Budget shoppers find value in low-cost plans from select providers. Match the company’s focus to your health goals.

Tips For Choosing The Right Insurer

Review each company’s plan options in detail. Compare costs beyond premiums, like copays and deductibles. Check provider networks for your doctors and hospitals. Read customer reviews for service quality insights. Confirm financial stability to ensure reliable coverage. Take time to select a plan that fits your lifestyle.

Frequently Asked Questions

Which Are The Top 10 Health Insurance Companies?

Top 10 health insurance companies are UnitedHealthcare, Elevance Health, Kaiser Permanente, Centene, Humana, Aetna, Cigna, Blue Cross Blue Shield, Molina Healthcare, and Highmark. These providers offer extensive coverage and strong market presence across the U. S.

Who Is The 1 Provider Of Health Insurance In The Us?

UnitedHealth Group is the 1 health insurance provider in the US by market share and revenue. It leads the industry consistently.

What Is The Top 10 Best Health Insurance?

Top 10 health insurance providers in the U. S. include UnitedHealthcare, Kaiser Permanente, Elevance Health, Centene, Humana, Cigna, Aetna, Molina Healthcare, HCSC, and Highmark. These companies offer extensive coverage, strong networks, and reliable customer service.

Who Is The Top 10 Insurance Company In The Usa?

Top 10 insurance companies in the USA are UnitedHealthcare, Elevance Health, Kaiser Permanente, Centene, Humana, CVS Health, Cigna, Aetna, HCSC, and Highmark. These firms lead in market share, premiums, and customer coverage nationwide.

Conclusion

Choosing the right health insurance company matters for your peace of mind. The top 20 providers offer various plans to fit different needs. Consider factors like coverage, cost, and customer service carefully. A good health plan helps protect you and your family.

Take time to compare options before deciding. Your health and finances deserve thoughtful choices. Stay informed and select a company that supports your well-being.