Are you ready for the changes coming to Medicare in 2026? If you’re on Medicare or planning to enroll, understanding your premiums is crucial.

Medicare 2026 premiums are set to rise, and this could affect your monthly budget more than you expect. But don’t worry—we’ll break down exactly what you need to know, from standard costs to higher income adjustments, so you can make smart decisions for your healthcare and finances.

Keep reading to discover how these changes impact you and what steps you can take to prepare.

Credit: www.aarp.org

Medicare Part B Premiums

Medicare Part B helps pay for doctor visits, outpatient care, and some medical services. Each year, premiums for Part B may change based on costs and policy updates. Understanding these premiums helps you plan your healthcare budget for 2026.

Part B premiums include a standard amount and adjustments for higher income earners. These changes affect many Medicare beneficiaries.

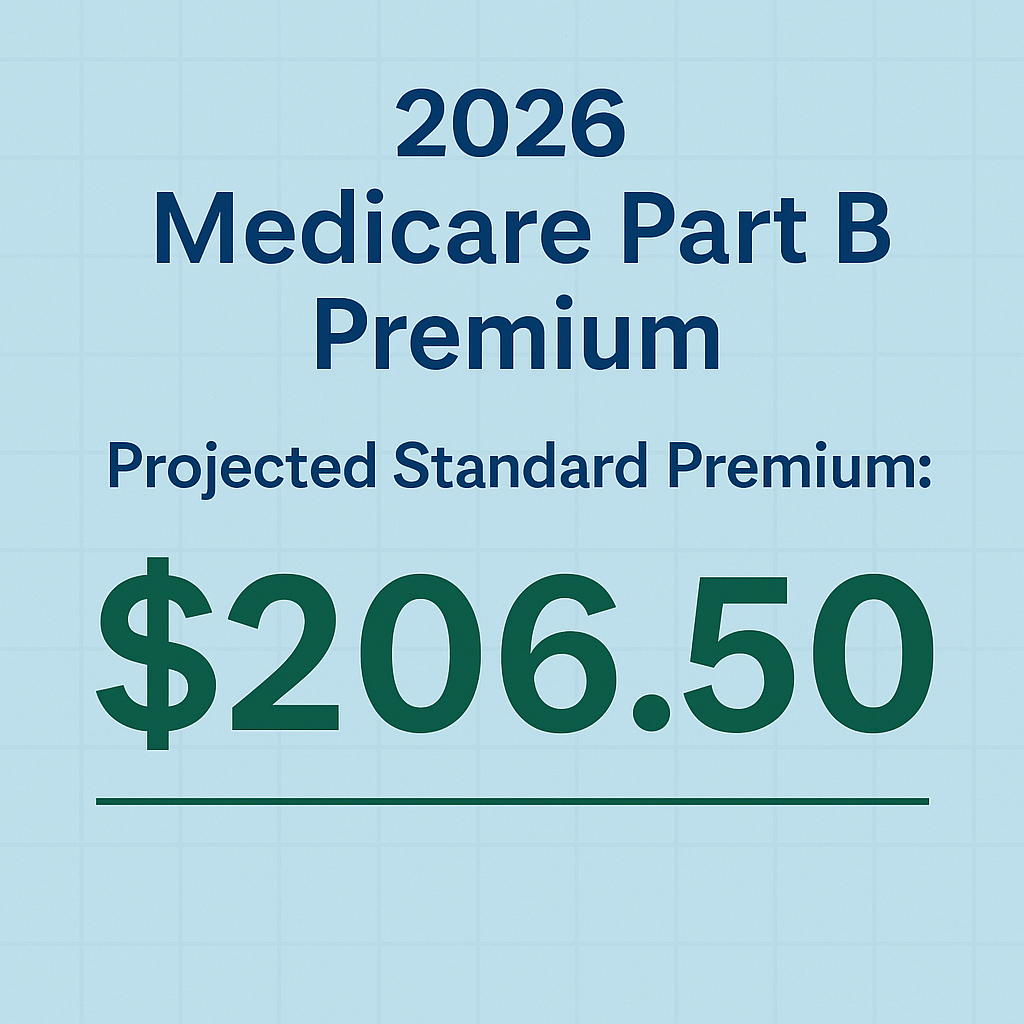

Standard Premium Amount

The standard Part B premium for 2026 is set by Medicare. Most people will pay this fixed monthly amount. It covers basic outpatient services and doctor visits.

This amount is based on the overall costs Medicare expects to cover. It may rise slightly compared to previous years.

Higher Income Premiums

People with higher income pay more for Part B. Medicare uses tax return data to decide who pays extra. This ensures those with greater ability to pay contribute more.

The extra cost is added to the standard premium. It can increase monthly payments significantly for some beneficiaries.

Income-related Monthly Adjustment Amounts

Income-Related Monthly Adjustment Amounts, or IRMAA, apply to higher income earners. IRMAA is an additional charge on top of the standard premium. It is calculated based on your reported income from two years ago.

There are several income brackets, each with a different IRMAA level. The higher your income, the higher the extra monthly amount you pay.

Medicare sends letters each year to those affected by IRMAA. This helps beneficiaries prepare for their new premium costs.

Medicare Part A Costs

Medicare Part A covers hospital stays and some care in skilled nursing facilities. Understanding its costs helps you plan your healthcare budget. Medicare Part A costs include premiums, deductibles, and limits on out-of-pocket spending. Changes in 2026 affect these key areas.

Deductible Changes

The Part A deductible is the amount you pay before Medicare starts to cover hospital costs. In 2026, this deductible will increase slightly. This means you pay more upfront for each hospital stay. Knowing this helps you prepare for hospital visits.

Hospital And Skilled Nursing Coverage

Medicare Part A covers inpatient hospital care and skilled nursing after a hospital stay. Coverage limits and daily coinsurance amounts may change in 2026. These updates affect how much you pay during extended stays. Plan carefully to avoid unexpected costs.

Out-of-pocket Limits

Medicare Part A does not have a strict out-of-pocket maximum like some plans. However, costs can add up during long hospital or nursing stays. Being aware of possible expenses can help you manage your healthcare budget better. Consider supplemental insurance to reduce financial risk.

Medicare Advantage Updates

Medicare Advantage plans for 2026 introduce key updates that affect coverage and costs. These changes aim to improve benefits and manage expenses for enrollees. Understanding these updates helps you make informed decisions about your healthcare.

Plan Benefit Changes

Some Medicare Advantage plans will adjust their benefits. Certain non-medical services like alcohol and tobacco products will no longer be covered. Cosmetic procedures are also excluded from benefits. Plans may add new services related to chronic illness care and preventive screenings.

Out-of-pocket Maximum Adjustments

The maximum out-of-pocket limit for Medicare Advantage plans will slightly decrease. This change reduces the highest amount you pay for covered services each year. It helps protect you from very high medical costs in 2026. This adjustment makes plans more affordable and predictable.

New Chronic Illness Benefits

Plans will offer new benefits for people with chronic illnesses. These include better care management and support services. Coverage for vaccines recommended by the Advisory Committee on Immunization Practices (ACIP) will expand. These updates aim to improve health outcomes and quality of life for beneficiaries.

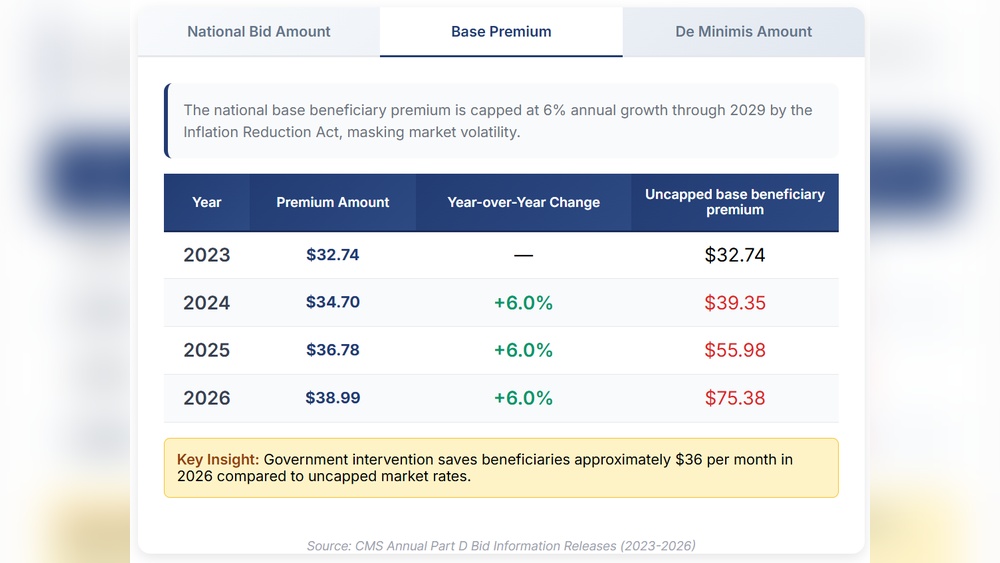

Prescription Drug Coverage

Prescription drug coverage remains a key part of Medicare in 2026. It helps many seniors afford their medicines. Changes this year affect costs and benefits. Understanding these updates can help beneficiaries manage expenses better.

Automatic Enrollment In Payment Plan

Medicare will automatically enroll eligible beneficiaries in the Prescription Payment Plan. This plan spreads drug costs over monthly payments. It reduces the burden of paying large bills at once. Beneficiaries will receive notices about their enrollment and payment details.

Coverage For Vaccines

Medicare expands coverage for vaccines recommended by the ACIP. This includes flu, shingles, and COVID-19 vaccines. The goal is to improve health and prevent illness. Vaccines are covered with no copay under prescription drug plans.

Changes To Non-medical Benefits

Medicare Advantage plans can no longer cover some non-medical benefits. These include alcohol, tobacco, cannabis products, and cosmetic procedures. The focus returns to essential health services and prescription drugs. This change aims to keep premiums stable and benefits focused.

Impact On Social Security

The 2026 Medicare premiums bring important changes that affect Social Security recipients. Many rely on Social Security as their main income source during retirement. Changes in Medicare premiums directly impact their monthly Social Security benefits. Understanding this impact helps retirees plan their finances better.

Effect Of Premium Increases

Medicare Part B premiums are rising in 2026. This increase reduces the net amount Social Security beneficiaries receive. For some, the premium hike may consume most or all of their Social Security cost-of-living adjustment. This means less money left for other expenses. Retirees with higher incomes face even larger premium increases due to income-related adjustments.

Cost-of-living Adjustments

Social Security benefits usually grow each year with cost-of-living adjustments (COLA). The 2026 COLA aims to help keep up with inflation. Yet, higher Medicare premiums can offset these increases. Some retirees might see their Social Security checks barely change after premium deductions. This challenge makes budgeting more difficult for fixed-income seniors.

Balancing Benefits And Costs

Medicare offers essential health coverage, but rising costs create tough choices. Beneficiaries must balance paying higher premiums with managing other living expenses. Understanding premium changes helps retirees avoid surprises in their Social Security income. Planning ahead ensures better financial stability during retirement years.

Credit: www.medicareplanning.com

Additional Medicare Changes

Medicare 2026 introduces several additional changes that affect beneficiaries beyond just premiums. These updates aim to improve care quality, expand preventive services, and streamline administrative processes. Understanding these changes helps you stay informed and make better health decisions.

Advanced Primary Care Management

Medicare will offer new benefits focused on advanced primary care management. This program helps doctors coordinate care for patients with complex health needs. It encourages regular check-ups and better communication between specialists. The goal is to reduce hospital visits and improve health outcomes.

Expanded Cancer Screenings

Medicare will cover more types of cancer screenings starting in 2026. This expansion targets early detection of colorectal and lung cancers. Early screening can catch diseases before symptoms appear. It helps save lives and lowers treatment costs over time. Beneficiaries should check their coverage for new screening options.

Use Of Ai In Prior Authorizations

Artificial intelligence will play a bigger role in prior authorizations for Medicare services. AI tools will speed up the approval process for treatments and tests. Faster decisions reduce delays in care and ease the workload for providers. This change aims to make healthcare more efficient and less stressful for patients.

Enrollment And Penalties

Understanding Medicare enrollment rules and potential penalties is crucial for 2026. Enrolling on time helps avoid extra costs. Missing enrollment deadlines can lead to late fees and higher premiums. Knowing automatic enrollment rules and prescription payment details eases the process. This section breaks down key points about enrollment and penalties.

Avoiding Late Enrollment Fees

Enroll during your Initial Enrollment Period to avoid fees. This period lasts seven months around your 65th birthday. Late enrollment can cause a permanent penalty. The penalty raises your monthly premium. It applies to Medicare Part B and Part D. The longer you wait, the higher the penalty. Avoid gaps in coverage to keep costs low.

Automatic Enrollment Rules

Some people qualify for automatic enrollment. If you receive Social Security benefits before 65, enrollment happens automatically. You will get your Medicare card by mail. Those not receiving benefits must enroll manually. Automatic enrollment applies to Medicare Part A and Part B. It simplifies the process and prevents late fees. Check your status early to understand your enrollment needs.

Medicare Prescription Payment Plan Details

The Medicare Prescription Payment Plan helps cover drug costs. Part D plans have monthly premiums and copayments. In 2026, some premiums may increase slightly. Higher-income beneficiaries pay more due to IRMAA rules. Enrolling in Part D during your initial period avoids penalties. Missing Part D enrollment triggers a late enrollment fee. Review plan options annually to find the best fit.

Credit: www.odysseyadvisors.com

Frequently Asked Questions

How Much Will Medicare Premiums Increase In 2026?

Medicare Part B premiums will rise by $21. 60 to $174. 70 monthly in 2026. Higher-income individuals face larger increases. Part A premiums remain unchanged.

What Will Happen With Medicare In 2026?

In 2026, Medicare will see higher Part B premiums and deductibles. Out-of-pocket limits for Advantage plans will decrease slightly. New benefits include expanded vaccine coverage, chronic illness support, and advanced primary care. Income-related premium adjustments will increase for higher earners.

Automatic enrollment in the Prescription Payment Plan begins.

Will Social Security Increase In 2026 For Medicare Deduction?

Social Security benefits will increase in 2026 due to the cost-of-living adjustment. However, higher Medicare premiums may reduce the net increase.

How Much Will Social Security Increase In 2026?

Social Security will increase by 3. 3% in 2026. This cost-of-living adjustment helps retirees offset inflation.

Conclusion

Medicare 2026 premiums will affect many beneficiaries’ budgets. Higher income earners face increased Part B costs. Standard premiums will rise but remain manageable for most. New rules aim to improve care and coverage options. Staying informed helps you plan your healthcare expenses wisely.

Review your plan details each year for best choices. Understanding these changes ensures you avoid unexpected costs. Keep track of enrollment deadlines to prevent penalties. Medicare updates focus on balancing costs with quality care. Small changes now can lead to better healthcare security later.