If you’re a lawyer, you know that even a small mistake can lead to serious consequences. Missing a deadline, overlooking important details, or miscommunicating with a client can open the door to costly legal malpractice claims.

That’s where lawyer malpractice insurance comes in—it’s your safety net when errors happen. But how do you choose the right coverage? What factors affect your premium? And how can you protect your practice without breaking the bank? Keep reading to discover everything you need to know about lawyer malpractice insurance and how it can safeguard your career and peace of mind.

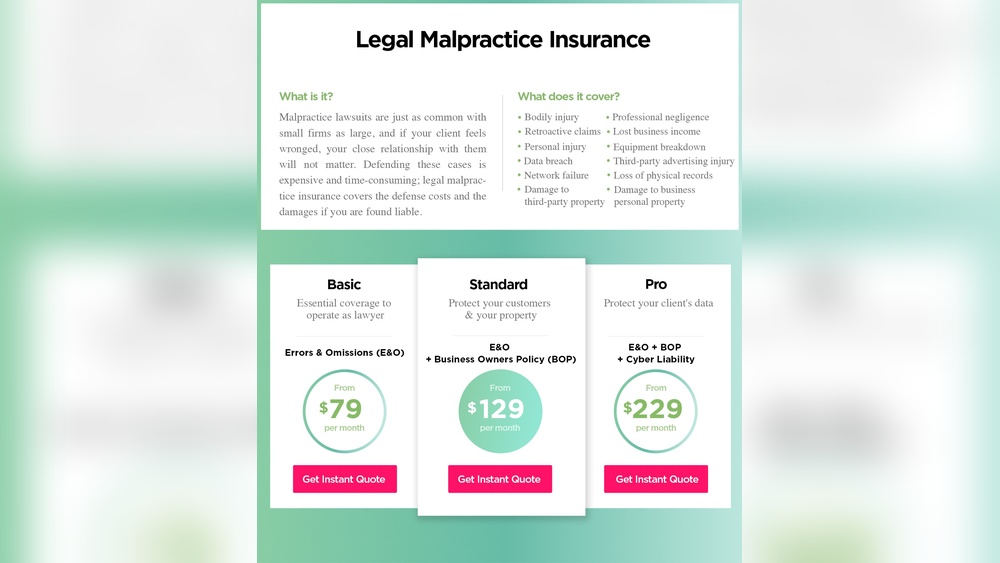

Credit: themoneyalert.com

Malpractice Risks For Lawyers

Lawyers face many risks that can lead to malpractice claims. These risks arise from mistakes, missed deadlines, or poor client communication. Understanding these risks helps lawyers protect themselves and their clients better. Malpractice insurance is essential for covering financial losses from such claims.

Common Legal Errors

Errors often happen due to missed deadlines or failure to file important documents. Some lawyers lack sufficient knowledge of specific laws. Poor communication with clients can cause misunderstandings and mistakes. Mishandling client funds is another frequent error. These mistakes increase the chance of malpractice claims.

Consequences Of Malpractice

Malpractice can damage a lawyer’s reputation and career. Clients may lose trust and refuse future services. Financial penalties can be high, leading to costly settlements or judgments. Legal fees to defend claims add to the burden. The stress from malpractice claims affects personal and professional life.

Frequency Of Claims

Malpractice claims happen more often than many expect. Even experienced lawyers face claims during their career. Certain practice areas, like personal injury or real estate, see higher claim rates. Insufficient insurance coverage can cause serious financial trouble. Regularly updating coverage helps lawyers stay protected.

Credit: www.l2insuranceagency.com

Coverage Basics

Understanding the basics of lawyer malpractice insurance coverage helps protect legal professionals from costly claims. This insurance shields lawyers from financial loss due to errors or negligence in their work. Knowing what is covered, limits, and defense costs can guide better insurance choices.

What Malpractice Insurance Covers

Malpractice insurance covers claims of legal mistakes or negligence. It protects against missed deadlines, poor advice, and failure to communicate properly. Coverage includes errors that harm clients financially. It does not cover intentional wrongdoing or criminal acts.

Limits And Deductibles

Coverage limits set the maximum amount the insurer will pay. Deductibles are the lawyer’s out-of-pocket costs before insurance applies. Higher limits provide more protection but cost more. Choosing the right balance depends on risk and budget.

Claims Defense Costs

Defense costs include lawyer fees and court expenses to fight claims. Most policies cover these costs even if the claim is groundless. Good coverage pays defense fees separately from the claim limit. This keeps defense costs from reducing the payout.

Cost Factors

Understanding the cost factors of lawyer malpractice insurance helps you plan your budget. Several elements influence the price you pay for this essential coverage. Knowing these factors can guide you in choosing the right policy and managing your expenses effectively.

Premium Influencers

Insurance premiums depend on your practice area. High-risk specialties like criminal law cost more. Your claim history also affects your rates. A clean record means lower premiums. The size of your law firm matters too. Larger firms usually pay higher premiums. Coverage limits influence the cost as well. Higher limits increase the premium price. Deductibles also play a role. Higher deductibles can lower your premium.

Regional Variations

Location impacts the cost of malpractice insurance. Some states have higher claim rates. These states often have higher premiums. Urban areas tend to have more lawsuits. This raises insurance costs there. Local laws and court systems affect prices. States with tough legal environments charge more. Finding a local agent can help. They understand the regional pricing nuances.

Ways To Lower Premiums

Choose a higher deductible to reduce premiums. Maintain a clean claims record over time. Invest in risk management training for your firm. Some insurers offer discounts for this. Avoid high-risk practice areas if possible. Shop around and compare different insurers. Bundling insurance policies can provide savings. Regularly review and update your coverage needs.

Credit: www.attorneys-advantage.com

Choosing A Policy

Choosing the right lawyer malpractice insurance policy requires careful thought. Each policy offers different protections and costs. Understanding what each plan covers helps you find the best fit for your practice.

Focus on your specific needs and risks. This approach ensures your coverage matches your legal work. The right policy protects your reputation and finances against claims.

Comparing Providers

Start by listing several insurance companies. Check their reputation and reviews from other lawyers. Compare the cost of premiums and deductibles for each provider. Look for companies that specialize in legal malpractice insurance. This focus often means better service and understanding of your risks.

Key Policy Features

Review what each policy covers carefully. Look for coverage of claims related to errors and omissions. Confirm whether the policy includes defense costs and settlements. Check if it covers claims from former clients. Some policies offer risk management support, which can help prevent claims.

Evaluating Coverage Needs

Assess your practice size and areas of law. Consider the risks that come with your specialty. Determine the amount of coverage you need based on these risks. Think about potential claim costs, including legal fees. Choose limits that protect your assets and income fully.

Legal Requirements By State

Legal requirements for lawyer malpractice insurance vary widely across the United States. Each state sets its own rules about whether lawyers must carry this coverage. Understanding these rules helps lawyers stay compliant and protect their practice from potential claims. Some states require mandatory coverage, while others leave it optional. This section explores these variations and highlights specific regulations in Texas.

Mandatory Vs Optional Coverage

Some states require lawyers to have malpractice insurance by law. This means coverage is mandatory to practice law. Other states do not impose this rule, making insurance optional. Lawyers in these states can choose whether to buy a policy. Mandatory coverage states aim to protect clients and maintain trust in legal services. Optional coverage states rely on lawyers to assess their own risk. Understanding your state’s stance is crucial for compliance and risk management.

Texas Malpractice Insurance Rules

Texas does not require lawyers to carry malpractice insurance. The State Bar of Texas encourages lawyers to consider coverage but leaves it optional. Many Texas lawyers still purchase insurance to protect their practice. The Texas Lawyers’ Insurance Exchange offers policies tailored to local legal professionals. Without mandatory insurance, Texas lawyers must weigh potential risks carefully. Voluntary coverage helps manage claims and legal fees if mistakes occur.

Impact Of State Regulations

State rules affect insurance availability and cost for lawyers. Mandatory coverage states often have more insurance providers competing. This can lower premiums and improve policy options. Optional coverage states may see fewer carriers offering policies. Laws also influence how claims are handled and reported. Regulations shape lawyers’ decisions on risk management and client protection. Knowing your state’s requirements helps ensure proper legal and financial safeguards.

Claims Process

The claims process is a crucial part of lawyer malpractice insurance. It helps lawyers handle accusations of errors or negligence. Knowing the steps in the claims process makes it easier to manage any issues.

This section explains how to file a claim, the insurer’s role in defense, and the choice between settlement and litigation.

Filing A Claim

Filing a claim starts with reporting the incident to the insurer. Provide clear details about the case and any related documents. Early reporting helps speed up the process. The insurer will review the claim and decide if it is covered.

Role Of Insurer In Defense

The insurer often takes charge of the legal defense. They hire lawyers to represent the insured attorney. The insurer works to reduce costs and protect the lawyer’s reputation. Communication between the lawyer and insurer is important during defense.

Settlement Vs Litigation

Settling can save time and money. The insurer and lawyer may agree to pay a sum to resolve the claim. Litigation means going to court for a full trial. It can be costly and take longer. The choice depends on the case details and potential outcomes.

Benefits Of Malpractice Insurance

Lawyer malpractice insurance offers crucial benefits that protect legal professionals. It safeguards lawyers from costly claims and lawsuits. This insurance helps maintain a lawyer’s career and credibility. Understanding its benefits clarifies why it is essential for every practicing attorney.

Financial Protection

Malpractice insurance covers legal fees and settlements. It shields lawyers from high costs of lawsuits. Without coverage, lawyers risk losing personal assets. This insurance helps manage unexpected financial burdens. It ensures lawyers can continue practicing after a claim.

Client Trust And Reputation

Having malpractice insurance builds client confidence. It shows lawyers take responsibility seriously. Clients feel safer hiring insured attorneys. Insurance also protects a lawyer’s professional reputation. It signals commitment to ethical and reliable service.

Peace Of Mind For Lawyers

Malpractice insurance reduces stress related to claims. Lawyers can focus on their work without fear. It creates a sense of security in daily practice. This peace of mind improves overall job performance. Lawyers can serve clients better knowing they are protected.

Tips For New Lawyers

Starting a legal career brings many challenges. One key step is securing lawyer malpractice insurance. This protects new lawyers from costly claims. Understanding how to choose and use this insurance helps avoid financial risks. Here are practical tips every new lawyer should consider.

Assessing Risk Exposure

Begin by identifying your practice area and its risks. Some fields face higher chances of claims than others. For example, litigation and real estate law often have more risks. Think about your clients’ needs and your experience level. This helps estimate your potential exposure to malpractice claims. Knowing your risk guides you in choosing the right insurance coverage.

Selecting Appropriate Coverage

Choose a policy that matches your risk level and budget. Look for coverage limits that protect your assets adequately. Consider deductibles that you can afford to pay out of pocket. Compare policies from multiple insurers to find the best fit. Check if the policy covers claims made after you leave the firm. Tailor your coverage to your specific practice and risks.

Maintaining Professional Standards

Follow ethical rules and best practices to reduce malpractice risks. Keep clear communication with clients and document all advice. Meet deadlines and stay updated on legal changes. Use checklists and peer reviews to avoid mistakes. Maintaining high standards lowers the chance of claims. Insurance is a safety net, but prevention is your strongest defense.

Frequently Asked Questions

How Does Malpractice Insurance Work For Lawyers?

Malpractice insurance for lawyers covers legal defense costs and damages from claims of errors or negligence in their practice. It protects against financial loss due to missed deadlines, poor research, or client communication failures. Lawyers pay premiums based on risk factors and coverage limits.

How Much Do Lawyers Pay For Malpractice Insurance?

Lawyers typically pay $1,000 to $5,000 annually for malpractice insurance. Costs vary by practice area, location, and coverage limits.

What Is An Example Of Attorney Malpractice?

An example of attorney malpractice is missing a lawsuit deadline, causing the client to lose their legal claim.

How Often Do Lawyers Get Sued For Malpractice?

Lawyers face malpractice suits relatively rarely, with only a small percentage sued annually. Most claims settle without trial.

Conclusion

Protecting your legal practice is essential. Malpractice insurance shields you from costly claims. It covers mistakes like missed deadlines or poor communication. Choosing the right policy helps manage risks wisely. Compare plans to find suitable coverage and price. Stay informed and prepared to protect your career.

This insurance gives peace of mind to lawyers. Without it, financial loss can be severe. Always prioritize your professional security and reputation.