Thinking about getting a mortgage loan with Truist? You want to make sure you choose a bank that fits your needs, offers competitive rates, and provides solid customer support throughout the process.

But is Truist really a good choice for your mortgage? You’ll get a clear picture of what Truist offers, including its strengths and potential drawbacks. By the end, you’ll feel confident about whether Truist is the right bank to help you secure your dream home.

Keep reading to discover the facts and make an informed decision that’s best for you and your future.

Credit: www.truist.com

Truist Mortgage Rates

Truist offers mortgage rates that reflect current market trends and borrower profiles. Understanding these rates helps potential homeowners plan their finances effectively. Truist’s rates depend on various factors, including loan type and credit score. This section breaks down Truist mortgage rates and compares them with competitors. It also explains how credit scores affect the rates you may receive.

Current Interest Rates

Truist provides competitive mortgage interest rates that change daily. Rates vary based on loan terms, such as 15-year or 30-year fixed mortgages. Adjustable-rate mortgages (ARMs) often start with lower rates but can increase over time. Truist publishes its current rates online and updates them frequently. Checking these rates before applying helps you know what to expect.

Rate Comparisons With Competitors

Compared to other banks, Truist’s mortgage rates are generally in the mid-range. Some lenders may offer slightly lower rates but with stricter requirements. Truist balances rate competitiveness with flexible loan options. Local credit unions sometimes provide better rates but have limited availability. National banks often match Truist’s rates but may add extra fees. Comparing rates from several lenders is wise before deciding.

Impact Of Credit Score On Rates

Your credit score plays a key role in determining your mortgage rate at Truist. Higher scores usually secure lower interest rates and better loan terms. Scores below 620 may lead to higher rates or loan denial. Truist reviews credit history thoroughly to assess risk. Improving your credit score before applying can lower your mortgage costs. Simple steps like paying bills on time help raise your score.

Credit: www.truist.com

Loan Options At Truist

Truist offers a variety of mortgage loan options to suit different borrower needs. Each loan type has specific features and benefits. Understanding these options helps you choose the best fit for your financial situation.

Fixed-rate Mortgages

Fixed-rate mortgages provide a stable interest rate for the entire loan term. This means your monthly payments stay the same. It offers peace of mind and easy budgeting. Truist offers terms from 10 to 30 years.

Adjustable-rate Mortgages

Adjustable-rate mortgages start with a lower rate than fixed loans. The rate can change after a set period, usually 5, 7, or 10 years. This option suits borrowers who plan to sell or refinance before rates adjust. Truist provides competitive initial rates and clear adjustment terms.

Fha And Va Loans

Truist supports government-backed FHA and VA loans. FHA loans help buyers with lower credit scores or smaller down payments. VA loans are available for veterans and active military members with favorable terms. These loans often require less upfront cash and offer flexible credit guidelines.

Jumbo Loans

Jumbo loans cover amounts exceeding conforming loan limits. They are ideal for high-value homes. Truist offers jumbo loans with competitive rates and various term options. These loans usually require higher credit scores and larger down payments.

Affordability And Qualification

Affordability and qualification are key factors when choosing a mortgage lender like Truist. These aspects help determine if you can secure a loan that fits your budget and financial situation. Understanding the requirements can save time and reduce stress during the application process.

Truist offers clear guidelines for down payments, credit scores, and debt levels. The bank also provides programs aimed at helping first-time homebuyers. Each factor plays a role in qualifying for a mortgage and getting affordable terms.

Down Payment Requirements

Truist usually requires a down payment of at least 3% for conventional loans. This low amount helps many buyers enter the market. For some loan types, like FHA loans, the down payment can be even lower. A bigger down payment often lowers monthly payments and interest rates.

Credit Score Criteria

A minimum credit score of 620 is common for Truist mortgage loans. Higher scores improve your chances of approval. Strong credit shows lenders you can handle debt responsibly. Poor credit may lead to higher interest rates or loan denial.

Debt-to-income Ratios

Truist typically accepts a debt-to-income (DTI) ratio up to 43%. This means your total monthly debts should not exceed 43% of your income. Lower DTI ratios increase loan approval chances and offer better rates. Managing debts before applying helps meet this standard.

Special Programs For First-time Buyers

Truist has programs designed for first-time homebuyers. These often include lower down payments and reduced fees. The bank may offer educational resources and counseling. Such programs make buying a home easier and more affordable for new buyers.

Customer Experience

Customer experience plays a big role in choosing a mortgage lender. It shapes how easy and smooth the loan process feels. Truist offers several features that impact this experience. Understanding these can help decide if Truist suits your mortgage needs.

From applying for a loan to handling questions, every step counts. Let’s explore Truist’s customer experience in detail.

Application Process

Truist’s mortgage application is mostly straightforward. You can start online or visit a branch. The forms ask for basic information like income and property details. Many find the paperwork clear and simple. Processing times vary but usually take a few weeks. Some customers mention helpful guidance from loan officers during this step.

Customer Service Feedback

Opinions on Truist’s customer service differ. Some borrowers report friendly and responsive support. Loan officers often provide clear answers and updates. Yet, others face delays and difficulty reaching agents. Response times can depend on the branch or loan type. Overall, service quality seems inconsistent across locations.

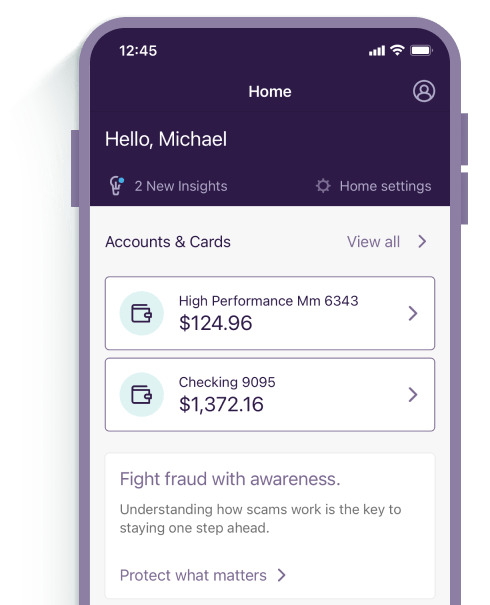

Digital Tools And Online Platform

Truist offers a digital platform for mortgage management. Users can upload documents and track loan status online. The website and mobile app provide basic functions. Many users find the platform helpful for quick updates. Some report issues with navigation or slow loading times. Still, digital tools reduce the need for frequent calls or visits.

Common Complaints

Common concerns include slow communication and unclear timelines. Some customers say loan approval takes longer than expected. Others mention confusing fee disclosures or changes in loan terms. Technical glitches in the online system also frustrate users. These issues can add stress during the mortgage process. Being aware helps set realistic expectations with Truist.

Fees And Closing Costs

Understanding the fees and closing costs is essential before choosing Truist for a mortgage loan. These expenses can affect the total amount you pay and your monthly budget. Truist’s fees are generally competitive, but you should know what to expect in detail.

Origination Fees

Truist charges an origination fee for processing your mortgage. This fee covers the work needed to evaluate and approve your loan. The cost usually ranges from 0.5% to 1% of the loan amount. Paying this fee upfront or rolling it into your loan balance is often an option.

Appraisal And Inspection Costs

Before approving a mortgage, Truist requires a property appraisal. This step confirms the home’s value matches the loan amount. Appraisal fees vary but often cost around $300 to $500. Home inspections may also be necessary. These inspections check the home’s condition and can cost $300 or more.

Other Potential Charges

Truist may include other fees, such as credit report fees, title search, and title insurance. These costs ensure the property has a clear title and your credit is verified. Some closing costs can also include taxes and recording fees. Knowing these possible charges helps you prepare financially.

Branch Availability And Support

Branch availability and support play a crucial role in choosing a bank for mortgage loans. Borrowers often need easy access to bank branches and reliable support to manage their mortgage smoothly. Truist offers a mix of physical locations and digital options to assist customers throughout their mortgage journey.

Physical Branch Locations

Truist has many physical branches, mainly in the Southeast United States. These branches provide face-to-face help with mortgage applications and questions. Visiting a branch can speed up the loan process and build trust. Customers who prefer personal service will find this helpful.

Regional Coverage

Truist’s branches are mostly in states like North Carolina, South Carolina, Georgia, and Florida. Their coverage outside these areas is limited. People living far from these regions may find fewer options for in-person visits. However, Truist is working to expand its reach gradually.

In-person Vs Online Support

Truist offers both in-person and online support for mortgage customers. In-person support helps with complex questions and detailed explanations. Online support includes phone, chat, and email services. This mix allows customers to choose the way they want help. It also makes mortgage management easier for those who cannot visit a branch.

Pros Of Choosing Truist

Choosing Truist for your mortgage loan brings several advantages. The bank offers options that suit different financial needs. Customers often find value in their competitive rates and variety of loan products. Truist also provides affordability features that can help many borrowers manage payments better.

Competitive Rates

Truist offers mortgage rates that are often lower than many local banks. These rates help reduce the total cost of your home loan. Lower rates mean smaller monthly payments and less interest over time. This makes Truist a smart choice for budget-conscious buyers.

Wide Loan Selection

The bank provides many types of mortgage loans. Options include fixed-rate, adjustable-rate, and government-backed loans. This variety helps borrowers find a loan that fits their situation. Truist also caters to first-time homebuyers and those refinancing their homes.

Affordability Options

Truist offers programs to support affordable homeownership. These include down payment assistance and flexible credit requirements. Such features make it easier for more people to qualify for loans. Payment plans can also be adjusted to match income changes.

Cons Of Choosing Truist

Choosing Truist for a mortgage loan comes with some drawbacks. These cons may affect your overall experience and convenience. Understanding these issues helps in making an informed decision about your mortgage lender.

Customer Service Issues

Many customers report slow responses from Truist’s support team. Resolving problems can take longer than expected. Some find the customer service unhelpful or unclear. This can cause frustration during important mortgage processes. Reliable support is key during mortgage approval and management.

Website And App Limitations

Truist’s online platform has some usability problems. Certain tasks, like changing auto-pay settings, can be confusing. The website and app may lack smooth navigation. This limits the ease of managing mortgage details digitally. A user-friendly online system is important for busy borrowers.

Limited Branch Network

Truist has fewer branches outside the Southeast region. This can be inconvenient for borrowers living elsewhere. In-person support and document handling become harder. Not all customers have easy access to a nearby branch. A wider branch network offers more flexibility and service options.

Comparing Truist To Other Lenders

Choosing the right lender for a mortgage loan can shape your home buying experience. Comparing Truist with other lenders helps you see what fits your needs. Each lender type offers different benefits and challenges. Knowing these differences can guide your decision.

Truist, as a regional bank, blends traditional banking with digital tools. It is important to understand how it stacks up against online lenders, credit unions, and big national banks.

Online Lenders Vs Truist

Online lenders offer fast approvals and easy applications. Their rates are often competitive due to low overhead costs. They provide 24/7 access to account information and loan status. However, online lenders lack in-person support and personal relationships. Truist provides branches where you can speak directly to loan officers. This can help with complex mortgage questions and paperwork. Truist’s digital services also compete well with online lenders, offering a blend of convenience and personal touch.

Credit Unions And Regional Banks

Credit unions often have lower fees and better rates than banks. They focus on member service and community support. Regional banks like Truist have more branch locations than many credit unions. Truist offers a wider range of financial products beyond mortgages. Credit unions may require membership, limiting access. Truist serves a broader customer base with flexible mortgage options. Both offer personalized service, but Truist has more resources for large loans and refinancing.

Big National Banks

Big national banks have extensive branch networks and strong brand recognition. Their mortgage products may include special programs and discounts. These banks often have strict lending criteria and slower approval processes. Truist, as a regional bank, offers more local decision-making and faster responses. Truist’s customer service feels more personal compared to large banks. Big banks may offer more digital tools, but Truist balances digital convenience with human support. This balance can benefit borrowers needing guidance.

Credit: www.truist.com

Expert Recommendations

Expert recommendations offer valuable insight into Truist’s mortgage loan services. They help identify who benefits most from Truist and when to explore other options. Understanding these points simplifies the decision process for homebuyers.

Who Should Consider Truist

Truist suits borrowers who live in the Southeast and nearby states. Its local branch network provides easy access to in-person support. Customers valuing personal service and face-to-face meetings find Truist helpful.

Homebuyers seeking a straightforward mortgage process with clear terms benefit from Truist’s offerings. The bank provides competitive fixed-rate mortgages, making it ideal for those planning long-term stays. Truist also appeals to repeat customers who already use its banking products.

Alternatives For Different Needs

Borrowers outside Truist’s main service area should consider national or online lenders. These often offer lower fees and higher interest rates on savings. Online lenders provide fast approvals and user-friendly platforms.

Customers needing specialized loan types, like FHA or VA loans, may find better options elsewhere. Some banks offer more flexible underwriting for lower credit scores or unique financial situations. Comparing multiple lenders ensures the best fit for individual needs.

Frequently Asked Questions

What Is The Rating Of Truist Mortgage?

Truist mortgage holds a solid rating with competitive interest rates and diverse loan options. Customer reviews note occasional service issues.

What Are The Cons Of Truist Bank?

Truist Bank charges high monthly fees on many accounts and low interest rates on deposits. ATM fees apply for non-network use. Some customers report poor service, a confusing online platform, limited branches, and occasional account closure issues. Past lawsuits also affect its reputation.

Which Is The Best Bank For A Mortgage Loan?

The best bank for a mortgage loan offers competitive rates, low fees, excellent customer service, and easy online access. Compare local and national lenders to find the best fit for your financial needs.

What Is Truist’s Mortgage Rate?

Truist’s mortgage rates vary based on loan type and credit profile. Current rates start around 6. 30% APR. Check Truist’s website for exact, updated offers.

Conclusion

Truist offers a range of mortgage loan options with competitive rates. Many borrowers appreciate its personalized service and flexible terms. Some customers mention challenges with fees and online tools. Branch availability varies by location, which can affect convenience. Overall, Truist can suit buyers seeking local support and standard mortgage products.

Comparing offers from different lenders remains a smart choice before deciding. This helps find the best fit for your financial needs and goals.