If you’re involved in banking or financial technology, understanding the Hogan Banking System Architecture can give you a clear edge. This powerful core banking software, trusted by major banks like Wells Fargo and KeyBank, shapes how banks handle everyday operations, from managing customer accounts to processing loans.

But what makes Hogan stand out? It’s designed to blend legacy systems with modern technology, ensuring your bank stays agile, secure, and ready for growth. You’ll discover how Hogan’s architecture works, why it’s vital for today’s banks, and how it can transform your banking operations.

Keep reading to unlock the secrets behind one of the most flexible and reliable banking systems in use today.

Credit: www.luxoft.com

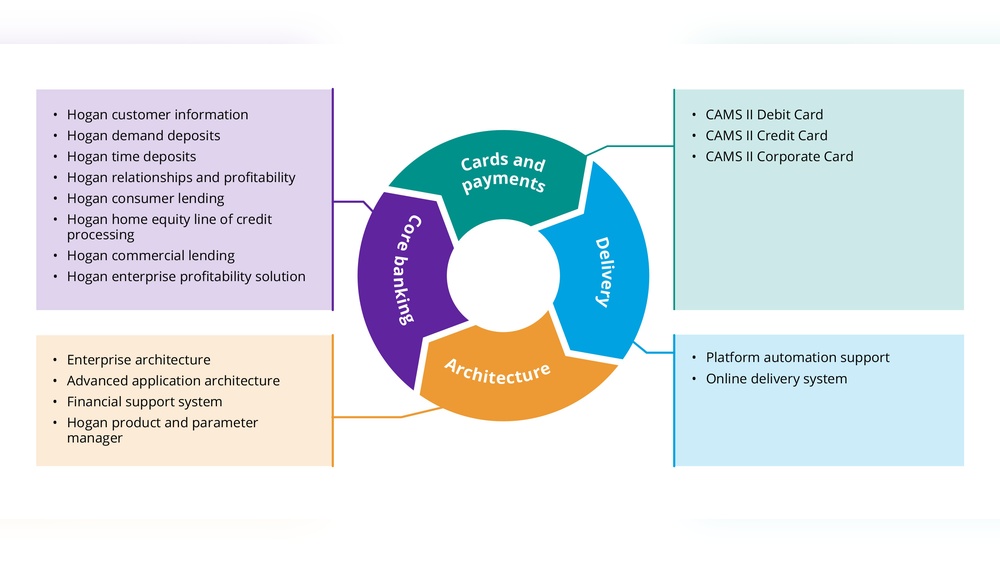

Hogan Core Banking Suite

The Hogan Core Banking Suite is a powerful software platform used by banks worldwide. It manages essential banking operations with a focus on both retail and commercial needs. The suite supports banks in running their daily tasks efficiently while adapting to new technology trends.

This system helps banks handle customer accounts, loans, and transactions smoothly. It also offers tools for integrating modern digital services and improving customer experiences. Designed for reliability, the Hogan Core Banking Suite can grow with a bank’s business needs.

Retail And Commercial Banking Features

The suite provides strong support for retail banking tasks such as managing savings and checking accounts. It also handles commercial banking functions like business accounts and cash management. Banks can process payments, deposits, and withdrawals quickly. This ensures smooth operations for individual and business customers alike.

Loan And Customer Management

Hogan offers tools to manage loan applications and approvals efficiently. It tracks customer data and loan repayments in real time. Banks can use this information to offer personalized services. The system simplifies credit checks and risk assessment, helping banks make better decisions.

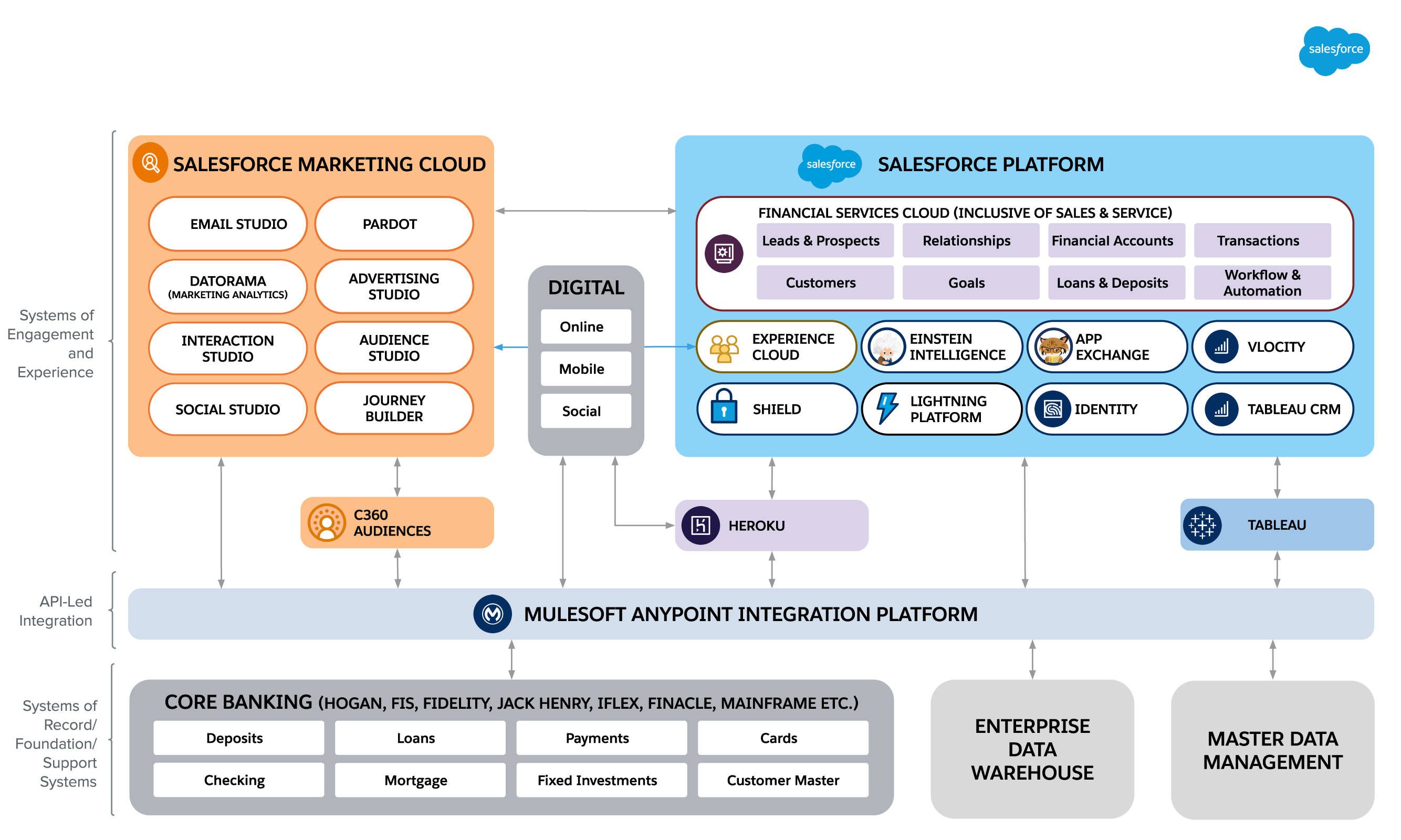

Api And Hybrid Cloud Integration

The suite supports API integration for connecting with other software and digital services. This allows banks to add new features faster. Hybrid cloud support means banks can use both on-site servers and cloud resources. This setup increases flexibility and improves system performance. It also helps banks keep data secure while using modern technology.

Credit: retailbanking-guide-salesforce.herokuapp.com

Modernization And Scalability

The Hogan Banking System Architecture supports banks in evolving with today’s fast-paced market. Modernization and scalability are key to this architecture’s success. It allows banks to update old systems without losing valuable data or functionality. Scalability ensures the system can grow as the bank’s needs increase. Together, these features help banks remain competitive and efficient.

Bridging Legacy And New Systems

Hogan connects older banking systems with new technologies smoothly. It uses APIs and hybrid cloud solutions to link mainframes and modern platforms. This bridge reduces risks and costs during system upgrades. Banks can keep trusted legacy processes while adding new digital features. The system ensures data flows securely between old and new parts.

Handling High Transaction Volumes

Hogan handles large numbers of daily transactions without slowing down. Its architecture supports high-performance processing to maintain speed and accuracy. This ability is crucial for retail and commercial banking operations. The system manages peak loads and prevents downtime. Banks can rely on Hogan to process payments, loans, and customer requests efficiently.

Supporting Business Growth

Hogan’s design allows banks to expand their services easily. Its scalable infrastructure adapts to increasing customer demands. Banks can add new products and markets without major system changes. The flexible architecture supports innovation and quick deployment of updates. Hogan helps banks grow while maintaining stability and security.

Customer Experience Enhancements

The Hogan Banking System Architecture focuses on improving how banks serve their customers. It helps banks offer smooth and easy banking experiences. Customers get faster access to services and personalized options. This leads to higher satisfaction and loyalty.

Enhancing customer experience is key for banks using Hogan. The system uses technology to simplify banking tasks. It supports both digital tools and personalized banking solutions. These improvements make banking more user-friendly and efficient.

Seamless Digital Services

Hogan supports a wide range of digital banking services. Customers can check balances, transfer money, and pay bills online. The system works quickly and without errors. Mobile and web banking apps are connected to the core system. This ensures real-time updates and smooth transactions.

Hogan’s cloud-based design allows banks to add new digital features. This keeps services modern and up to date. Customers enjoy 24/7 access to their accounts. The system reduces wait times and simplifies processes. Digital banking becomes effortless and reliable.

Personalized Banking Solutions

Hogan uses customer data to tailor banking services. Banks can offer customized loan options and savings plans. Customers receive recommendations based on their habits and needs. This personal touch improves trust and engagement.

The system supports targeted marketing campaigns and special offers. It helps banks respond quickly to customer feedback. Personalized solutions drive better financial outcomes for customers. Hogan makes banking feel more personal and relevant.

Security And Compliance

The Hogan Banking System Architecture prioritizes security and compliance to protect sensitive banking data. It ensures that banks meet strict regulations and safeguard customer information across all platforms. The architecture supports robust security frameworks tailored for complex banking environments.

Security controls are embedded in every layer of the system. This helps prevent unauthorized access and data breaches. Compliance with global and local regulations is a key focus, helping banks avoid penalties and maintain trust.

Regulatory Support

Hogan supports numerous banking regulations worldwide. It helps banks comply with standards such as GDPR, PCI-DSS, and SOX. The system includes audit trails and reporting tools for regulatory inspections. Automated compliance checks reduce manual errors and speed up processes. Constant updates ensure the system adapts to changing laws.

Data Protection Across Environments

Data security spans on-premise, cloud, and hybrid environments. Hogan uses encryption to protect data in transit and at rest. Role-based access controls limit data access to authorized users only. Data masking and tokenization secure sensitive information during processing. Regular security assessments identify and fix vulnerabilities promptly.

Hybrid Cloud Security Models

Hogan’s hybrid cloud model combines private and public cloud strengths. It isolates sensitive workloads in secure private clouds. Public cloud resources handle less critical functions with strong security layers. The system uses firewalls, intrusion detection, and multi-factor authentication. This approach balances flexibility, scalability, and security efficiently.

Operational Efficiency Gains

Operational efficiency gains are crucial for banks to stay competitive. The Hogan Banking System Architecture offers tools and features that help banks run smoothly. It reduces delays and cuts down on errors. This allows banks to serve customers faster and better. Efficiency improvements also lower costs and improve overall performance.

Streamlining Banking Processes

Hogan simplifies many core banking tasks. It automates routine operations like account management and loan processing. This automation reduces manual work and speeds up transactions. Banks can handle more operations without adding staff. Clear workflows in Hogan reduce confusion and errors. Faster processing means customers get quicker responses and services.

Optimizing Resource Allocation

Hogan helps banks use their resources wisely. It provides real-time data on workload and system performance. Banks can assign staff to high-demand areas efficiently. The system also manages IT resources to avoid overload. Proper resource allocation lowers costs and improves service quality. Banks can focus efforts where they are needed most.

Innovation And Agility

The Hogan Banking System Architecture drives innovation and agility for banks. It supports fast changes and adapts to new market needs. This architecture helps banks stay competitive and respond quickly. It simplifies launching new services and integrating with other systems. Banks gain flexibility to meet customer expectations and regulatory demands. The system’s design promotes smooth updates without disrupting daily operations.

Rapid Product Deployment

Hogan enables banks to launch new products quickly. The system’s modular design reduces development time. Banks can configure features without heavy coding. This speeds up bringing new loans, accounts, or services to market. Rapid deployment helps banks respond to customer needs and market trends. It also lowers costs linked to product development.

External Pricing Interface

The external pricing interface in Hogan separates pricing rules from core logic. Banks can update prices and fees without changing the main system. This flexibility allows quick adaptation to market changes and competitor moves. It supports complex pricing strategies for various products. The interface ensures pricing updates are accurate and consistent across channels.

Api-driven Integrations

Hogan uses APIs to connect with external applications and services. This open approach enables seamless integration with fintech tools and third-party platforms. APIs allow data exchange in real time, improving operational efficiency. Banks can add new capabilities without rebuilding core systems. The API-driven model supports innovation and faster adaptation to technology advances.

Hogan System Users

The Hogan Banking System serves a wide range of users across the financial industry. These users rely on Hogan to manage core banking operations smoothly. The system supports retail banks, commercial banks, and credit unions alike. Each institution uses Hogan to meet its specific needs. This ensures efficient transaction processing, customer management, and compliance with regulations.

Hogan users benefit from its scalability and modern architecture. The system adapts to growing transaction volumes and evolving business demands. It also offers APIs that connect legacy systems with new technologies. This flexibility helps banks stay competitive and responsive to customer needs.

Wells Fargo

Wells Fargo is one of the largest banks using Hogan. They depend on Hogan for reliable core banking functions. Hogan helps Wells Fargo manage millions of daily transactions. It supports both retail and commercial banking services. The system’s stability and security are vital for Wells Fargo’s operations.

The Huntington National Bank

The Huntington National Bank uses Hogan to streamline its banking processes. Hogan enables Huntington to deliver fast and accurate services. The system supports loan management, deposits, and customer accounts. Huntington values Hogan’s ability to scale with its growth. This ensures consistent service quality across all branches.

Keybank And Pentagon Federal Credit Union

KeyBank and Pentagon Federal Credit Union both utilize Hogan for core banking operations. KeyBank relies on Hogan to manage its vast customer base efficiently. Pentagon Federal Credit Union uses Hogan to enhance its member services. Both institutions benefit from Hogan’s hybrid cloud capabilities. This allows them to combine legacy systems with modern solutions.

Credit: www.semanticdesigns.com

Hogan Intelligent Operations

Hogan Intelligent Operations transform traditional banking processes into smarter, faster workflows. It blends automation, data, and AI to improve daily operations. Banks can reduce errors, cut costs, and respond quicker to customer needs.

The system supports seamless integration with existing platforms. It enhances decision-making through real-time insights. This approach helps banks stay competitive and efficient in a fast-changing market.

Hogan Io Platform

The Hogan io Platform is the core engine behind intelligent operations. It uses automation to handle routine tasks like transaction processing and compliance checks. This frees staff to focus on complex customer service.

Built on modern technology, Hogan io supports cloud and hybrid environments. It ensures smooth data flow between mainframe systems and new digital tools. The platform offers APIs that simplify connectivity and customization.

Boosting Business Outcomes

Hogan Intelligent Operations drive better business results by improving speed and accuracy. Banks can launch new products faster with less risk. Operational costs drop as manual work decreases.

Customer satisfaction rises through faster responses and personalized service. Data-driven insights guide strategy and risk management. Overall, Hogan helps banks grow sustainably and adapt to market demands.

Architecture Components

The Hogan Banking System Architecture is built on several key components that work together. These components ensure smooth operation, high performance, and flexibility. Understanding these parts helps to see how the system supports modern banking needs.

The architecture divides tasks between different layers and technologies. Each layer focuses on specific functions. This separation allows easier maintenance and faster updates. It also helps banks offer secure and reliable services to customers.

Frontend And Backend Technologies

The frontend uses user-friendly interfaces for easy customer interaction. It supports web and mobile platforms. Technologies like HTML5, CSS, and JavaScript frameworks create responsive designs.

The backend handles business logic and data processing. It uses robust programming languages like Java or C. This layer manages transactions, account management, and security checks.

Database Integration

Hogan integrates with powerful databases to store critical banking data. It supports relational databases such as Oracle and SQL Server. These databases ensure data consistency and fast access.

The system uses optimized queries and indexing for high performance. Data backup and recovery mechanisms protect against loss. Encryption safeguards sensitive information within the database.

Microservices And Api Layers

Microservices break down the system into small, independent modules. Each microservice handles a specific banking function. This approach improves scalability and fault isolation.

APIs connect these microservices and enable communication with external systems. They allow banks to integrate third-party services easily. APIs also support modern digital channels like mobile apps and online banking.

Managed Services And Training

Managed services and training form the backbone of a successful Hogan Banking System implementation. They ensure banks maintain smooth operations, stay updated with the latest features, and optimize system use. These services reduce downtime and increase the system’s reliability.

Training equips banking professionals with the skills needed to handle complex tasks confidently. It also supports continuous learning to keep pace with industry changes and technological upgrades.

Hogan Managed Services

Hogan Managed Services provide expert support for daily system operations. This service includes monitoring, maintenance, and troubleshooting to prevent issues before they arise. Banks benefit from reduced operational risks and faster problem resolution.

The managed service team handles software updates and security patches. It ensures the Hogan system runs efficiently and securely. Banks can focus on their core business while experts manage the technical side.

Hogan Academy For Professionals

The Hogan Academy for Professionals offers specialized training programs. These courses cover system functionality, best practices, and new features. Training sessions are designed for all skill levels, from beginners to advanced users.

Hands-on workshops and online modules help professionals learn at their own pace. The academy also provides certification programs to validate skills and knowledge. This boosts confidence and career growth in the banking sector.

Frequently Asked Questions

What Is The Hogan System In Banking?

The Hogan system is a core banking software by DXC Technology. It manages retail, commercial banking, loans, and customer services efficiently. It supports hybrid cloud, APIs, and ensures scalability, security, and regulatory compliance. Banks use it to modernize operations, enhance customer experience, and accelerate innovation.

What Is The System Architecture Of Bank Management System?

The bank management system uses a modular architecture with Java Swing frontend and JDBC backend. It connects to relational databases like MySQL or Oracle for efficient banking operations.

What Are The 4 Pillars Of Banking?

The 4 pillars of banking are retail banking, commercial banking, investment banking, and private banking. These pillars support diverse financial services and customer needs.

Which Banks Use Hogan?

Major global banks, especially those using DXC Technology, implement Hogan for core banking operations and digital transformation.

Conclusion

The Hogan Banking System Architecture supports core banking needs efficiently. It blends traditional mainframe strengths with modern cloud technology. Banks gain flexibility, security, and scalability through this design. The system helps improve customer experiences by enabling fast, reliable services. Its APIs allow easy integration with new tools and apps.

Hogan also ensures compliance with financial regulations and data protection. This architecture suits banks aiming for steady growth and innovation. Understanding Hogan helps grasp how banks manage complex operations today.