If you run an independent law firm, finding the right health insurance can feel overwhelming. You want coverage that protects you and your team without breaking the bank or getting tangled in confusing rules.

The truth is, your options are more flexible than you might think, and choosing wisely can save you money while giving you peace of mind. You’ll discover clear, practical health insurance solutions tailored specifically for independent law firms like yours.

Whether you’re a solo practitioner or managing a small team, we’ll help you understand your choices and make smart decisions that keep your firm—and your health—secure. Keep reading to find the best path forward for your unique needs.

Affordable Plans For Independent Firms

Affordable health insurance plans help independent law firms manage costs and protect their team. These plans offer flexibility and coverage without large premiums. Independent firms can find options suited to their size and budget. Choosing the right plan supports employee well-being and firm growth.

Individual Health Insurance

Individual health insurance plans cover each employee separately. These plans work well for firms with few employees. Independent lawyers can select coverage that fits personal health needs. Premiums depend on age, location, and plan type. These plans often have lower monthly costs but may have higher deductibles.

Group Health Insurance Options

Group health insurance pools all employees under one plan. This option suits firms with multiple staff members. Group plans usually offer better rates than individual plans. Employers can share premium costs to reduce expenses. These plans include various coverage levels and benefits to meet team needs.

Medical Expense Reimbursement Plans

Medical Expense Reimbursement Plans (MERPs) allow firms to reimburse employees for medical costs. Firms pay for expenses up to a set limit. This plan is tax-deductible for the business and tax-free for employees. MERPs offer flexibility and control over healthcare spending. They work well for small or solo law practices.

Credit: www.federalregister.gov

Tax Implications For Llc Health Insurance

Understanding the tax implications of health insurance for LLCs is crucial for independent law firms. The tax treatment varies based on the LLC’s structure and tax election. Proper planning can reduce tax burdens and maximize benefits.

Each LLC type—single-member, multi-member, S-Corp, or C-Corp—has unique rules. These rules affect how health insurance premiums are paid and deducted. Knowing these differences helps law firms choose the best option.

Single-member Llc Tax Benefits

A single-member LLC is treated as a sole proprietorship for tax purposes. The owner can buy individual health insurance plans directly. Premiums paid are deductible as a self-employed health insurance deduction.

This deduction reduces taxable income, lowering overall tax liability. The LLC itself does not pay the premiums. Instead, the owner handles payments and claims the deduction on their personal tax return.

Another option is a Medical Expense Reimbursement Plan (MERP). This plan lets the LLC reimburse the owner for medical costs. The business deducts these reimbursements, and the owner does not report them as income.

Multi-member Llc Tax Treatment

Multi-member LLCs are treated as partnerships unless they elect otherwise. If the LLC pays for group health insurance, the cost is generally deductible for the business.

If the LLC pays individual premiums for members, the amount must be included as income on each member’s tax return. Members can then deduct these premiums under self-employed health insurance rules.

This process means premiums flow through to members’ personal taxes. Proper record-keeping is essential to avoid confusion and ensure correct deductions.

S-corp And C-corp Differences

LLCs can choose to be taxed as S-Corps or C-Corps. Each has distinct rules for health insurance premium deductions.

For S-Corps, shareholder-employees pay premiums, and the S-Corp reimburses them. The premiums are added to wages for payroll tax but are deductible on the shareholder’s personal return.

C-Corps pay premiums directly and deduct the full cost as a business expense. Employees do not report the premiums as income, avoiding extra tax burdens.

Choosing the right tax status impacts both tax savings and administrative complexity. Law firms should review these differences carefully.

Choosing The Right Plan

Choosing the right health insurance plan is a crucial step for independent law firms. It affects the well-being of your team and the financial health of your practice. Making an informed choice means balancing cost, coverage, and compliance with legal requirements. Careful planning ensures you provide valuable benefits without overextending your budget.

Coverage Needs Assessment

Start by evaluating the specific health needs of your firm. Consider the number of employees and their family situations. Identify essential services such as preventive care, prescription drugs, and specialist visits. Include potential future needs like maternity or mental health coverage. A clear understanding of these needs helps narrow down plan options effectively.

State Eligibility Requirements

Each state has different rules for health insurance plans. These rules can affect plan availability and coverage standards. Check your state’s requirements to ensure compliance. Pay attention to mandates on minimum coverage and enrollment periods. Knowing these details prevents legal issues and ensures your plan meets local standards.

Working With Health Insurance Brokers

Health insurance brokers can simplify the selection process. They have expertise in various plans and can match options to your firm’s needs. Brokers explain complex terms and coverage details in plain language. They also help with paperwork and claims support. Partnering with a broker saves time and reduces confusion.

Legal And Regulatory Factors

Understanding legal and regulatory factors is crucial for independent law firms choosing health insurance. These rules affect plan options, costs, and compliance requirements. Firms must follow state and federal laws carefully to avoid penalties.

Health insurance laws vary by state and depend on firm size. Employee classification also impacts which plans are available. Staying updated with health regulations helps law firms protect their employees and business.

Group Plan Eligibility By State

States set different rules about who can join group health plans. Some require a minimum number of employees to qualify. Others offer special options for small businesses or solo practitioners. Knowing your state’s rules helps select the right plan.

Eligibility also depends on how employees are counted. Part-time and contract workers may or may not count towards the minimum. This affects whether the firm can offer a group plan or must choose individual coverage.

Compliance With Health Laws

Law firms must follow federal laws like the Affordable Care Act (ACA). The ACA requires firms with 50 or more employees to provide health insurance. Smaller firms have different obligations but still must meet certain standards.

Other regulations include HIPAA for privacy and ERISA for employee benefits. Compliance protects the firm from fines and legal issues. It also ensures fair treatment of employees regarding health coverage.

Employee Status Considerations

Employee status affects health insurance options and costs. Full-time employees usually qualify for group plans. Part-time, freelance, or contract workers often do not.

Classifying workers correctly prevents legal problems. Misclassification can lead to penalties and back payments. Clear definitions help firms offer proper benefits and stay compliant with laws.

Maximizing Tax Deductions

Maximizing tax deductions is essential for independent law firms managing health insurance costs. Understanding deduction options reduces taxable income and improves cash flow. Smart tax planning helps keep more money within the firm.

Self-employed Health Insurance Deduction

Lawyers operating as sole proprietors or single-member LLCs can use the self-employed health insurance deduction. This deduction allows the full cost of health insurance premiums to be deducted from taxable income. It applies to premiums paid for the lawyer, spouse, and dependents. The deduction reduces adjusted gross income, lowering overall tax liability. This benefit encourages independent professionals to maintain coverage.

Medical Expense Reimbursement Strategies

Medical Expense Reimbursement Plans (MERPs) offer a way to reimburse healthcare costs tax-free. The law firm pays for medical expenses directly or reimburses the owner for personal payments. These reimbursements count as deductible business expenses. MERPs help manage costs while providing financial relief. They also avoid increasing the owner’s taxable income, making them tax-efficient for small firms.

Consulting Tax Professionals

Tax rules for health insurance deductions can be complex. Consulting a tax professional ensures compliance with IRS regulations. Professionals identify all possible deductions and credits. They tailor strategies to the firm’s business structure and needs. Expert advice prevents costly mistakes and maximizes tax benefits. Independent law firms benefit from customized tax planning guidance.

Credit: www.federalregister.gov

Additional Insurance Options

Independent law firms need more than basic health insurance. Additional insurance options protect against gaps in coverage. These options help manage risks that standard plans might miss. Choosing the right ones strengthens your firm’s financial health and peace of mind.

Long-term Care Insurance

Long-term care insurance covers services not paid by regular health plans. It helps with nursing home care, home health aides, and assisted living. Law firm owners and employees benefit from this protection as they age. This insurance reduces the financial burden of long-term medical needs.

Supplemental Health Plans

Supplemental health plans fill coverage gaps in primary insurance. They include dental, vision, critical illness, and accident policies. These plans offer extra financial support during unexpected medical events. Independent firms can customize coverage to fit their team’s specific needs.

Small Business Insurance Solutions

Small business insurance solutions bundle multiple coverages for law firms. These may include general liability, professional liability, and workers’ compensation. Combining policies simplifies management and often lowers costs. Protect your firm from legal claims and workplace injuries with these tailored options.

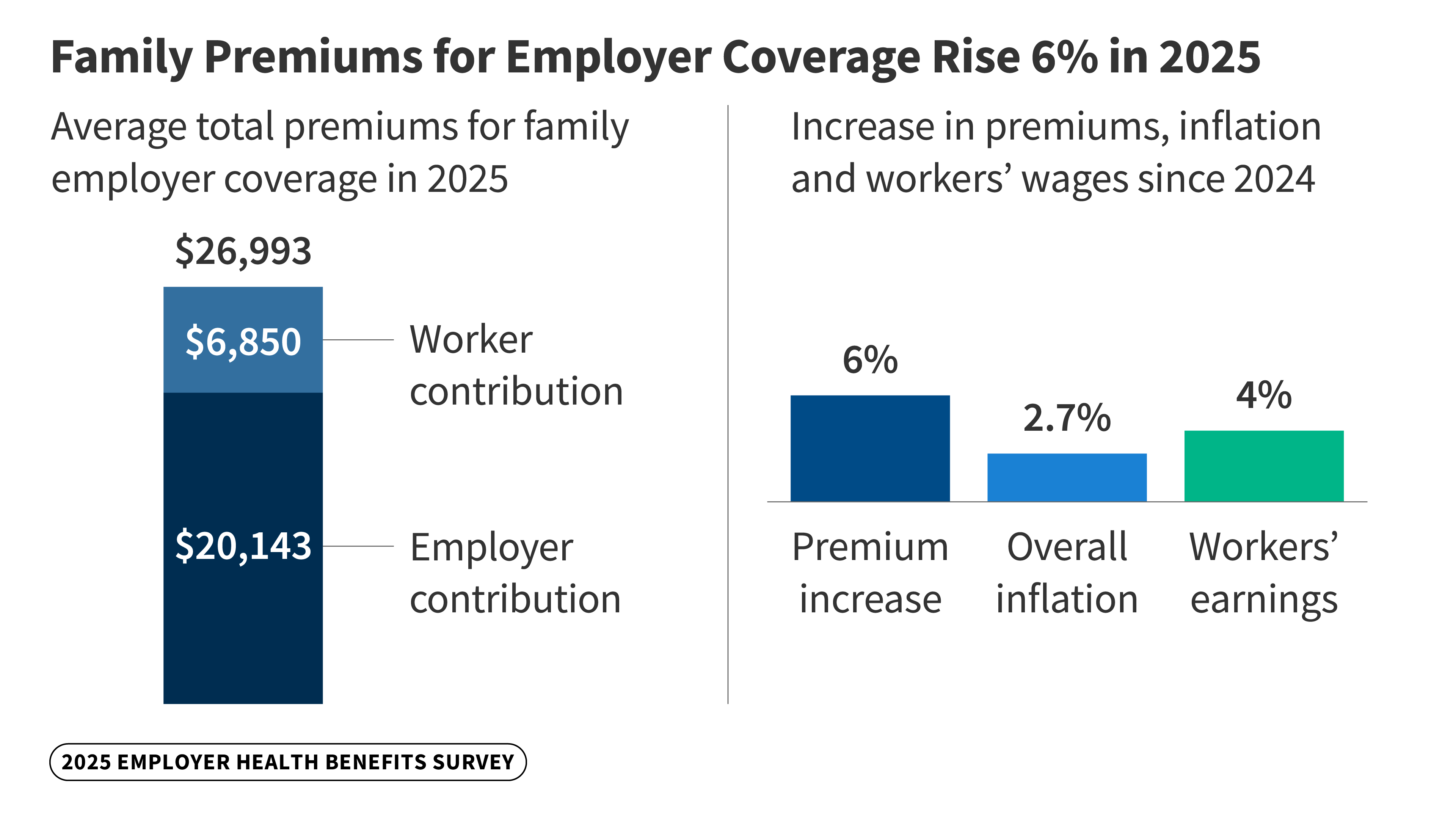

Credit: www.kff.org

Frequently Asked Questions

How Do Consultants Get Health Insurance?

Consultants get health insurance by purchasing individual plans or using group plans via an LLC or broker. They can also use health insurance brokers to find suitable coverage. Tax treatment depends on the business structure, so consulting a tax professional helps optimize benefits and deductions.

Do Big Law Firms Pay For Health Insurance?

Big law firms typically cover health insurance costs for their employees as part of competitive benefits packages. This helps attract and retain top talent. Coverage often includes medical, dental, and vision plans with employer-subsidized premiums. Benefits may vary by firm size and location but generally offer comprehensive options.

Do Lawyers Make $500,000 A Year?

Some lawyers earn $500,000 annually, especially in top law firms or with specialized expertise. Most earn less.

Can An Llc Pay For Owners’ Health Insurance?

Yes, an LLC can pay for owners’ health insurance. Tax treatment depends on the LLC’s tax status and owner role. Single-member LLC owners can deduct individual premiums. Multi-member LLCs may include premiums as income. S-Corps allow personal deductions; C-Corps offer tax-free benefits.

Consult a tax professional.

Conclusion

Choosing the right health insurance can protect your law firm’s future. Independent firms benefit from exploring all available plans. Consider your firm’s size, tax status, and budget carefully. Compare group plans, individual policies, and reimbursement options. Each choice impacts your taxes and coverage differently.

Consulting with a specialist helps simplify the process. Staying informed keeps your firm and employees secure. Prioritize clear, affordable coverage that fits your needs. Health insurance is an important step in running a successful independent law firm.