Are you trying to decide between group coverage and individual health insurance but unsure which one will cost you less? Understanding the difference in costs can save you hundreds or even thousands of dollars each year.

You might think group plans offered by employers are always cheaper, but individual plans can sometimes surprise you with flexibility and savings, especially with available subsidies. This article breaks down the real costs behind both options, helping you see which fits your budget and health needs better.

Keep reading to uncover the factors that impact your insurance expenses and make the best choice for your wallet and well-being.

Group Health Insurance Basics

Group health insurance is a common choice for many employees. It provides health coverage through an employer or organization. This type of plan often costs less than individual insurance. Understanding how group health insurance works helps you see its benefits clearly.

Group plans cover a large number of people under one contract. This setup creates a shared risk and lowers the cost for each member. Employers play a key role in managing these plans. Let’s explore the main features of group health insurance.

How Group Plans Work

Group health insurance covers all eligible employees under a single policy. The employer negotiates with insurance companies. They choose a plan that fits the needs of the workforce. Employees get similar benefits and coverage options. This system simplifies the signup and renewal process.

Since many people join the plan, insurers can offer lower rates. Coverage often includes medical, dental, and vision services. Employees usually pay a portion of the premium through payroll deductions. The plan stays active as long as the employer offers it.

Employer Contributions

Employers often pay part of the insurance premium. This reduces the cost employees must pay. The amount varies by company but can cover up to 50% or more. Employer contributions make group plans more affordable for workers.

These contributions also show the employer’s commitment to employee health. In some cases, the employer covers administrative fees too. This support helps maintain stable insurance coverage for all members.

Risk Pooling Benefits

Risk pooling means spreading health costs across many people. It lowers the cost for everyone in the group. Healthy members balance out those who need more care. This shared risk makes premiums more stable and affordable.

Group plans often do not check individual health history. This means no one is denied coverage due to pre-existing conditions. Risk pooling creates a fair system for all employees. It helps keep monthly costs manageable.

Individual Health Insurance Basics

Individual health insurance is coverage you buy on your own. It is not tied to an employer or group plan. This type of insurance lets you choose plans that fit your needs and budget. Costs can vary widely based on your choices and health status.

Understanding the basics helps you compare individual plans with group coverage. It also guides you to make smart decisions about your health protection.

Plan Customization Options

Individual plans offer many ways to customize your coverage. You can select the level of benefits that suit your health needs. Options include different deductibles, copayments, and out-of-pocket limits. This flexibility helps you control how much you pay monthly and when you need care.

Custom plans let you add extra benefits like dental or vision coverage. You decide what matters most for your health and budget.

Premium Tax Credits And Subsidies

Many individual plans qualify for tax credits or subsidies. These reduce the monthly premium based on your income. Lower-income individuals often get bigger savings. This helps make health insurance more affordable.

You must meet certain income limits to qualify. These credits are available through government programs like the Health Insurance Marketplace. They can greatly lower your total cost.

Marketplace Enrollment

The Health Insurance Marketplace is where you buy individual plans. It opens during specific enrollment periods each year. Outside these times, you need a special event like job loss or marriage to enroll.

The Marketplace shows all available plans in your area. You can compare prices, coverage, and benefits side-by-side. This makes choosing the right plan easier and clearer.

Cost Comparison Factors

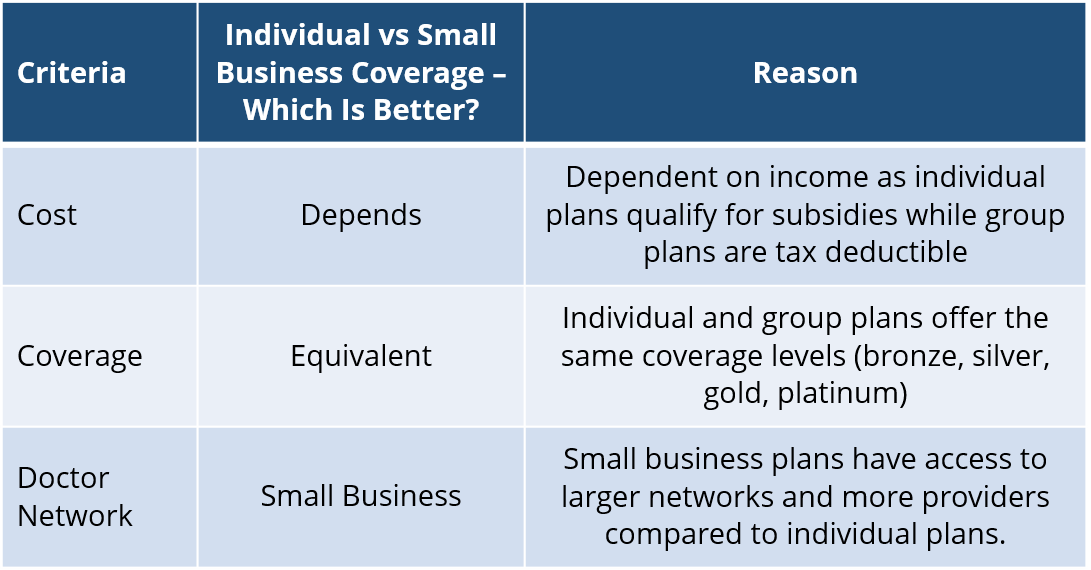

Understanding the cost differences between group coverage and individual health insurance is key. Several factors influence these costs. Breaking down these factors helps you see where your money goes. This section covers premium differences, deductibles, out-of-pocket costs, and coverage limits.

Premium Differences

Group health insurance usually offers lower premiums. Employers often pay part of the premium. This reduces the amount employees pay monthly. Individual plans tend to have higher premiums because you cover the full cost. Premiums also depend on age, health, and location. Group plans spread risk across many members, lowering premiums.

Deductibles And Out-of-pocket Costs

Deductibles in group plans are often lower. You pay less before insurance starts to cover costs. Individual plans may have higher deductibles to lower premiums. Out-of-pocket limits can differ too. Group plans usually have set limits to protect members. Individual plans vary widely, affecting how much you pay during the year.

Coverage Limits And Benefits

Group coverage often includes more comprehensive benefits. Employers negotiate plans with wider coverage options. Individual plans might have stricter limits on services and medications. Group plans may cover preventive care fully. Individual plans sometimes require additional payments for similar services. Benefits and limits directly affect your total health costs.

Advantages Of Group Coverage

Group health insurance offers several clear benefits compared to individual plans. These advantages often translate into better affordability and coverage options. Understanding these benefits helps employees make informed decisions about their health insurance choices.

Lower Premiums Through Employer Support

Employers usually pay a portion of the insurance premium. This reduces the amount employees must pay from their own pockets. Group plans spread costs across many members. This sharing lowers the price per person. Lower premiums make group coverage more affordable than individual plans.

Access To Comprehensive Benefits

Group insurance often includes more health benefits than individual plans. Employers negotiate better coverage options for their employees. These may include dental, vision, and wellness programs. Employees get access to services that may be costly alone. Comprehensive benefits improve overall healthcare protection.

Risk Sharing Among Members

Group plans pool the health risks of all members. Healthy members help balance the cost of those with higher needs. This risk sharing keeps premiums stable and predictable. Individual plans charge based on personal health risk. Group coverage reduces the financial impact of unexpected health issues.

Advantages Of Individual Coverage

Choosing individual health insurance offers unique advantages that suit personal needs. It allows you to pick a plan that fits your lifestyle and health requirements. Individual coverage gives more freedom compared to group plans. It also stays with you, no matter your job status.

Flexible Plan Choices

Individual coverage lets you select from many plans available. You can choose the level of coverage you want. This flexibility helps you find a plan that matches your budget and health needs. Unlike group plans, you are not limited to one option. This freedom lets you tailor your insurance to your life.

Control Over Benefits

You decide which benefits to include in your plan. This control means you pay only for what you need. You can add or remove services as your health changes. Group plans often have fixed benefits for everyone. Individual plans let you focus on your personal health priorities.

Portability When Changing Jobs

Individual health insurance stays with you when you change jobs. It does not depend on your employer. This portability means no gaps in coverage during job transitions. Group coverage usually ends when you leave a job. Individual plans provide security and peace of mind in uncertain times.

Credit: www.bbd.ca

Potential Drawbacks

Choosing between group coverage and individual health insurance involves more than just comparing costs. Each option has its own set of drawbacks that can affect your access to care and overall expenses. Understanding these potential downsides helps you make a better decision for your health needs and budget.

Group Coverage Restrictions

Group health insurance often comes with strict rules. Employers decide the plan options and coverage details. This limits your ability to customize the plan to fit your specific needs. Some treatments or providers may not be covered. Changing jobs means losing your group coverage. This can disrupt your healthcare continuity.

Higher Costs In Individual Plans

Individual health insurance usually costs more per person. Insurers consider your age, health, and location. Without employer subsidies, premiums can be high. Deductibles and co-pays might also be larger. For healthy people, this can feel like paying too much. The lack of group risk sharing raises prices.

Eligibility And Enrollment Challenges

Individual plans require you to meet certain rules to enroll. Missing open enrollment periods can delay coverage. Pre-existing conditions might affect your plan choices or costs, depending on the state. Group plans often cover all employees automatically. Navigating individual plan options can be confusing and time-consuming.

Tax Implications And Savings

Understanding the tax implications of health insurance is crucial. It helps in choosing the most cost-effective plan. Both group coverage and individual insurance offer unique tax benefits. These benefits can lower the overall cost. Knowing these can lead to smarter financial decisions.

Tax Advantages In Group Plans

Group health plans often come with tax perks. Employers usually pay part of the premium. This portion is not counted as taxable income for employees. Premiums paid by employees through payroll deductions are usually pre-tax. This lowers the employee’s taxable income. As a result, employees pay less in income taxes. Also, employer contributions are tax-deductible for the business. This makes group plans attractive from a tax perspective.

Individual Plan Tax Credits

Individual health insurance can offer tax credits. These credits depend on income and family size. The government provides premium tax credits to eligible buyers. These credits reduce monthly premium costs directly. Tax credits are available through the health insurance marketplace. People with lower incomes benefit the most. Claiming these credits requires filing taxes properly. Without them, individuals may pay higher premiums.

Impact On Overall Savings

Tax benefits in both plans affect total savings. Group plans reduce taxable income for many employees. This creates steady savings each year. Individual plans with tax credits can lower upfront costs. However, savings vary by personal income and eligibility. Understanding both options helps in planning finances. Considering tax impact is key to maximizing savings.

Credit: www.peoplekeep.com

Choosing The Best Option

Choosing between group coverage and individual health insurance requires careful thought. Each option fits different needs and budgets. Understanding your health and financial situation helps in making the right choice. Consider what matters most to you now and in the future.

Assessing Personal Health Needs

Think about your current health status. Do you have ongoing medical conditions? Group plans often cover many people with varied health needs. Individual plans can be tailored to your specific needs. Check if your preferred doctors and medications are included in the plan. Consider how often you visit a doctor or need prescriptions.

Evaluating Financial Considerations

Compare the monthly premiums for both options. Group coverage usually offers lower premiums because employers share the cost. Individual plans can be more expensive but may offer subsidies. Look at deductibles and out-of-pocket costs too. Balance what you pay monthly with what you pay when using care. Think about your budget and how much you can afford.

Long-term Coverage Goals

Consider your future health needs and job stability. Group insurance depends on your employer, so coverage may change if you switch jobs. Individual insurance stays with you regardless of employment. Plan for possible changes in health or family size. Choose a plan that supports your long-term health and financial security.

Special Considerations In Austin, Texas

Austin, Texas has unique factors that affect health insurance costs. These factors shape the differences between group coverage and individual plans. Understanding local trends helps you make better insurance choices. Austin’s market, employers, and state rules all play a role in pricing and coverage options.

Local Market Pricing Trends

Health insurance prices in Austin reflect local healthcare costs. Providers set rates based on area demand and service availability. Individual plans often have varied prices due to risk assessment. Group plans benefit from spreading costs across many employees. This pooling lowers the average premium for group coverage.

Employer Coverage Trends

Many Austin employers offer group health insurance to attract workers. Larger companies usually provide more comprehensive plans at lower costs. Smaller businesses may offer limited coverage or none at all. Employer contributions can greatly reduce the employee’s share of premiums. These trends influence how affordable group insurance is compared to individual plans.

State Regulations Impact

Texas laws affect health insurance rules and pricing. The state does not require all employers to provide health insurance. Regulations also shape what benefits plans must cover. Texas allows a wide range of plan choices in the individual market. These laws create a diverse insurance landscape in Austin. Understanding state rules helps compare group and individual costs clearly.

Credit: www.simplyinsured.com

Frequently Asked Questions

Is Group Or Individual Health Insurance More Expensive?

Group health insurance usually costs less because employers share premiums. Individual plans can be pricier but offer more customization and subsidies.

Is It Cheaper To Get Health Insurance As A Couple Or Individual?

Health insurance as a couple often costs less per person than individual plans due to shared premiums and coverage. Group plans, like employer-sponsored ones, usually offer lower rates than individual policies. However, costs vary by plan, location, and eligibility for subsidies or tax credits.

Is Group Health Insurance Worth It?

Group health insurance offers lower premiums and shared risk, making it cost-effective and valuable for most employees.

Is It Better To Have A $500 Deductible Or $1 000 Health Insurance?

Choosing a $500 deductible means higher premiums but lower out-of-pocket costs. A $1,000 deductible lowers premiums but increases your expenses if you need care. Select based on your health needs and budget for best savings.

Conclusion

Choosing between group coverage and individual health insurance depends on your needs and budget. Group plans usually cost less because employers share the expense. Individual plans offer more control and flexibility but may have higher premiums. Tax credits can help reduce individual plan costs.

Consider your health, finances, and coverage options carefully. Weigh the benefits of both to find the best fit. Your choice should balance affordability with the coverage you require. Take time to compare plans before deciding.