Looking to save money on your car insurance? You’re not alone.

Finding the best coverage at the right price can feel overwhelming. But what if you could see multiple insurance quotes side-by-side in just minutes? When you compare car insurance online, you take control of your choices and your budget. This simple step can uncover better deals, tailor coverage to your needs, and protect your wallet from surprise costs.

Keep reading to discover how easy it is to compare car insurance online and why it’s the smartest move you can make before buying your next policy.

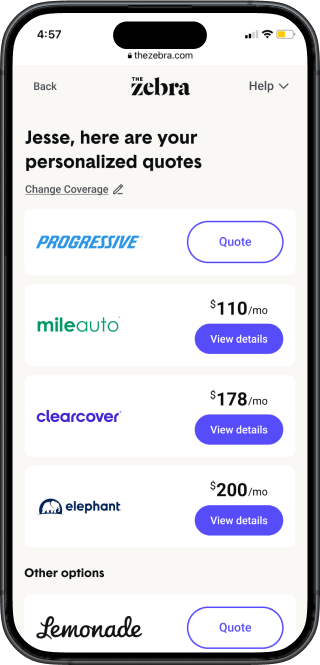

Credit: www.thezebra.com

Top Car Insurance Comparison Sites

Top car insurance comparison sites help you find the best deals fast. They gather quotes from many insurers in one place. This saves time and effort. Users can see prices side by side. This makes it easy to pick the right policy. These platforms offer tools and advice to guide your choice. Understanding their features helps you choose the best site for your needs.

Features Of Leading Platforms

Leading comparison sites offer wide insurer coverage. They include major and smaller companies. Most have filters for coverage types and price ranges. Some provide customer reviews and ratings. Many allow you to customize policies. Extra tools like calculators help estimate costs. Alerts notify you of new deals or discounts. Secure data handling protects your personal info. These features create a complete user toolkit.

User Experience And Ease Of Use

Top sites have simple, clean designs. They guide users step by step. Forms are short and easy to fill. Mobile-friendly layouts let you compare on any device. Fast loading times prevent user frustration. Clear buttons and labels improve navigation. Some sites offer live chat or phone support. Overall, the experience is smooth and stress-free.

Accuracy Of Quotes

Accurate quotes depend on up-to-date data from insurers. Leading sites update prices frequently. They ask detailed questions to tailor quotes. Some cross-check info with insurers for precision. Real-time quote updates reflect market changes. Transparent pricing shows all fees and discounts. Accurate quotes help you avoid surprises later. Trustworthy sites prioritize honesty in pricing.

How To Find The Cheapest Car Insurance

Finding the cheapest car insurance takes some effort. Prices vary widely based on many factors. Comparing online helps find the best deals fast. It saves money and time. Knowing what affects rates improves your search. Using smart tips lowers premiums. Discounts offer extra savings. Start with the basics, then dive deeper.

Factors Affecting Insurance Rates

Insurance companies consider many details. Your age and driving history matter a lot. The car model and year affect costs. Location plays a big role too. Urban areas often have higher rates. How much you drive changes the price. Coverage type and deductible size also impact rates.

Tips For Lower Premiums

Choose a higher deductible to reduce costs. Maintain a clean driving record. Limit annual mileage if possible. Bundle car insurance with other policies. Pay your premium yearly instead of monthly. Use safe driver programs offered by insurers. Shop and compare quotes every year.

Common Discounts To Look For

Many insurers offer discounts that save money. Good student discounts reward young drivers. Defensive driving courses can lower premiums. Multi-car discounts apply if you insure several vehicles. Low mileage discounts suit those who drive less. Loyalty discounts reward long-term customers. Ask about any special offers available.

Comparing Quotes Without Hassle

Comparing car insurance quotes online can save time and money. The key is to do it without stress. Avoiding repeated work and protecting your privacy are important. Using the right tools makes the process smooth and fast.

Avoiding Repetitive Data Entry

Entering the same details multiple times wastes time. Many comparison sites let you fill data once. They send your information to several insurers automatically. This saves effort and reduces errors. You get multiple quotes without typing again and again.

Privacy Concerns And Email Requirements

Some sites ask for your email to send quotes. This can lead to many marketing messages. Choose platforms with clear privacy policies. Look for options to limit emails or opt out later. Protect your personal data and avoid spam.

Tools For Quick And Easy Comparisons

Online tools simplify comparing car insurance rates. They show quotes side by side for easy review. Filters help you find policies matching your needs. Mobile apps add convenience, letting you compare on the go. These tools speed up decision-making and ensure you see the best offers.

Car Insurance Comparison By Location

Car insurance rates and options vary widely by location. Comparing car insurance by location helps find the best deals and coverage. Different states have unique rules, pricing, and discounts that affect your insurance costs. Understanding these local factors can save money and improve coverage quality.

State-specific Rates And Regulations

Each state sets its own rules for car insurance. These rules include minimum coverage requirements and premium calculations. States like Texas have specific laws that impact insurance rates. Some states require uninsured motorist coverage, others do not. Knowing these regulations helps in choosing the right policy. Rates also change due to local traffic, weather, and accident rates.

Popular Comparison Sites In Texas

Texas drivers can use several reliable sites to compare car insurance. Sites like Compare.com and NerdWallet offer side-by-side quote comparisons. These platforms show rates from multiple insurers quickly. Users can filter results by coverage type and price. They also provide state-specific information for Texas residents. Using these tools makes shopping for insurance faster and easier.

Regional Discounts And Offers

Insurance companies offer discounts based on your location. Texas drivers may qualify for regional deals like safe driver discounts. Some areas offer lower rates due to fewer accidents or thefts. Bundling home and auto insurance can also reduce premiums. Local credit unions or employers might provide additional offers. Checking these regional discounts saves money on car insurance.

Benefits Of Comparing Car Insurance Online

Comparing car insurance online offers many benefits. It helps drivers find the best deals fast. The process is simple and clear. More people choose online comparison to make smart choices. This method puts control in the hands of the buyer. It removes guesswork from buying car insurance.

Saving Time And Money

Online comparison saves hours of searching. It shows many quotes in one place. Users can see prices side by side. This helps pick the cheapest option quickly. Saving time means less stress and hassle. Money saved on insurance can be used elsewhere.

Access To Multiple Insurers

Many insurance companies appear in one search. This gives a wide range of options. Users can check big brands and smaller firms. More choices increase chances of finding good deals. It also reveals companies that suit different needs.

Customized Coverage Options

Online tools allow adjusting coverage details easily. Users choose what fits their budget and needs. This makes policies more personal and effective. Customized options avoid paying for unwanted extras. It ensures enough protection for each driver.

Credit: www.pbpartners.com

What To Check Before Choosing A Policy

Choosing the right car insurance policy requires more than just picking the cheapest option. Several key factors affect how well a policy protects you and your vehicle. Checking these details carefully helps avoid surprises later. Focus on the coverage, customer feedback, and how smoothly claims are handled.

Coverage Details And Limits

Review what the policy covers and the limits it sets. Check if it includes liability, collision, and comprehensive coverage. Understand the maximum amount the insurer will pay for each type of damage. Look for any exclusions that might leave you unprotected. Make sure the coverage fits your needs and budget.

Customer Reviews And Ratings

Read reviews from current and past policyholders. These provide insight into the insurer’s reliability and service quality. Pay attention to common complaints or praise about coverage and pricing. High ratings generally mean better customer satisfaction. Choose insurers with a strong track record in your area.

Claim Process And Support

Understand how to file a claim and the steps involved. Check if the insurer offers 24/7 support for emergencies. Fast and easy claims handling reduces stress during accidents. Look for companies with clear communication and helpful customer service. Good support can make a big difference after a crash.

Using Comparison Tools For Better Decisions

Using comparison tools helps make smarter choices about car insurance. These tools gather many insurance offers in one place. They show prices and coverage options clearly. This makes it easier to spot the best deals quickly. Understanding what each policy offers is key to saving money and getting proper protection.

Side-by-side Quote Analysis

Comparison tools display insurance quotes side by side. This lets you see price differences instantly. You can check coverage limits, deductibles, and premiums all at once. It helps avoid missing hidden fees or extra costs. Side-by-side views save time and reduce confusion during shopping.

Understanding Policy Differences

Not all car insurance policies cover the same risks. Some include roadside assistance; others may not. Some policies cover rental cars after an accident. Comparison tools highlight these differences clearly. This understanding helps pick a policy that fits your needs well. It also prevents paying for unwanted coverage.

Making Informed Choices

With clear data from comparison tools, decisions become easier. You can balance cost and coverage without guessing. Informed choices protect your car and wallet better. These tools empower you to choose wisely based on facts. They remove guesswork and make insurance shopping straightforward.

Credit: www.youtube.com

Frequently Asked Questions

What Is The Best Place To Compare Car Insurance?

The best place to compare car insurance is on trusted sites like Compare. com, NerdWallet, The Zebra, and Insurify. These platforms show side-by-side quotes from top insurers quickly. They help you find affordable rates and suitable coverage tailored to your needs.

Who Typically Has The Cheapest Car Insurance?

Young drivers with clean records, good students, and those with minimal coverage often have the cheapest car insurance rates.

Which Comparison Site Is Most Reliable?

Compare. com, NerdWallet, and The Zebra rank among the most reliable comparison sites. They offer real quotes from top insurers instantly. These platforms provide accurate, side-by-side price comparisons, helping users find the best coverage and rates easily. Always verify reviews and data freshness for trustworthiness.

Who Has The Cheapest Auto Insurance Rates In Nc?

Geico, State Farm, and Progressive often offer the cheapest auto insurance rates in North Carolina. Compare quotes online to find the best deal.

Conclusion

Comparing car insurance online saves time and money. It helps you find the best rates fast. Checking multiple quotes lets you see real differences. You get to choose coverage that fits your needs. Don’t settle for the first offer you see.

Spend a few minutes comparing to avoid costly mistakes. Smart shopping leads to better protection on the road. Start your comparison today and drive with confidence.