If you run a business in Austin, Texas, you know how quickly unexpected accidents can turn into costly legal battles. Imagine a customer slipping in your store or a mishap damaging a client’s property—without the right protection, these incidents could drain your finances and put your business at risk.

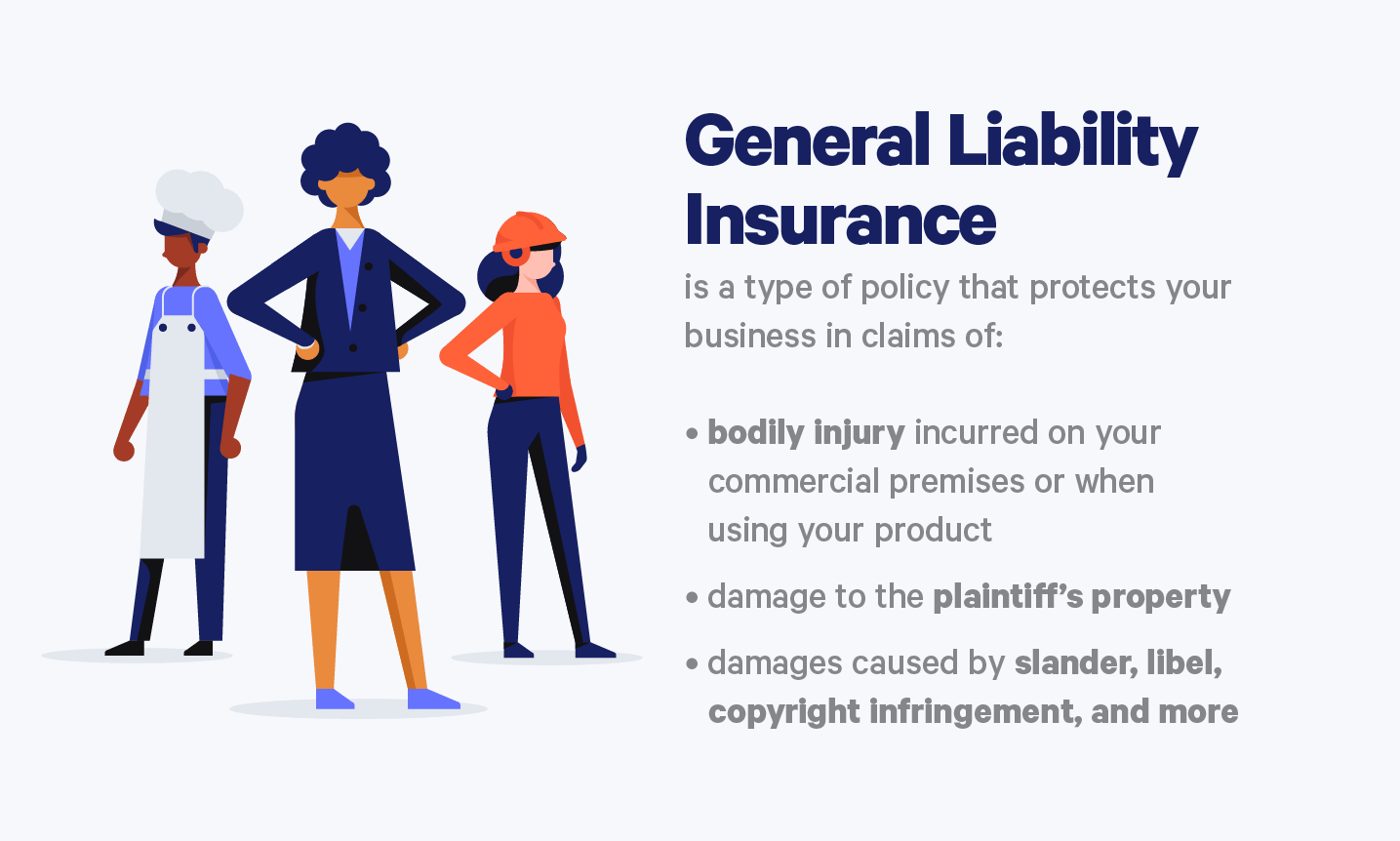

That’s where Commercial General Liability (CGL) insurance comes in. It acts as a safety net, covering you against claims of injury, property damage, and more. You’ll discover exactly what CGL insurance covers, why it’s crucial for your business, and how it can save you from financial headaches.

Keep reading to learn how to protect your business and gain peace of mind every day.

Credit: www.embroker.com

Coverage Areas

Commercial General Liability Insurance covers many risks that businesses face daily. It protects against costs from injuries, damages, and legal claims. Understanding coverage areas helps you see how this insurance supports your business. Each area targets specific types of risk to keep your business safe.

Bodily Injury Protection

This coverage protects your business if someone gets hurt on your property. It covers medical bills and related expenses. It also applies if your product or service causes injury. This helps avoid paying large costs out of pocket.

Property Damage Coverage

Covers damage your business causes to others’ property. This can include accidents at your workplace or damage caused by your employees. The insurance pays for repairs or replacement. It helps maintain good business relationships by handling these costs.

Personal And Advertising Injury

Protects against claims like libel, slander, or copyright violation in ads. It covers false arrest or invasion of privacy claims. This area shields your business reputation and finances. Legal issues from marketing mistakes can be costly without this coverage.

Legal Expense Coverage

Covers the costs of defending your business in lawsuits. This includes attorney fees, court costs, and settlements. It helps your business handle legal challenges without financial strain. Having legal expense coverage ensures you get proper defense support.

Importance For Businesses

Commercial General Liability Insurance is vital for every business. It shields companies from financial losses caused by accidents or lawsuits. This insurance helps businesses operate with confidence. It protects against claims for injury, property damage, or advertising mistakes. Understanding its importance can help companies stay secure and meet their obligations.

Financial Security

This insurance covers costs linked to lawsuits or claims. It pays for legal fees, settlements, and judgments. Without it, businesses may face huge out-of-pocket expenses. Financial security allows businesses to focus on growth. It prevents unexpected costs from harming the company’s future.

Meeting Contract Requirements

Many contracts require proof of liability insurance. Clients and landlords often ask for this coverage. It shows that the business is responsible and prepared. Without it, businesses risk losing deals or leases. Meeting these requirements builds trust and opens opportunities.

Operational Peace Of Mind

Running a business involves risks every day. This insurance reduces worry about accidents or claims. Business owners can focus on their work with less stress. Knowing there is protection helps maintain smooth operations. Peace of mind improves decision-making and productivity.

Claims And Lawsuits

Claims and lawsuits are common risks in business operations. Commercial General Liability (CGL) insurance protects companies from costly legal battles. It covers expenses related to bodily injury, property damage, and other liabilities. This section explains typical claim scenarios, how legal fees are handled, and details about settlements and judgments.

Common Scenarios

Many claims arise from slips, trips, and falls on business premises. Customers or visitors may get injured and seek compensation. Another scenario includes property damage caused by employees during work. Advertising mistakes like false claims or copyright infringement can also lead to lawsuits. CGL insurance helps cover these everyday risks.

Handling Legal Fees

Legal fees can quickly become expensive without insurance. CGL insurance usually covers attorney fees, court costs, and other related expenses. This support helps businesses defend themselves in court without financial strain. The policy pays these costs up to the coverage limits, protecting business cash flow.

Settlements And Judgments

Settlements often resolve claims without going to trial. CGL insurance covers agreed settlement amounts within policy limits. If a case goes to court, judgments may require businesses to pay damages. The insurance helps cover these payments, reducing the risk of severe financial loss. This protection is vital for business stability.

Credit: pi-ins.com

Policy Details

Understanding the policy details of Commercial General Liability (CGL) insurance is crucial for every business owner. This section breaks down key aspects of the policy. It helps you know what protection you have and where limits may exist. Knowing these details helps avoid surprises during a claim.

Coverage Limits

Coverage limits set the maximum amount the insurer pays for a claim. These limits vary by policy and type of coverage. Commonly, policies have separate limits for bodily injury, property damage, and personal injury. There is usually an aggregate limit that caps total payments within the policy period. Choosing the right limits depends on your business size and risk level. Lower limits may save money but increase out-of-pocket risk.

Exclusions To Know

Exclusions specify what the policy does not cover. Typical exclusions include damage caused by pollution, professional errors, or intentional acts. Also, some policies exclude certain high-risk activities or product defects. Understanding exclusions prevents costly gaps in coverage. Always review these carefully to see if your business needs extra protection.

Adding Endorsements

Endorsements are additions that expand or modify the base policy. They can add coverage for special risks or increase limits for specific areas. Common endorsements include coverage for hired vehicles, cyber liability, or liquor liability. Adding endorsements tailors the policy to fit your unique business needs. They often come with extra costs but improve overall protection.

Choosing A Policy

Choosing the right Commercial General Liability (CGL) insurance policy is essential for protecting your business. A well-selected policy shields your company from costly claims and legal fees. It also helps maintain trust with clients and partners. Understanding how to pick the best coverage can save you money and stress. Below are key steps to guide you in choosing a policy that fits your business needs.

Assessing Business Risks

Start by identifying risks unique to your business type. Consider the nature of your operations, location, and customer interactions. Think about possible accidents, injuries, or property damage that could happen. Assess how often these risks might occur and the potential cost. This helps you decide the coverage level needed. A clear risk assessment prevents underinsurance or unnecessary expenses.

Comparing Providers

Compare insurance companies based on reputation and customer service. Look for providers with experience in your industry. Check reviews and ratings from other business owners. Request quotes from multiple insurers to find competitive pricing. Review policy details carefully, noting coverage limits and exclusions. A reliable provider offers clear terms and prompt claim support.

Cost Factors

Insurance cost depends on several factors. These include your business size, location, and risk profile. Higher risk businesses usually pay more for coverage. Policy limits and deductibles also affect price. Larger limits and lower deductibles increase premiums. Discounts may apply for safety measures or bundled policies. Understand these elements to balance protection and affordability.

Maintaining Coverage

Maintaining Commercial General Liability (CGL) insurance coverage ensures ongoing protection for your business. It requires regular attention to stay effective and relevant. Proper management helps avoid coverage gaps and costly surprises.

Reviewing your policy often keeps it aligned with your current risks. As your business changes, your insurance needs evolve too. Staying proactive with your coverage safeguards your operations and finances.

Renewal Process

Renew your CGL policy before the expiration date. Late renewals may cause lapses in coverage. Confirm your renewal terms and premiums early. Check for any changes in policy conditions or costs. Discuss any concerns with your insurance agent promptly.

Updating Policy As Business Grows

Update your policy when adding new products or services. Expanding locations or hiring more staff may increase risks. Inform your insurer about major changes in your business. Adjust coverage limits to match your growing exposure. This ensures your policy adequately protects your evolving business.

Claims Reporting Tips

Report claims to your insurer quickly and accurately. Provide clear details about the incident and damages. Keep copies of all related documents and communications. Follow your insurer’s instructions carefully to avoid delays. Prompt reporting helps speed up claim processing and resolution.

Credit: www.zimmerinsure.com

Frequently Asked Questions

What Is Commercial General Liability Insurance?

Commercial general liability insurance protects businesses from claims of injury, property damage, and advertising injury. It covers legal fees, settlements, and judgments from lawsuits related to daily operations. This insurance safeguards businesses against financial losses from third-party claims and is often required by contracts.

How Much Is $1 Million Commercial Insurance?

The cost of $1 million commercial insurance varies by business type, location, and risk factors. Average premiums range from $400 to $1,500 annually. Factors like industry, claims history, and coverage limits affect pricing. Get personalized quotes for accurate costs.

What Does Commercial General Liability Insurance Cost?

Commercial general liability insurance costs vary widely, typically ranging from $400 to $1,500 annually for small businesses. Factors like industry, location, and coverage limits affect the price. Higher risk businesses or larger coverage limits usually pay more. Getting multiple quotes helps find the best rate.

Who Has The Cheapest General Liability Insurance?

The cheapest general liability insurance varies by location and business type. Compare quotes from providers like Hiscox, Next Insurance, and State Farm for best rates.

Conclusion

Commercial General Liability Insurance offers key protection for your business. It covers injuries, property damage, and legal costs from accidents or claims. Having this insurance helps avoid large financial losses from lawsuits. Many clients and landlords also require it for contracts or leases.

Choosing the right coverage brings peace of mind and stability. Protect your business today to face risks with confidence and security.