Are you trying to decide where to keep your money safe while still making it work for you? Choosing between a Cash Management Account (CMA) and a traditional savings account can be confusing.

Both options offer ways to save, but they work very differently—and understanding these differences can help you get the most out of your cash. What if you could access your money anytime, earn better returns, and avoid limits on withdrawals?

Or maybe you prefer the simplicity and security of a savings account. You’ll discover the key benefits and drawbacks of Cash Management Accounts versus Savings Accounts, so you can pick the right option to grow and protect your money. Keep reading to find out which choice fits your lifestyle and financial goals best.

Cash Management Accounts Basics

Understanding the basics of cash management accounts (CMAs) helps you decide how to handle your money. CMAs blend features from checking, savings, and investment accounts. They provide flexibility and easy access to funds. This section explains what CMAs are, their key features, and how they work.

What Is A Cash Management Account

A cash management account is a financial tool offered by brokerage firms and fintech companies. It combines banking and investment features in one account. Unlike a traditional savings account, a CMA lets you manage cash and investments easily. It is not a bank account but offers similar services like debit cards and check writing. CMAs aim to give users more control over their money.

Key Features Of Cmas

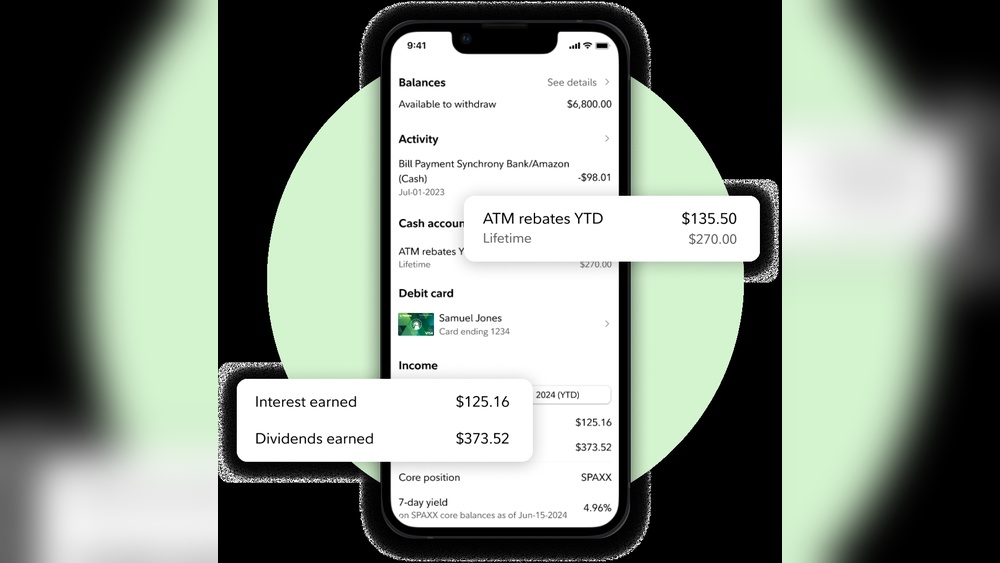

CMAs provide several useful features. They often include a debit card for spending and ATM access. Users can write checks and pay bills directly from the account. CMAs usually offer higher interest rates than regular savings accounts. Another feature is unlimited transactions without withdrawal limits. Many CMAs also allow automatic transfers to investment accounts. These features make CMAs flexible and convenient for daily money management.

How Cmas Work

Money deposited into a CMA is often swept into partner banks or invested in short-term assets. This helps earn interest while keeping funds accessible. You can spend, save, or invest from the same account. Most CMAs provide easy digital access through apps or websites. There is no limit on how often you can access your money. This makes CMAs a good option for managing cash flow and savings in one place.

Savings Accounts Essentials

Savings accounts serve as a basic tool for setting money aside. They offer a safe place to keep cash while earning interest. Understanding their key features helps in choosing the right option for your finances.

Knowing the limits and benefits of savings accounts helps avoid surprises. This section explains the essentials you should know about savings accounts.

What Is A Savings Account

A savings account is a bank account that holds money for future use. It pays interest on the balance to help your money grow. It is different from a checking account, which is used for daily spending.

Savings accounts encourage saving by limiting access to funds. They are a good option for emergencies or planned expenses.

Common Features Of Savings Accounts

Savings accounts offer interest earnings, though rates vary by bank. They are insured by the FDIC up to $250,000 for security. Most accounts have no monthly fees if minimum balances are met.

These accounts usually come with online access and easy transfers to checking accounts. They provide a simple way to build savings over time.

Withdrawal Limits And Restrictions

Savings accounts often limit withdrawals to six per month. This rule aims to encourage saving and reduce frequent spending. Exceeding this limit may cause fees or account changes.

Withdrawals can be made via online transfer, ATM, or in-branch visits. Cash withdrawals directly from savings accounts might be less convenient than from checking accounts.

Comparing Accessibility

Accessibility plays a key role in choosing between cash management accounts and savings accounts. It affects how easily and quickly you can use your money. This section compares the two accounts based on access features.

Understanding withdrawal limits, deposit methods, and card options helps pick the right account for your needs.

Withdrawal And Transfer Options

Cash management accounts usually allow unlimited withdrawals and transfers. You can move money anytime without fees or limits.

Savings accounts often limit withdrawals to six per month. Excess transactions can lead to fees or account restrictions.

This makes cash management accounts better for frequent access and flexible money use.

Digital Vs Physical Deposits

Savings accounts accept both digital and physical deposits easily. You can deposit cash or checks at a bank or ATM.

Cash management accounts mostly support digital deposits. Physical cash deposits may not be accepted or may require special steps.

This could affect users who prefer depositing cash in person.

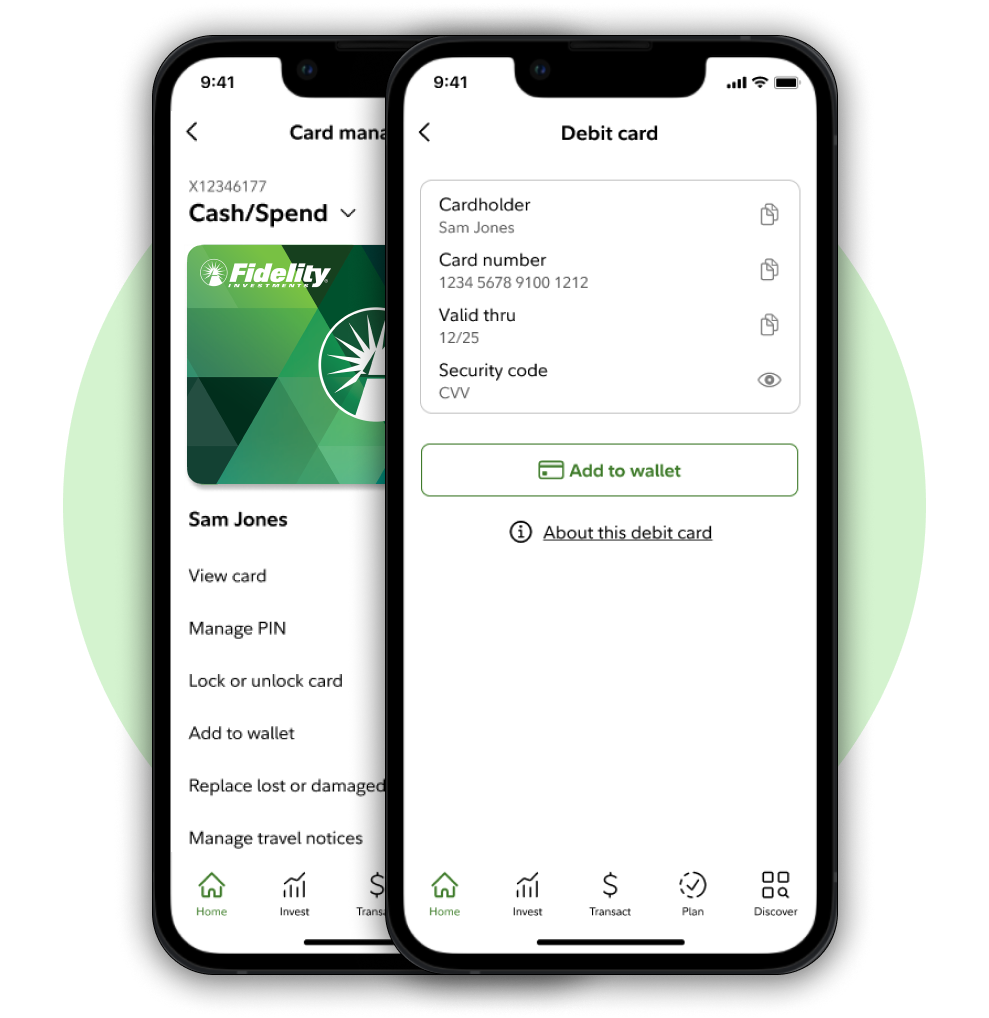

Debit Card And Check Writing

Most cash management accounts come with a debit card. You can use it for purchases and ATM withdrawals.

They often offer check writing and bill pay services too, adding convenience.

Savings accounts rarely provide debit cards or checks. You might need to transfer money to a checking account first.

Interest Rates And Returns

Interest rates and returns play a key role in choosing between cash management accounts (CMAs) and savings accounts. These factors determine how much your money grows over time. Understanding typical rates and how market changes affect them helps you make smart decisions about your funds.

Typical Rates For Cmas

Cash management accounts often offer interest rates higher than traditional savings accounts. Many CMAs provide rates close to those of high-yield savings accounts. These accounts combine the features of checking and savings, allowing easy access with competitive returns. Rates vary by provider and can change frequently.

Savings Account Interest Trends

Savings account rates tend to be lower than CMA rates. Banks typically offer modest interest to encourage long-term savings. Over recent years, these rates have slowly increased but remain conservative. Savings accounts provide steady but limited growth on your deposits.

Impact Of Market Conditions

Market conditions strongly influence both CMA and savings account rates. When central banks raise rates, interest on these accounts usually rises too. During economic slowdowns, rates often fall to encourage spending. Staying aware of these trends helps you choose the best account at the right time.

Security And Insurance

Security and insurance are key factors to consider when choosing between Cash Management Accounts (CMAs) and traditional savings accounts. Both offer ways to protect your money, but the coverage and limits differ. Understanding these differences helps you keep your funds safe and reduces financial risks.

Fdic Insurance Coverage

Savings accounts at banks usually come with FDIC insurance. This insurance protects deposits up to $250,000 per depositor, per bank. It safeguards your money if the bank fails. This coverage is automatic and free with your savings account.

Higher Insurance Limits With Cmas

Cash Management Accounts often use multiple banks to hold your money. This setup increases FDIC insurance limits. Your deposits can be spread across several banks, each insured up to $250,000. This means total protection can reach much higher amounts than a single savings account.

Brokerage Account Protections

CMAs are usually held at brokerage firms. These firms provide extra protections beyond FDIC insurance. The Securities Investor Protection Corporation (SIPC) covers up to $500,000 in securities and cash. This protects you if the brokerage firm fails but does not cover market losses.

Credit: www.youtube.com

Tax Implications

Tax rules affect Cash Management Accounts (CMAs) and savings accounts differently. Understanding tax implications helps you manage your money better. Taxes can reduce your earnings from both account types. Knowing how each account reports income is important for tax filing.

Taxable Income From Cmas

Income from CMAs usually includes interest and dividends. These earnings count as taxable income. The brokerage firm sends a 1099 form to you and the IRS. You must report all interest and dividends on your tax return. CMAs do not offer tax-deferred growth like some retirement accounts.

Reporting Interest And Dividends

Interest from savings accounts is reported on Form 1099-INT. Dividends from CMAs appear on Form 1099-DIV. You must include these amounts in your income for the year. Keep records of all statements to ensure accurate reporting. Failure to report can lead to penalties from the IRS.

Comparing Tax Treatments

Savings accounts and CMAs are taxed similarly on interest income. CMAs may also generate dividend income, which can have different tax rates. Qualified dividends from CMAs may be taxed at lower rates than interest. Neither account type offers tax breaks on contributions or earnings. Choose accounts based on access and interest, not tax savings.

Advantages Of Cash Management Accounts

Cash management accounts (CMAs) offer several advantages over traditional savings accounts. They combine features of checking and savings accounts, providing more versatility. Many people find CMAs useful for managing daily expenses and investments in one place. Below are some key benefits that make CMAs appealing.

Flexibility And Convenience

Cash management accounts allow easy access to your funds. You can make unlimited withdrawals and payments without restrictions. Many CMAs come with a debit card, checks, and mobile banking features. This flexibility makes it simple to pay bills or shop online. Unlike savings accounts, CMAs do not limit how often you move money.

Higher Return Potential

Cash management accounts often offer better interest rates than regular savings accounts. This means your money can grow faster while staying accessible. Some CMAs invest in short-term securities, which may boost returns. The higher earnings help your savings keep pace with inflation.

Consolidated Financial Services

CMAs combine banking and investment tools in one account. You can save, spend, and invest without moving money between accounts. This consolidation simplifies money management and tracking. Many CMAs provide access to financial advice and planning tools as well. It reduces the need to juggle multiple providers.

Limitations Of Cash Management Accounts

Cash Management Accounts (CMAs) offer many benefits but also have clear limits. Understanding these limits helps you choose the right account for your needs. CMAs differ from traditional savings accounts in several key ways. These differences may affect how you use your money daily. Below are some main limitations to consider.

Deposit Restrictions

Most CMAs accept deposits only through electronic transfers. Physical cash deposits are often not allowed. This can be inconvenient if you get paid in cash. Also, some CMAs do not accept checks directly. These restrictions limit how you can add money to your account.

Lack Of Physical Branch Access

CMAs usually do not have physical branches. You cannot visit a local office for help or to make transactions. This limits personal service options. Some people prefer talking to a banker face-to-face, which is not possible with CMAs. All transactions happen online or through apps.

Unavailable Traditional Banking Services

CMAs often lack services found in regular banks. For example, they may not offer cashier’s checks or safe deposit boxes. Loan services like mortgages or personal loans are usually not available. These missing services mean you may need another bank account for full banking needs.

When To Choose A Savings Account

Choosing between a savings account and a cash management account depends on your financial goals and needs. Savings accounts offer a straightforward way to grow money safely. They suit people who want easy access to funds with fewer risks. Understanding when a savings account fits best helps in managing money wisely.

Ideal Use Cases

Savings accounts work well for money you do not plan to spend soon. They are perfect for setting aside cash for future plans. Think of saving for a vacation, a car, or a down payment. You earn interest, which helps your money grow slowly over time. It is a simple way to keep funds safe and separate from daily spending.

Emergency Fund Considerations

Use a savings account to build an emergency fund. This fund covers unexpected costs like medical bills or car repairs. Savings accounts offer easy access in emergencies but limit how often you can withdraw. This limit helps keep the money intact for true emergencies. It also reduces the temptation to spend the fund on non-urgent needs.

Simplicity And Stability

Savings accounts offer a stable place for your money. Banks insure these accounts, so your funds are protected. The account is easy to open and manage without complex rules. Interest rates may be lower than some options but offer steady growth. This makes savings accounts a good choice for those who want less risk and more peace of mind.

When To Opt For A Cash Management Account

Cash Management Accounts (CMAs) serve unique purposes compared to traditional savings accounts. Understanding when to choose a CMA can improve your financial handling. This section highlights key moments to consider opting for a CMA over a savings account.

Maximizing Earnings

CMAs often offer higher interest rates than regular savings accounts. Your money grows faster while remaining easily accessible. This suits those who want better returns without locking funds away.

Frequent Access Needs

Unlike savings accounts, CMAs allow unlimited withdrawals and transfers. This makes CMAs ideal for people who need regular access to their money. You avoid withdrawal limits and penalties common with savings accounts.

Integrated Spending And Saving

CMAs combine spending and saving features in one account. You can use a debit card, write checks, and pay bills directly. This integration simplifies money management and reduces the need for multiple accounts.

Tips For Smart Cash Management

Smart cash management helps you control your money wisely. It involves keeping enough cash ready for daily needs and growing your savings safely. Managing cash well reduces stress and prepares you for emergencies. Here are simple tips to manage your cash effectively with either cash management accounts or savings accounts.

Balancing Liquidity And Growth

Keep enough cash accessible for quick use. Cash management accounts offer easy access without limits. Savings accounts may limit withdrawals but often pay higher interest. Find a balance that fits your spending and saving habits. This way, your money grows and stays ready for expenses.

Monitoring Account Fees

Check fees regularly. Some accounts charge monthly or transaction fees. These fees reduce your earnings over time. Choose accounts with low or no fees. Watch out for hidden costs like minimum balance fees. Keeping fees low saves more money in the long run.

Using Multiple Account Types

Use different accounts for different goals. Keep a cash management account for bills and daily expenses. Use a savings account for emergency funds or long-term goals. This approach helps organize money and improves financial control. Multiple accounts help you avoid mixing spending and saving.

Credit: www.youtube.com

Credit: www.fidelity.com

Frequently Asked Questions

What Is The Difference Between Savings And Cash Management Accounts?

Savings accounts limit monthly withdrawals and focus on earning interest. Cash management accounts offer flexible access, combining spending, saving, and investing features with often higher returns.

What Are The Disadvantages Of A Cash Management Account?

Cash management accounts may limit physical cash deposits and often lack access to cashier’s checks. They might not offer the same protections as traditional bank accounts. Tax reporting can be complex due to interest and investment income. Fees and withdrawal restrictions vary by provider.

Do You Have To Pay Taxes On A Cash Management Account?

Yes, you must pay taxes on a cash management account. Interest, dividends, and capital gains are taxable income each year.

Is A Fidelity Cash Management Account A Savings Account?

A Fidelity Cash Management Account is not a traditional savings account. It functions as a brokerage account for spending, saving, and investing with flexible access and competitive rates.

Conclusion

Choosing between cash management accounts and savings accounts depends on your needs. Cash management accounts offer easy access and extra features. Savings accounts provide steady interest and traditional banking services. Both help grow your money safely. Think about how often you need to use your funds.

Consider interest rates and fees too. Understanding these basics helps you pick the best option. Manage your money wisely for a secure financial future.