Looking to finance your next car? A Bank of America car loan might be just what you need.

Whether you’re buying new or used, Bank of America offers competitive rates and perks that could save you money. If you already bank with them, you might even qualify for special discounts through their Preferred Rewards program. Imagine getting prequalified quickly online without hurting your credit score—making the car buying process smoother and less stressful.

But is it the right choice for you? You’ll discover the key benefits, potential drawbacks, and everything you need to know to decide if a Bank of America car loan fits your budget and goals. Keep reading to make your next move a smart one.

Credit: thedetroitbureau.com

Bank Of America Auto Loan Benefits

Bank of America offers a range of benefits for its auto loan customers. These benefits help make financing a car easier and more affordable. The bank focuses on providing value through discounts, flexible terms, and a smooth application process. Borrowers can enjoy savings and convenience with their auto loans.

Interest Rate Discounts With Preferred Rewards

Bank of America rewards loyal customers with lower interest rates. Members of the Preferred Rewards program get special discounts. This can reduce the cost of borrowing. The more you save, the less you pay in interest over time.

No Prepayment Penalties

Paying off your loan early does not cost extra. Bank of America does not charge fees for early repayment. This gives borrowers freedom to save on interest. You can clear your debt faster without penalties.

Quick Prequalification Process

The prequalification process is fast and simple. It does not affect your credit score. This helps you know your loan options before you shop. You can compare and plan without risk to your credit.

Online Application Convenience

The entire loan application can be completed online. This saves time and effort. You can apply from home and avoid long waits. The process is user-friendly and secure.

No Origination Or Documentation Fees

Bank of America does not charge extra fees to start your loan. There are no origination or paperwork fees. This lowers the upfront cost of borrowing. More of your money goes toward the car purchase.

Credit: lendedu.com

Potential Drawbacks To Consider

Bank of America car loans offer many benefits, but some drawbacks exist. Understanding these can help you decide if their loan fits your needs. Keep these points in mind before applying.

Customer Satisfaction Challenges

Customer reviews show mixed experiences with Bank of America loans. Some borrowers report slow responses and difficulty resolving issues. Complaints to the Consumer Financial Protection Bureau highlight problems managing loans. Low satisfaction scores from Trustpilot and J.D. Power suggest service could improve.

Vehicle Eligibility Restrictions

Bank of America limits the types of vehicles eligible for financing. Not all cars or dealers qualify. This can restrict your options and make it harder to get a loan for certain vehicles.

High Minimum Loan Amounts

The lender often requires a high minimum loan amount. This may not suit buyers seeking smaller loans. It limits flexibility for customers with modest financing needs.

No Private-party Sale Financing

Bank of America does not finance private-party car sales. Loans are only available through authorized dealers. This excludes buyers wanting to buy directly from individuals.

Limited Financing For Recreational Vehicles

The bank does not finance motorcycles or most recreational vehicles. RV loans are only available through select dealers. This limits options for buyers of specialty vehicles.

Eligibility And Vehicle Requirements

Understanding eligibility and vehicle requirements is key to securing a Bank of America car loan. The bank sets clear rules to ensure smooth financing. These guidelines cover who can apply and what types of vehicles qualify. Knowing these details helps you prepare for the loan process with confidence.

Authorized Dealer Network

Bank of America works with a network of authorized dealers. These dealers offer new and used cars eligible for financing. You must purchase your vehicle from one of these dealers to qualify. This ensures the vehicle meets the bank’s standards for loans.

Financing New And Used Cars

The bank finances both new and used cars. Used cars must meet certain age and mileage limits. Usually, the car should be less than seven years old. Mileage should not exceed 100,000 miles. Meeting these limits helps keep the loan risk low.

Restrictions On Motorcycles And Rvs

Bank of America does not finance motorcycles or most RVs. Some RV loans may be available through authorized dealers. Recreational vehicles and motorcycles are generally excluded. This policy narrows the types of vehicles eligible for loans.

Private-party Purchase Rules

Loans for private-party purchases are not allowed. The vehicle must be bought through an authorized dealer. This rule protects buyers and lenders. It ensures the vehicle’s history and condition are verified before financing.

Loan Features And Terms

Bank of America offers clear and flexible loan features for car buyers. Understanding these loan terms helps you choose the right option. The loan suits many budgets and preferences. It provides convenience and competitive pricing to fit your needs.

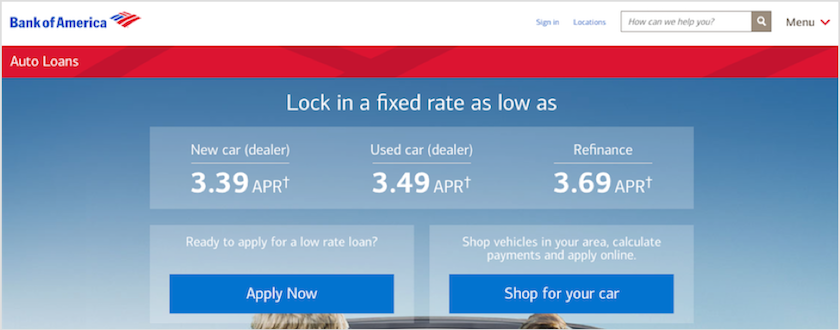

Competitive Interest Rates

Bank of America provides interest rates that are competitive in the market. Rates vary based on credit score and loan details. Preferred Rewards members receive additional discounts. Low rates reduce your monthly payments and overall loan cost.

Loan Duration Options

Loan terms range from 12 to 72 months. Shorter terms mean higher payments but less interest paid. Longer terms lower monthly payments but increase total interest. Choose a term that fits your financial plan and comfort level.

Refinancing Considerations

Refinancing can lower your interest rate or monthly payment. Bank of America allows refinancing without prepayment penalties. Check current rates and fees before refinancing. Refinancing might extend the loan duration and increase total cost.

Managing Your Loan Online

Bank of America offers an online portal for loan management. You can view balances, make payments, and track progress. The system is simple and secure. Managing your loan online saves time and helps avoid missed payments.

Applying For A Bank Of America Car Loan

Applying for a Bank of America car loan is a straightforward process. It starts with checking your eligibility and ends with receiving your loan approval. The bank offers tools that make each step clear and simple. This helps you understand what to expect and how to prepare. Below are the key steps to guide you through the application process.

Prequalification Steps

Prequalification lets you see your potential loan terms without hurting your credit score. You provide basic financial details online. Bank of America then gives an estimate of your interest rate and loan amount. This step helps you plan your budget before visiting a dealer or finalizing your car choice.

Completing The Online Application

The application is fully online for convenience. You enter personal information, employment details, and the car’s data. The system guides you through each field. It reduces errors and speeds up submission. Keep your information handy to fill the form accurately and quickly.

Required Documentation

Bank of America needs some documents to process your loan. These include proof of identity, income, and residence. You may also need the vehicle’s information, like the VIN and purchase agreement. Having these ready speeds up your loan approval. Make sure documents are clear and up to date.

Approval Timeline

Loan approval usually takes a few business days. The bank reviews your credit, income, and documents. They may contact you for extra details. You get a decision via email or phone. Early preparation often leads to faster approval. After approval, you can finalize your car purchase.

Tips For Maximizing Savings

Saving money on a Bank of America car loan is possible with a few smart choices. Small actions add up to big savings over time. Focus on benefits, loan terms, rates, and common mistakes. Each step helps reduce costs and improve your loan experience.

Leveraging Preferred Rewards Benefits

Bank of America rewards loyal customers with lower interest rates. Preferred Rewards members enjoy better loan terms. Check if you qualify for these benefits before applying. Saving on interest lowers your monthly payments and total cost.

Choosing The Right Loan Term

Shorter loan terms usually mean higher monthly payments but less interest paid overall. Longer terms lower monthly payments but increase total interest. Pick a term that fits your budget and saves the most money. Balance monthly costs with total loan cost carefully.

Comparing Rates Before Applying

Interest rates vary between lenders and loan types. Shop around to find the lowest rate before applying. Prequalification with Bank of America does not affect your credit score. Use this to compare offers and choose the best rate.

Avoiding Common Loan Pitfalls

Watch out for hidden fees and penalties. Bank of America does not charge prepayment penalties, which is good. Avoid borrowing more than needed to reduce interest costs. Read all loan terms carefully to avoid surprises later.

Customer Experiences And Reviews

Customer experiences and reviews reveal important insights about Bank of America car loans. These opinions help potential borrowers understand what to expect. Feedback includes both positive points and common issues.

Reading real user reviews shows the loan process’s strengths and weaknesses. It also highlights how the bank handles problems and offers support to customers.

Common Complaints

Many users mention slow customer service response times. Some find managing their loan accounts online confusing. Complaints often focus on difficulties with payment processing. A few customers report issues with unexpected fees or charges. Others say the loan approval process can be strict, especially for certain vehicle types.

Positive Feedback Highlights

Borrowers appreciate the competitive interest rates offered by Bank of America. The online prequalification process is quick and does not affect credit scores. Many like that there are no penalties for early loan repayment. Users also value the convenience of handling most tasks online. Existing customers with Preferred Rewards often receive better rates.

How To Address Issues

Start by contacting Bank of America customer service directly. Use clear and polite communication to explain your problem. Keep records of all your interactions for future reference. If the issue is not resolved, escalate it to a supervisor or manager. Consider using the bank’s online help tools and FAQs for quick answers.

Resources For Assistance

The Consumer Financial Protection Bureau (CFPB) accepts complaints about loan problems. Bank of America’s official website provides loan management tools and support contacts. Third-party review sites give insights into common issues and solutions. Local consumer protection agencies can offer guidance on loan disputes. Use these resources to get help when needed.

Credit: www.bankofamerica.com

Frequently Asked Questions

Is It Good To Finance A Car Through Bank Of America?

Bank of America offers competitive auto loan rates and no prepayment penalties. Preferred Rewards members get discounts. Online prequalification is quick and doesn’t affect credit scores. However, customer satisfaction is low, and loans exclude private-party sales and certain vehicle types.

Consider your needs before financing.

How Do I Access My Bank Of America Car Loan?

Access your Bank of America car loan by logging into your online banking account or the Bank of America mobile app. Select “Auto Loans” to view details, make payments, or manage your loan. Contact customer service for additional assistance.

How Much Is $40,000 Car Payment For 60 Months?

A $40,000 car loan over 60 months typically costs around $667 monthly, excluding interest and fees. Interest rates affect the exact payment.

What Is The Best Auto Loan Rate Right Now?

The best auto loan rates currently range around 3% to 5% APR for qualified buyers. Rates vary by lender, credit score, and loan term. Check with local banks or credit unions for personalized offers. Rates change frequently, so compare options before applying.

Conclusion

Bank of America car loans offer clear benefits for many buyers. You can prequalify quickly without hurting your credit score. No fees for early repayment make paying off your loan easier. Rates stay competitive, especially for Preferred Rewards members. Still, keep in mind the limits on vehicle types and loan amounts.

Customer service reviews vary, so consider your needs carefully. Overall, Bank of America can be a solid choice for dealer-financed cars. Compare options to find the best fit for your budget and situation.