If you need SR22 insurance, you’re probably worried about finding coverage that won’t break the bank. SR22 requirements can feel overwhelming, but getting cheap SR22 insurance quotes is possible—and it starts with knowing where to look and what to ask.

Imagine saving money while meeting your state’s legal requirements, avoiding penalties, and getting back on the road with confidence. You’ll discover simple strategies to compare quotes, uncover hidden savings, and choose the best policy for your situation. Keep reading to take control of your insurance costs and drive smarter today.

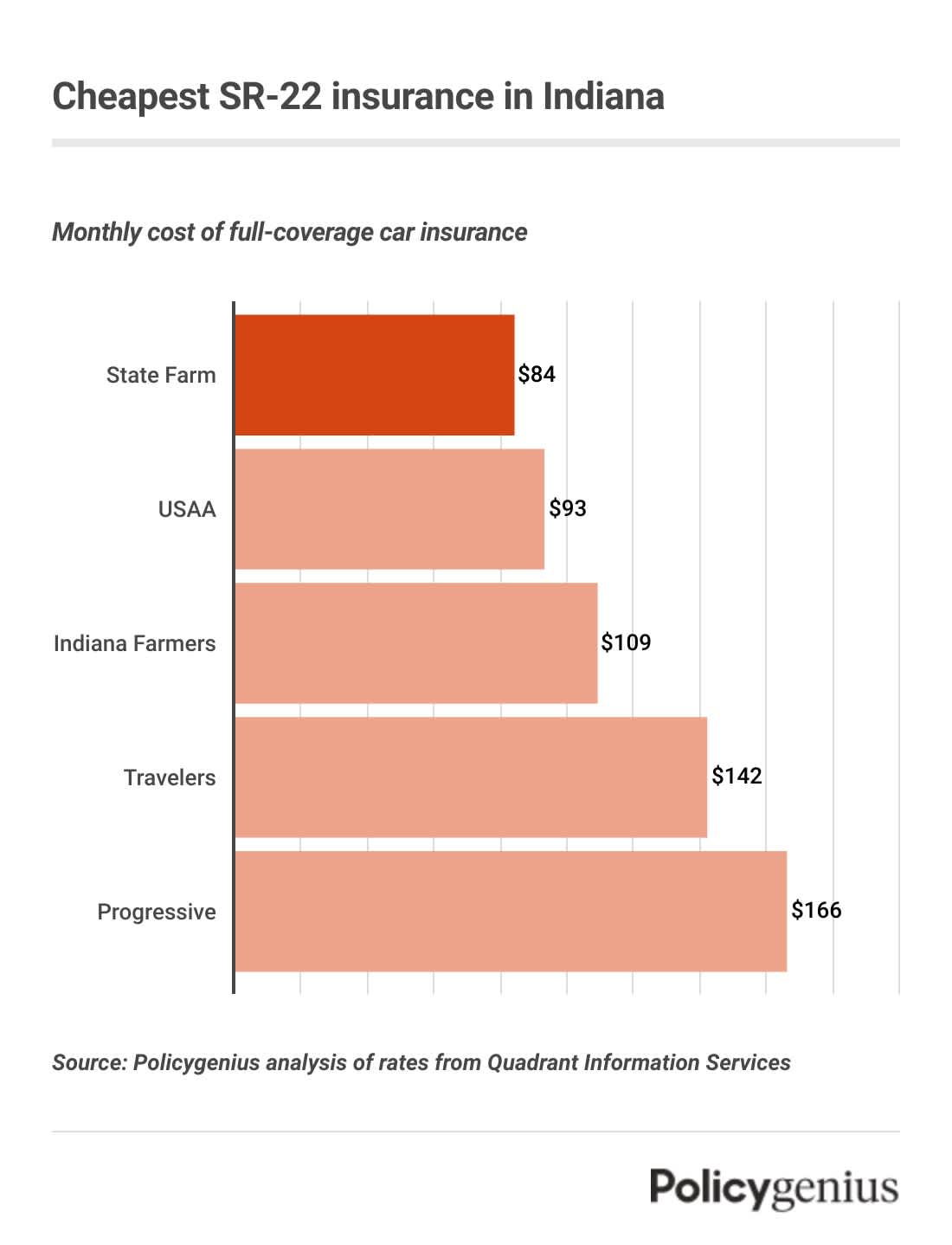

Credit: www.policygenius.com

What Is Sr22 Insurance

SR22 insurance is not a typical insurance policy. It is a special certificate filed with the state. This certificate proves you carry the minimum required auto insurance.

States require SR22 for certain drivers. Usually, these drivers had serious driving violations. Examples include DUI, reckless driving, or driving without insurance.

SR22 insurance is often called a “proof of financial responsibility.” It shows the state you are financially responsible to drive.

What Does Sr22 Insurance Cover?

SR22 itself does not provide coverage. It is a form your insurance company files with the state. Your actual insurance policy covers your vehicle and liability.

The SR22 filing confirms your insurance meets state minimum limits. It stays active for a required period, often three years.

Who Needs Sr22 Insurance?

Drivers with serious traffic offenses often need SR22. Common reasons include DUI convictions, driving without insurance, or license suspension.

The state or court usually orders SR22 after an incident. It helps ensure the driver has proper insurance before regaining driving privileges.

How To Get Cheap Sr22 Insurance Quotes

SR22 insurance costs more than regular insurance. This is due to the higher risk of the driver. Finding cheap SR22 quotes requires comparison.

Contact multiple insurers and ask about SR22 rates. Use online tools to compare prices quickly. Some companies specialize in SR22 insurance and offer better rates.

Why Sr22 Insurance Costs Vary

SR22 insurance costs differ for many reasons. Understanding these factors helps you find affordable coverage. Insurance companies look at different criteria to set prices.

Each driver’s situation is unique. This causes variation in SR22 insurance quotes. Some things increase costs, others lower them. Knowing these can save you money.

Driver’s Risk Profile

Insurance firms evaluate your driving record and history. Tickets, accidents, and DUIs raise your risk level. Higher risk means higher insurance premiums. A clean record gets you cheaper SR22 rates.

State Requirements

SR22 rules vary by state. Some states require longer coverage periods or higher minimum limits. These rules affect the final cost of your insurance. Check your state’s specific SR22 demands.

Insurance Company Policies

Each insurer uses its own method to price SR22 insurance. Some companies offer discounts for good drivers or bundling policies. Others charge more for SR22 filings. Comparing multiple insurers helps find the best deal.

Type Of Vehicle

Car make, model, and year impact SR22 insurance rates. Expensive or high-performance cars often cost more to insure. Older or safer vehicles typically have lower premiums. Choose your vehicle wisely to control costs.

Coverage Limits And Deductibles

Higher coverage limits increase insurance costs. Choosing a higher deductible can lower your premium. Balancing coverage and deductible amounts helps manage SR22 insurance expenses.

Top Ways To Find Cheap Sr22 Quotes

Finding cheap SR22 insurance quotes can save you a lot of money. SR22 insurance is often costly because it is required after serious driving violations. Using smart methods helps lower these costs. Simple steps can help you find affordable options fast. Focus on comparing, using tools, and working with agents. These methods make the search easier and more effective.

Compare Multiple Providers

Rates for SR22 insurance vary a lot between companies. Do not assume one company offers the best price. Check quotes from many providers. Comparing helps spot the cheapest and best coverage. Take time to review each offer carefully. This step often leads to big savings on your premium.

Use Online Tools

Online tools make it easy to get quotes quickly. Many websites let you enter your info once and see multiple quotes. These tools save time and effort. They show prices side by side to help you choose. Use them to find the lowest rates without calling each company.

Work With Independent Agents

Independent agents represent several insurance companies. They can find quotes from many providers at once. Agents know which companies offer cheaper SR22 insurance. They can also explain coverage details in simple terms. Working with an agent can simplify your search and lower costs.

Average Sr22 Insurance Rates By Company

Average SR22 insurance rates differ widely by company. Knowing these rates helps find affordable coverage. SR22 insurance is required after certain driving violations. This type of insurance proves you carry the state’s minimum liability coverage.

Rates depend on factors like driving history, location, and insurer policies. Comparing prices from different companies can save money. Below are average annual costs from popular insurers offering SR22 insurance.

Mercury Sr22 Insurance Rates

Mercury offers some of the lowest SR22 rates. The average annual cost is around $948. This makes Mercury a common choice for budget-conscious drivers. Coverage includes liability and options for added protection.

State Farm Sr22 Insurance Rates

State Farm’s SR22 rates tend to be moderate. Prices usually range higher than Mercury but remain competitive. State Farm is known for good customer service and nationwide coverage.

Progressive Sr22 Insurance Rates

Progressive has flexible SR22 policies with average annual costs near the market median. Discounts may apply for safe driving or bundling policies. Progressive offers easy online quote tools for quick estimates.

Travelers Sr22 Insurance Rates

Travelers provides SR22 insurance with rates similar to other major insurers. Their coverage options include roadside assistance and accident forgiveness. Travelers is a solid option for those needing SR22 filing.

Tips To Lower Your Sr22 Premium

Lowering your SR22 insurance premium is possible with smart choices. Small changes can make a big difference. Understanding these tips helps you save money.

Maintain A Clean Driving Record

Your driving record affects your SR22 rates. Avoid tickets and accidents to keep premiums down. Insurance companies reward safe drivers with lower costs. Focus on following traffic rules and driving carefully every day.

Increase Your Deductible

Raising your deductible lowers your monthly premium. Choose a deductible amount you can afford in case of a claim. Higher deductibles mean you pay more out-of-pocket but less each month. Balance risk and savings to find the right deductible.

Bundle Insurance Policies

Combine your auto insurance with other policies like home or renters insurance. Bundling often leads to discounts from insurers. It simplifies payments and reduces overall costs. Check with your provider about available bundle offers.

Credit: sr22bondofohio.com

Common Mistakes That Raise Sr22 Costs

SR22 insurance can become costly quickly. Many drivers face higher costs due to common errors. Avoiding these mistakes helps keep your insurance affordable.

Knowing what raises SR22 costs can save you money. These errors often happen without drivers realizing it.

Failing To Compare Multiple Insurance Quotes

Not shopping around limits your chance to find low rates. Prices vary a lot between insurance companies. Using online tools or agents can help you compare offers easily.

Ignoring Your Driving Record

Accidents and tickets increase your insurance costs. Clean records get better rates. Driving safely lowers SR22 insurance expenses over time.

Choosing The Wrong Coverage Limits

Selecting coverage that is too high raises premiums. Picking only the state minimum limits lowers costs but may reduce protection. Balance your needs and budget carefully.

Not Updating Your Personal Information

Incorrect or outdated details like address or vehicle can cause higher rates. Inform your insurer of changes promptly. This keeps your policy accurate and fair.

Letting Your Sr22 Certificate Lapse

Missing deadlines to file or renew the SR22 certificate leads to penalties. Insurance companies may increase your premium. Stay on top of all SR22 requirements.

How Non-owner Sr22 Insurance Works

Non-owner SR22 insurance helps drivers who do not own a car but must prove financial responsibility. This insurance is required by the state after certain violations or license suspensions. It provides an SR22 certificate to the DMV without needing to insure a vehicle.

This policy covers you when driving a car you do not own, like borrowing a friend’s or renting a car. It is usually cheaper than standard SR22 insurance because it does not cover a specific vehicle. The main goal is to meet legal requirements and keep your driving privileges.

What Is Non-owner Sr22 Insurance?

Non-owner SR22 insurance is a special type of policy. It files an SR22 form on your behalf to the state. This shows you have the required liability coverage. The policy covers you as the driver, not the car.

Who Needs Non-owner Sr22 Insurance?

Drivers who lost their license and want to regain it may need this insurance. People who drive but do not own a vehicle also require it. It is common for those with DUI or reckless driving violations.

How Long Does Non-owner Sr22 Insurance Last?

The SR22 filing usually lasts for three years. The state may require a different period depending on the offense. You must keep the insurance active to avoid further penalties.

How To Get Non-owner Sr22 Insurance

Find an insurance company that offers SR22 filing. Request a non-owner SR22 policy and provide your driving history. The insurer will file the SR22 form with your state DMV. Pay your premiums on time to keep coverage active.

Best Sr22 Insurers For Austin, Texas Drivers

Finding affordable SR22 insurance in Austin, Texas is a priority for many drivers. SR22 insurance proves you meet state requirements after serious driving offenses. Not all insurers offer the same rates or services. Choosing the right company saves money and stress.

Several insurers stand out for their affordable SR22 policies and good customer service in Austin. Each company has unique benefits and pricing. Comparing options helps drivers find the best fit for their needs.

Compare Multiple Insurers

Rates for SR22 insurance vary widely between companies. Your current insurer may not offer the best price. Use online comparison tools or work with an independent agent. Agents can shop several carriers to find lower rates quickly.

Representative Rates By Company

| Insurance Company | Average Annual Cost |

|---|---|

| Mercury | $948/year |

| State Farm | $1,100/year |

| Progressive | $1,050/year |

| Travelers | $1,200/year |

Top Sr22 Insurers In Austin

- Mercury: Known for competitive rates and quick SR22 filing.

- State Farm: Offers strong customer support and local agents.

- Progressive: Provides flexible payment plans and discounts.

- Freeway Insurance: Specializes in affordable SR22 policies.

- Dairyland Insurance: Good option for high-risk drivers needing SR22.

Credit: insurify.com

Frequently Asked Questions

What Is Sr22 Insurance And Why Is It Needed?

SR22 insurance is a certificate proving you carry required auto liability coverage. It’s often mandated after DUI or serious driving violations to reinstate your license.

How Can I Find Cheap Sr22 Insurance Quotes?

Compare multiple insurers online or use an independent agent. Shopping around helps find the lowest rates tailored to your driving record.

Does Sr22 Insurance Cost More Than Regular Insurance?

Yes, SR22 insurance typically costs more due to high-risk status. However, rates vary widely, so comparing quotes can save money.

How Long Do I Need To Maintain Sr22 Insurance?

Usually, SR22 is required for 3 years, but state laws differ. Maintaining continuous coverage is essential to avoid penalties.

Conclusion

Finding cheap SR22 insurance quotes takes time and effort. Compare multiple companies to spot the best rates. Use online tools or agents to save money fast. Remember, the lowest price may not always mean best coverage. Read terms carefully and ask questions before buying.

Staying informed helps protect your driving record and wallet. Keep checking quotes regularly to get better deals. Affordable SR22 insurance is possible with smart choices. Don’t rush—choose wisely to meet your needs and budget.