Running a small business means juggling many responsibilities, and protecting your hard work should be at the top of your list. Have you thought about what could happen if a customer gets hurt on your property or if your business faces a lawsuit?

That’s where small business liability insurance steps in to shield you from unexpected financial risks. This insurance isn’t just a safety net—it’s a smart move to keep your business secure and your mind at ease. Keep reading to discover exactly how this coverage works, what it protects you against, and why it might be the most important investment you make for your business’s future.

Credit: www.insureon.com

Liability Insurance Basics

Small business liability insurance protects your business from financial losses. It covers legal costs if someone sues your company. This insurance helps keep your business safe from unexpected accidents and claims. Many small businesses rely on it for peace of mind.

This insurance is essential for businesses that interact with customers or clients. It offers a layer of protection against everyday risks. Understanding what liability insurance covers and what it does not is important. This knowledge helps you choose the right policy for your business needs.

What It Covers

Liability insurance covers several common business risks. It pays for medical costs if someone is hurt on your property. It also covers damage to someone else’s property caused by your business. Legal fees and settlements from lawsuits are included too. Personal injury claims like slander or libel can be covered. Advertising injury, such as copyright infringement claims, is also protected. These coverages help keep your business financially stable.

What It Does Not Cover

Liability insurance does not cover everything. It usually excludes damage to your own property or equipment. Employee injuries are not covered; workers’ compensation handles those. Professional mistakes or errors often need separate professional liability insurance. Intentional harm or illegal acts are not covered. Business interruption losses also fall outside general liability policies. Knowing these limits helps avoid surprises during a claim.

Credit: www.insureon.com

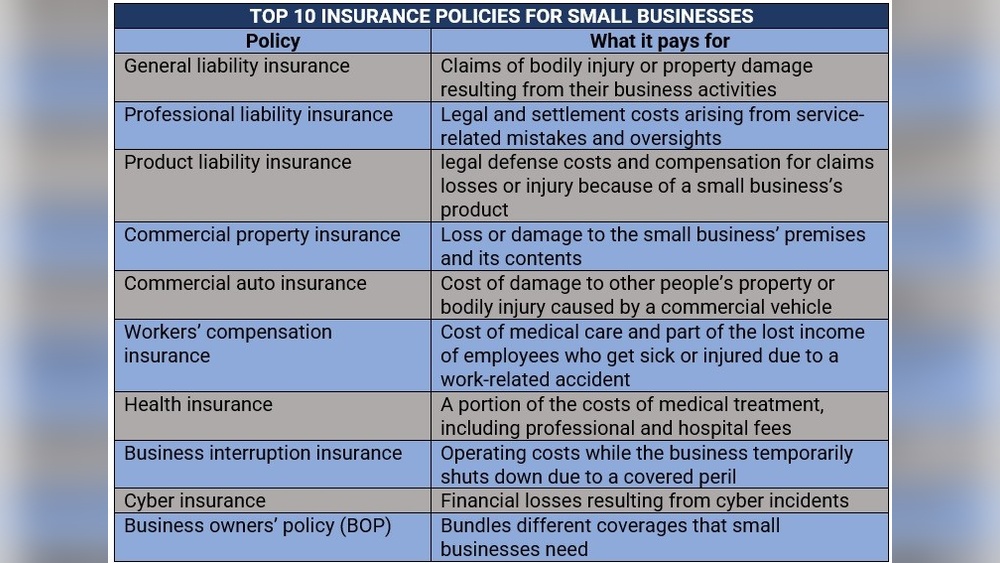

Types Of Liability Insurance

Small businesses face many risks every day. Liability insurance helps protect your business from financial loss. Different types of liability insurance cover various risks. Understanding these types ensures you get the right protection.

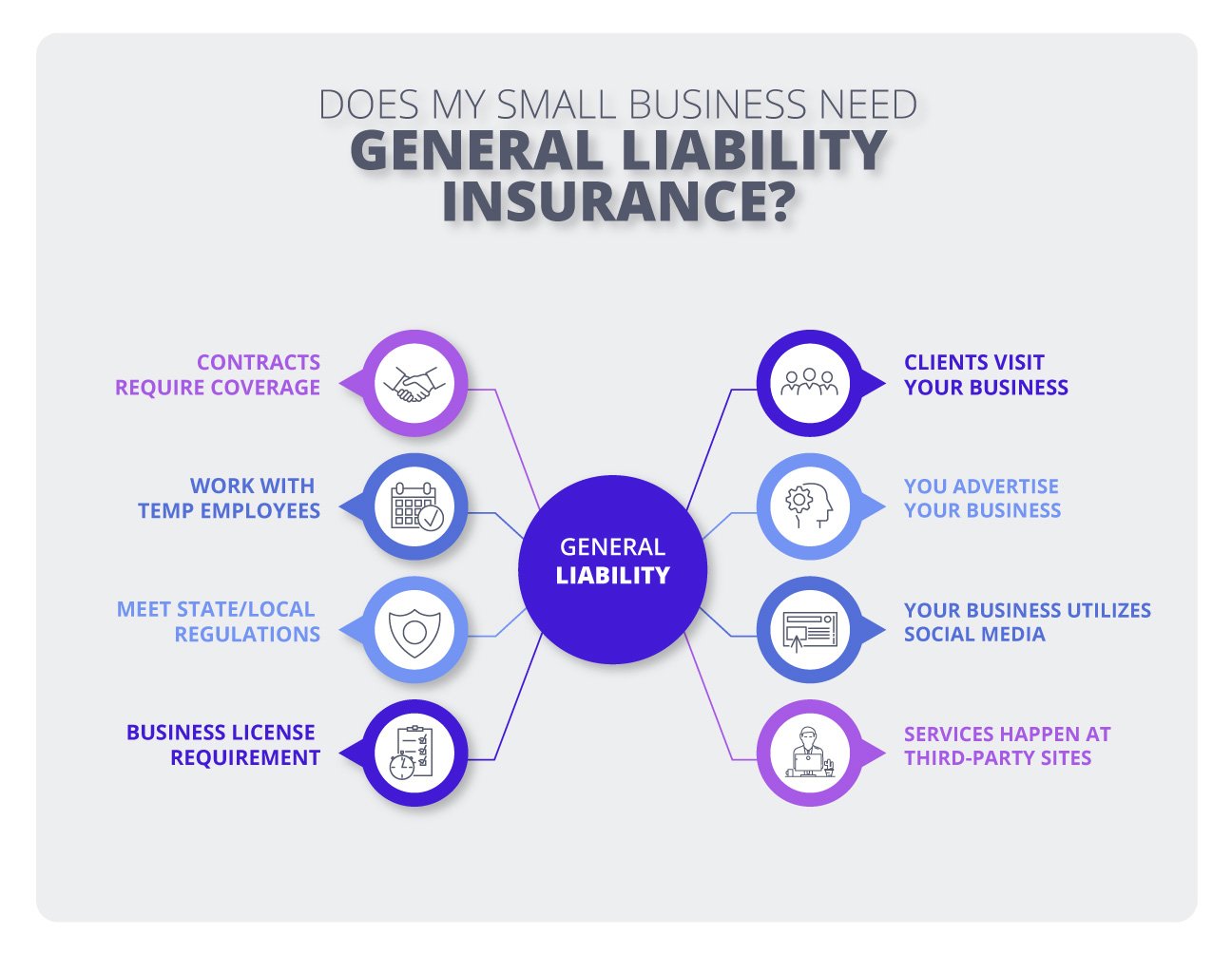

General Liability

General liability insurance covers claims of bodily injury and property damage. It protects your business from lawsuits by customers or visitors. This insurance also covers legal fees and settlements. It is essential for most small businesses.

Professional Liability

Professional liability insurance protects against claims of mistakes or negligence. It is important for service-based businesses. This coverage is also called errors and omissions insurance. It helps cover legal costs and damages.

Workers’ Compensation

Workers’ compensation insurance covers employee injuries on the job. It pays for medical care and lost wages. Many states require this insurance for businesses with employees. It keeps your business safe from costly injury claims.

Commercial Property

Commercial property insurance protects your business location and assets. It covers damage from fire, theft, or natural disasters. This insurance helps repair or replace your building and equipment. It is vital for businesses with physical property.

Commercial Auto

Commercial auto insurance covers vehicles used for business purposes. It protects against accidents, theft, and damage. This insurance covers both property damage and bodily injury. It is necessary if your business owns or uses vehicles.

Cyber Liability

Cyber liability insurance protects against data breaches and cyberattacks. It covers costs for data recovery and legal fees. This insurance is crucial for businesses handling sensitive customer information. It helps manage risks in the digital world.

Choosing Coverage

Choosing the right coverage for small business liability insurance requires careful thought. Each business faces unique risks. Selecting proper protection helps avoid costly surprises and keeps the business secure. Consider your specific situation before deciding on a policy.

Assessing Business Risks

Start by identifying potential risks your business might face daily. Think about accidents, injuries, or property damage that could occur. Evaluate how likely these events are and their possible impact. This understanding guides you in choosing sufficient coverage. Avoid underestimating risks as it may lead to inadequate protection.

Industry-specific Needs

Different industries have unique liability concerns. A restaurant may face food safety claims, while a contractor deals with property damage risks. Research common claims in your field to find appropriate coverage. Some policies offer add-ons tailored to particular industries. These extras can provide extra security for your business operations.

Policy Limits And Deductibles

Policy limits define the maximum amount an insurer will pay. Choose limits that cover potential damages and legal fees. Low limits might save money upfront but increase financial risk later. Deductibles are the amounts you pay before insurance kicks in. Higher deductibles lower premiums but increase your out-of-pocket costs. Balance limits and deductibles to fit your budget and risk tolerance.

Cost Factors

Several factors influence the cost of small business liability insurance. Understanding these helps you plan your budget better. Costs vary based on the nature and size of your business. Insurers evaluate different risks to set premiums. Here are the main cost factors to consider.

Location And Size

Insurance rates depend on your business location. Some areas have higher risks of claims. Urban locations often face more lawsuits than rural ones. The size of your business also matters. Larger businesses usually pay more due to increased exposure. The physical space and number of business sites affect costs too.

Revenue And Employees

Your annual revenue impacts insurance costs. Higher income means more business activity, leading to higher risk. The number of employees also plays a role. More employees increase the chance of workplace accidents or claims. Insurers consider payroll size and job types for pricing.

Claims History

Past claims influence your insurance premium. Businesses with frequent or serious claims face higher costs. A clean claims history can lower your rates. Insurers see claims as indicators of future risk. Maintaining good safety and risk management practices helps reduce premiums.

Tips To Lower Premiums

Lowering your small business liability insurance premiums saves money. Smart steps help reduce risks and keep costs down. Insurance providers reward businesses that manage risks well. Use practical tips to pay less for good coverage.

Risk Management Strategies

Identify possible risks in your business daily. Train employees on safety and proper procedures. Maintain clean and safe workspaces to avoid accidents. Use security systems to protect property and data. Fewer claims mean lower insurance costs over time.

Bundling Policies

Combine multiple insurance policies with one provider. Bundling general liability with property or auto insurance cuts costs. Insurance companies often offer discounts for bundled coverage. This approach simplifies payments and saves money.

Regular Policy Reviews

Review your insurance policy at least once a year. Update coverage to match current business needs. Remove unnecessary coverage to reduce premiums. Talk with your agent about discounts or better options. Staying current helps avoid overpaying for insurance.

Claims Process

The claims process for small business liability insurance is straightforward but requires attention to detail. Understanding how to file a claim and work with adjusters can help your business recover quickly. Knowing common claim scenarios prepares you for what to expect.

Filing A Claim

Start by notifying your insurance company as soon as possible. Provide clear and accurate information about the incident. Keep all documents and evidence related to the claim. This includes photos, receipts, and any communication with the other party involved. Follow your insurer’s instructions carefully to avoid delays.

Working With Adjusters

An adjuster will review your claim to assess the damage or liability. Be honest and detailed when answering their questions. Cooperate fully and provide any additional information requested. The adjuster’s goal is to determine the validity and value of your claim. This step helps ensure fair compensation for your business.

Common Claim Scenarios

Typical claims include property damage caused by your business operations. Bodily injury to customers or visitors is another frequent issue. Claims may also arise from advertising mistakes or personal injury allegations. Knowing these scenarios helps you prepare and react wisely if a claim occurs.

Finding The Right Provider

Finding the right provider for small business liability insurance is crucial. The right insurer offers protection that fits your business’s unique needs. Choosing carefully can save money and stress later. Focus on key factors like price, coverage, and service. These will help you make a well-informed decision.

Comparing Quotes

Start by gathering multiple insurance quotes. Different providers charge different rates for similar coverage. Compare the prices side by side. Look beyond just the premium cost. Check for deductibles, limits, and exclusions. This helps you find the best value for your budget.

Evaluating Coverage Options

Not all liability insurance policies cover the same risks. Review each policy’s details carefully. Ensure it covers bodily injury, property damage, and personal injury. Some policies may include extra protections like product liability or advertising injury. Match the coverage to your business’s specific risks.

Customer Service Considerations

Good customer service makes managing your policy easier. Choose a provider known for quick responses and clear communication. Check online reviews and ask other business owners for recommendations. A helpful insurer supports you during claims and questions. This reduces hassle and keeps your business protected.

Credit: insurancebrokersofaz.com

Frequently Asked Questions

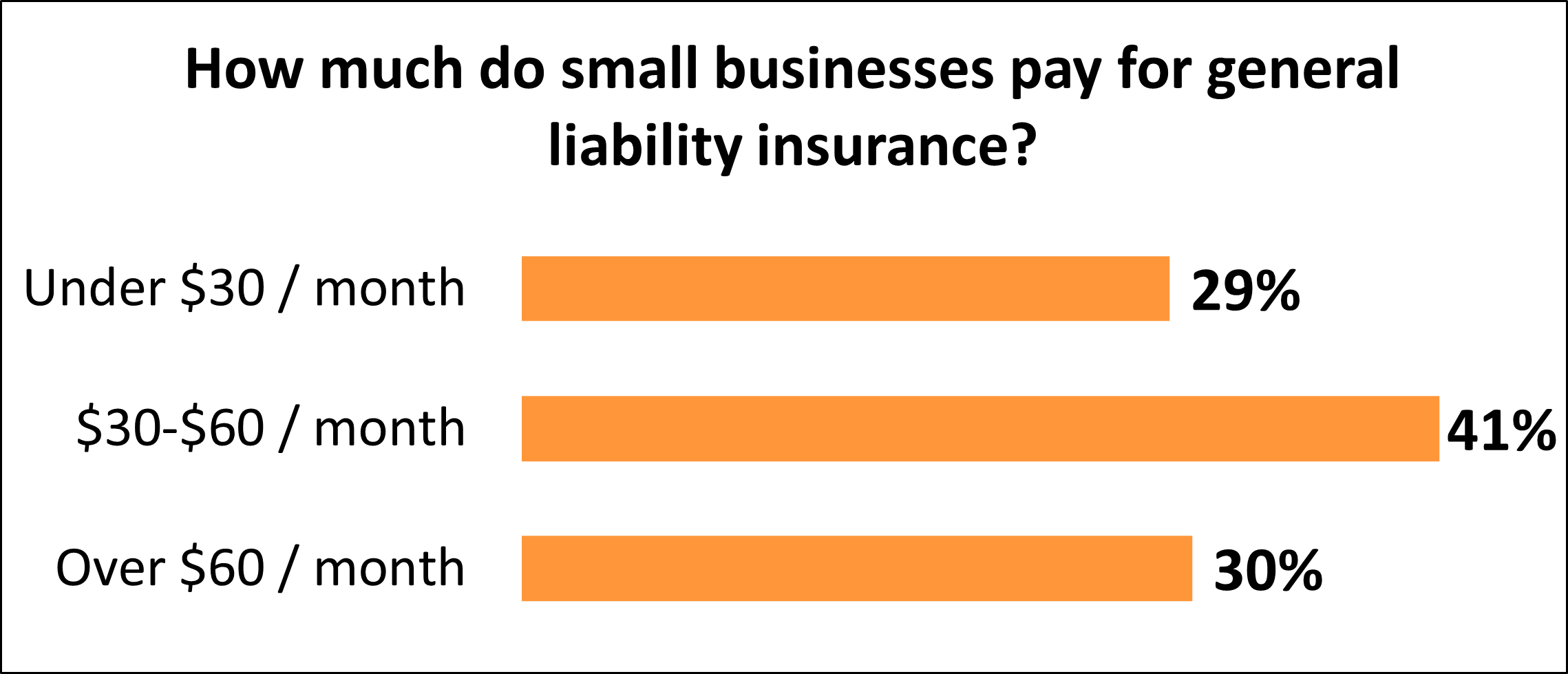

How Much Does Liability Insurance Cost For A Small Business?

Liability insurance for small businesses typically costs between $400 and $1,500 annually. Rates vary by industry, location, and coverage limits.

What Is Basic Liability Insurance For Small Business?

Basic liability insurance for small businesses protects against third-party claims like bodily injury, property damage, and advertising injury. It covers legal fees and medical costs from accidents related to your business operations. This insurance is essential but doesn’t cover professional mistakes or employee injuries.

How Much Is A $1,000,000 General Liability Policy?

A $1,000,000 general liability policy typically costs between $400 and $1,000 annually. Prices vary by industry, location, and business size.

What Type Of Insurance Is Best For A Small Business?

General liability insurance is best for small businesses, covering bodily injury, property damage, and legal claims. Consider adding professional liability and workers’ compensation based on your business needs.

Conclusion

Small business liability insurance shields your business from common risks. It helps cover costs from injuries and damages tied to your work. This insurance supports your financial safety and business stability. Choosing the right coverage fits your business needs well.

Protect your business today to avoid unexpected expenses tomorrow. Simple protection can make a big difference. Stay prepared and focus on growing your business with confidence.