Choosing the best online banking solution can feel overwhelming. With so many options out there, how do you know which one fits your needs?

You want a service that is safe, easy to use, and saves you time. Imagine having your money management at your fingertips, without the hassle of long lines or confusing fees. You’ll discover simple steps to find the perfect online bank that makes your life easier and gives you peace of mind.

Keep reading to make a smart choice that works for you.

Credit: www.digitalauthority.me

Top Online Banking Features To Look For

Choosing the best online banking solution requires understanding key features that match your needs. The right platform offers a mix of convenience, security, and cost-effectiveness. Focus on Online Banking Features that simplify managing money and protect your data. Comparing Online Bank Comparison results helps spot differences in Banking Fees And Charges and service quality. Pay attention to Digital Banking Security to keep your information safe. The Best Online Banking Apps offer seamless Online Account Management and Mobile Banking Solutions for easy access. Secure Online Transactions are essential to avoid fraud and theft.

Online Account Management

Easy account management saves time and reduces stress. Look for platforms that let you:

- View balances and transactions instantly

- Set up alerts for unusual activity

- Transfer money between accounts quickly

- Pay bills without extra fees

- Download statements anytime

Online Account Management tools should be user-friendly on both desktop and mobile devices.

Digital Banking Security

Security is the backbone of online banking. Strong Digital Banking Security means:

- Two-factor authentication to verify identity

- Encryption of your data during transmission

- Regular security updates from the bank

- Fraud detection systems that alert suspicious activity

- Secure logins with biometric options like fingerprint or face ID

Choose banks that prioritize customer safety with clear security measures.

Banking Fees And Charges

Banking Fees And Charges can reduce your savings if not monitored. Check for:

| Fee Type | What to Watch For |

|---|---|

| Monthly Maintenance Fees | Low or no monthly fees preferred |

| Transfer Fees | Free internal transfers and low external fees |

| ATM Fees | Wide ATM network or reimbursed fees |

| Overdraft Charges | Reasonable overdraft policies or fee waivers |

Mobile Banking Solutions

Mobile Banking Solutions provide access anytime, anywhere. Features to check:

- Fast and responsive app design

- Easy navigation with clear menus

- Mobile check deposit using camera

- Real-time transaction alerts

- Ability to freeze or unfreeze cards instantly

The Best Online Banking Apps combine convenience with strong security.

Secure Online Transactions

Secure Online Transactions protect your money and data. Look for:

- SSL encryption on all web pages

- Automatic logout after inactivity

- Transaction limits you can set yourself

- Verification steps before large transfers

- Customer support for suspicious activity

These features help reduce risks during payments and transfers.

Benefits Of Online Banking

Choosing the best online banking solution means understanding the key benefits it offers. Online banking brings many advantages that help manage money easily and safely. It saves time and effort by letting users do banking tasks anytime and anywhere. These benefits improve financial control and provide peace of mind. Below are some main benefits of online banking that make it a smart choice for many people.

Convenience And Accessibility

Online banking offers unmatched convenience. You can access your account 24 hours a day from any device with internet. No need to visit a branch or wait in lines. This saves valuable time and effort.

- Check balances instantly without delays.

- Transfer money between accounts quickly.

- Pay bills automatically or manually.

- View statements and transaction history anytime.

Mobile apps and websites make banking easy on the go. You can deposit checks by taking photos with your phone. Alerts notify you of important changes or suspicious activity. This keeps you informed and in control.

| Feature | Benefit |

|---|---|

| 24/7 Access | Bank anytime without branch hours |

| Mobile Deposits | Deposit checks without visiting a bank |

| Instant Transfers | Move funds quickly between accounts |

Cost Savings

Online banking reduces many costs linked to traditional banking. It often has lower fees or no fees for common services. This helps save money over time.

Branches need staff and buildings, which increases costs. Online banks cut these expenses and pass savings to customers. Here are some ways online banking saves money:

- No monthly fees on many accounts.

- Lower or no minimum balance requirements.

- Free transfers and bill payments.

- Reduced ATM fees with wider networks.

Some banks offer higher interest rates on savings accounts online. This means your money grows faster. Spending less on fees and earning more interest improves your finances.

| Cost Type | Traditional Bank | Online Bank |

|---|---|---|

| Monthly Fees | $10-$15 | $0-$5 |

| ATM Fees | $2-$3 per use | Free or reimbursed |

| Interest Rates | 0.01% – 0.05% | 0.50% – 1.00% |

Advanced Security Features

Online banking uses strong security to protect your money and information. Banks invest in technology to prevent fraud and theft. This creates a safer banking experience.

Security measures include:

- Two-factor authentication requiring a password and a code.

- Encryption to keep data safe during transfers.

- Automatic alerts for unusual activity.

- Biometric login like fingerprint or face ID.

Many banks monitor accounts 24/7 for suspicious behavior. They can freeze accounts quickly if needed. Users also have control to lock cards or change passwords easily.

Strong security means less risk of losing money or data. This builds trust and confidence in using online banking every day.

Key Features To Consider

Choosing the best online banking solution requires careful thought about the features that make your banking simple and secure. The right features help save time and reduce stress. Focus on key aspects that improve your experience and meet your daily banking needs. These features include ease of use, mobile access, and reliable support. Understanding these will guide you to the best choice.

User-friendly Interface

A user-friendly interface means the online banking site or app is easy to use for everyone. It should be clear and simple, so you can find what you need fast. Good design helps avoid mistakes and confusion.

Look for these in a user interface:

- Simple layout: Clear menus and buttons that are easy to find.

- Fast loading times: Pages should open quickly without delays.

- Accessible design: Works well for people with different abilities.

- Clear instructions: Helps guide you through tasks like transfers or bill payments.

- Easy navigation: Ability to move between sections without frustration.

Here is a quick comparison of interface features:

| Feature | Why It Matters |

|---|---|

| Simple Layout | Reduces errors and saves time |

| Fast Loading | Improves user satisfaction |

| Accessible Design | Supports all users |

| Clear Instructions | Helps complete tasks easily |

Test the interface yourself before deciding. A bank that offers a demo or trial is valuable. Your comfort using the platform matters most.

Mobile App Capabilities

Mobile apps make online banking convenient. You can check your balance, pay bills, or transfer money anytime, anywhere. A good app must be reliable and secure.

Important mobile app features include:

- Easy login: Options like fingerprint or face recognition speed up access.

- Full banking functions: Ability to do all tasks without switching to a computer.

- Notifications: Alerts for transactions or important updates keep you informed.

- Offline access: Some features should work without internet.

- Regular updates: Fix bugs and improve security often.

Here is a simple checklist for mobile apps:

- Does the app support biometric login?

- Can you deposit checks by taking photos?

- Are notifications customizable?

- Is the app fast and free of crashes?

- Does the bank update the app regularly?

Before choosing, download the app and explore its features. A well-built app saves time and keeps your money safe.

Customer Support Options

Good customer support helps solve problems quickly. When you face issues, fast and clear help is essential. Check what support options the bank offers.

Key support features include:

- Multiple contact methods: Phone, email, chat, or even social media.

- 24/7 availability: Help anytime, especially for urgent issues.

- Knowledge base: FAQs and guides to solve common problems yourself.

- Language support: Services in your preferred language.

- Response time: How fast the support team replies.

Here is a quick table comparing support options:

| Support Type | Benefit |

|---|---|

| Phone | Direct and personal help |

| Live Chat | Quick answers without waiting |

| Good for non-urgent questions | |

| FAQs & Guides | Self-help anytime |

Test the support channels by asking simple questions. Good support improves your confidence in the bank and saves frustration.

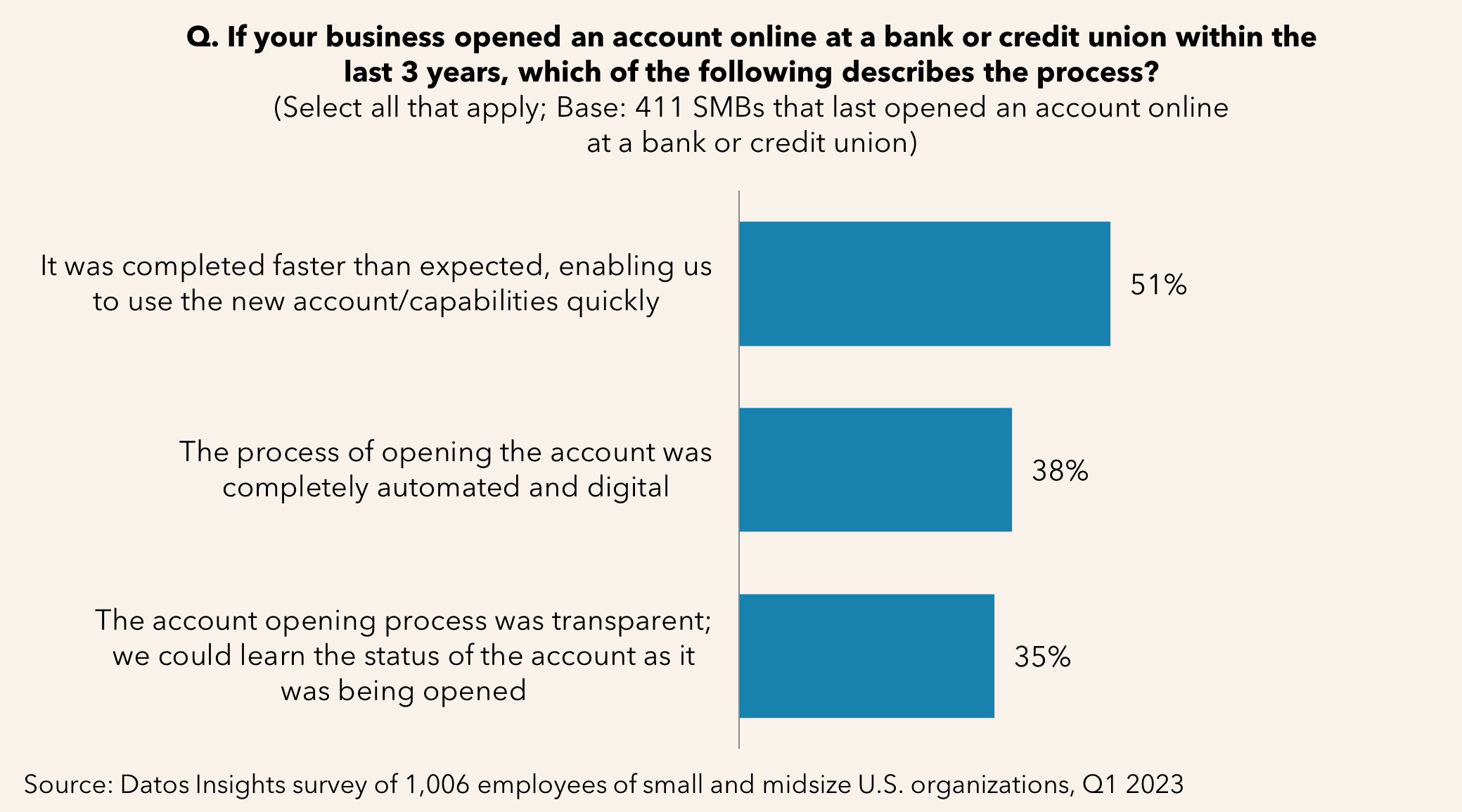

Credit: datos-insights.com

Security Measures To Look For

Choosing the best online banking solution means paying close attention to security measures. Security protects your money and personal information from hackers and fraudsters. Without strong security, even the best features can put you at risk. Understanding key security elements helps you pick a safe and reliable banking service.

Encryption And Authentication

Encryption is the first line of defense in online banking. It scrambles data so outsiders cannot read it. Banks use SSL (Secure Sockets Layer) or TLS (Transport Layer Security) to encrypt information between your device and their servers. This keeps passwords, account numbers, and transactions safe.

Look for these signs of strong encryption:

- Website address starts with

https:// - Padlock icon in the browser’s address bar

- Use of 256-bit encryption or higher

Authentication confirms your identity before you access your account. It stops unauthorized users from logging in. Common methods include:

- Password protection: Use complex passwords and change them regularly

- Two-factor authentication (2FA): Requires a second step like a text code or app notification

- Biometric authentication: Uses fingerprints, face scans, or voice recognition

| Authentication Method | Security Level | User Convenience |

|---|---|---|

| Password Only | Low to Medium | High |

| Password + 2FA | High | Medium |

| Biometric + 2FA | Very High | Medium |

Strong encryption and multi-layered authentication make online banking safer. Avoid banks with weak or no encryption and single-factor login.

Fraud Detection Systems

Fraud detection systems spot unusual activities in your account to stop theft. These systems use technology to monitor transactions in real time. They flag or block suspicious behavior before harm happens.

Key features to expect:

- Transaction monitoring: Checks for large or odd transactions

- Location tracking: Alerts if login comes from a new or unusual place

- Spending pattern analysis: Identifies changes in how you use your account

- Instant alerts: Sends notifications for unusual activities

Some banks use artificial intelligence (AI) and machine learning to improve fraud detection. These systems learn from past fraud cases and get smarter over time.

Here is a simple fraud detection workflow:

- Transaction occurs

- System compares transaction to normal patterns

- If suspicious, transaction is flagged or blocked

- Customer receives alert to confirm or deny

- Bank takes action based on customer response

Choose banks that clearly explain their fraud detection process. Quick detection and alerts reduce risks and give peace of mind.

Privacy Policies

Privacy policies tell you how a bank collects, uses, and protects your data. A clear and strict privacy policy shows the bank respects your information. Read policies carefully before signing up.

Important points to check in privacy policies:

- Data collection: What personal and financial data the bank collects

- Data use: How the bank uses your information

- Data sharing: Who the bank shares your data with, such as third parties

- Data protection: Measures taken to secure your data

- User rights: Your control over data, such as access, correction, or deletion

Good privacy policies also mention compliance with laws like GDPR or CCPA. These laws protect consumer rights and hold banks accountable.

Here is a checklist for privacy policy review:

| Privacy Aspect | What to Look For |

|---|---|

| Transparency | Clear language, easy to find policy |

| Data Minimization | Only necessary data collected |

| Third-Party Sharing | Limited and explained sharing |

| User Control | Options to manage or delete data |

| Security Measures | Details on encryption and protection |

Strong privacy policies protect your personal data and build trust with your bank. Avoid services with vague or missing privacy information.

Types Of Online Banking Solutions

Choosing the best online banking solution starts with understanding the types available. Online banking options vary widely, each offering different features, fees, and conveniences. Knowing the main types helps pick the right fit for your needs. The three common types are traditional banks with online services, online-only banks, and neobanks or fintech apps. Each serves customers differently, balancing digital tools with physical presence or innovation.

Traditional Banks With Online Services

Traditional banks have physical branches and offer online services. These banks combine in-person help with digital tools. Customers can visit branches for face-to-face support and use websites or apps for daily tasks.

Advantages of traditional banks:

- Access to local branches and ATMs

- Wide range of financial products

- Customer service via phone, chat, or in person

- Trusted and established institutions

Disadvantages:

- Usually higher fees and minimum balances

- Slower innovation in digital tools

- Less competitive interest rates on savings

| Feature | Traditional Banks |

|---|---|

| Branch Access | Yes |

| Mobile App | Yes |

| Fees | Often High |

| Interest Rates | Low |

These banks suit people who want a mix of digital and face-to-face banking. They work well for those needing complex services or local branches.

Online-only Banks

Online-only banks operate without physical branches. They serve customers entirely through websites and mobile apps. These banks often offer better rates and lower fees.

Benefits of online-only banks:

- Higher interest rates on savings accounts

- Lower or no monthly fees

- User-friendly mobile apps and websites

- Fast account opening process

Drawbacks:

- No physical branches for in-person help

- Limited product range compared to traditional banks

- Cash deposits and withdrawals can be tricky

| Feature | Online-Only Banks |

|---|---|

| Branch Access | No |

| Mobile App | Yes |

| Fees | Low or None |

| Interest Rates | Higher |

Online-only banks suit tech-savvy users who want better rates and low costs. They fit well for everyday banking without needing physical locations.

Neobanks And Fintech Apps

Neobanks and fintech apps focus on innovation. They provide banking services with modern technology and user-friendly designs. Many neobanks partner with traditional banks to offer insured accounts.

Key features of neobanks and fintech apps:

- Instant notifications and spending insights

- Easy budgeting and money management tools

- Simple and fast account setup

- Customizable cards and rewards

Limitations include:

- Usually no physical branches

- Some accounts lack full banking licenses

- Limited range of financial products

| Feature | Neobanks / Fintech Apps |

|---|---|

| Branch Access | No |

| Mobile App | Yes, advanced |

| Fees | Low or None |

| Unique Features | Budgeting, rewards, instant alerts |

Neobanks attract younger users and those who want control over their money. They offer creative tools but may not suit complex banking needs.

Comparing Fees And Charges

Choosing the best online banking solution means paying close attention to fees and charges. These costs affect how much you keep in your account. Different banks have various fees that may seem small but add up fast. Comparing these fees helps pick a bank that fits your needs and saves money. Here, we break down the key fees to watch for.

Account Maintenance Fees

Account maintenance fees are monthly or yearly charges to keep your bank account open. Some banks charge these fees no matter what. Others waive them if you meet certain rules.

- Monthly Fee: A fixed amount charged every month for account upkeep.

- Minimum Balance Requirement: Fees can be waived if you keep a minimum balance.

- Age or Employment Status: Some banks offer fee waivers for students or seniors.

Here is a simple comparison of typical account maintenance fees:

| Bank | Monthly Fee | Minimum Balance to Waive | Fee Waivers |

|---|---|---|---|

| Bank A | $10 | $1,000 | Students, Seniors |

| Bank B | $0 | None | None |

| Bank C | $5 | $500 | Online-only accounts |

Before opening an account, check if fees are avoidable. Many banks offer accounts with no maintenance fees. These accounts often require online activity or direct deposits.

Transaction Fees

Transaction fees occur when you move money in or out of your account. These fees vary widely by bank and account type.

Common transaction fees include:

- ATM Fees: Charges for using ATMs outside the bank’s network.

- Transfer Fees: Costs for sending money via wire transfer or electronic payment.

- Overdraft Fees: Penalties for spending more than your account balance.

Some banks offer free unlimited transactions, while others charge per use. Here’s a breakdown:

| Fee Type | Bank A | Bank B | Bank C |

|---|---|---|---|

| ATM Withdrawal | $2 per use (out-of-network) | Free (nationwide) | $1 per use (out-of-network) |

| Wire Transfer | $15 domestic | $10 domestic | $0 (online only) |

| Overdraft | $35 per transaction | $30 per transaction | No overdraft service |

Knowing these fees helps avoid surprises. Choose a bank that fits your spending and transaction habits.

Hidden Charges

Hidden charges are costs not clearly shown in fee lists. These fees surprise many customers and can increase your banking costs.

Watch for these common hidden charges:

- Paper Statement Fees: Some banks charge for mailing paper statements.

- Account Closure Fees: Fees if you close your account too soon.

- Inactive Account Fees: Charges if your account stays unused for months.

- Foreign Transaction Fees: Extra costs for purchases or ATM use abroad.

Ask banks to explain all fees before signing up. Read the terms carefully. Many hidden fees only appear in fine print.

Here is a checklist to spot hidden charges:

- Check if paper statements cost extra.

- Ask about fees for closing accounts early.

- Find out about inactivity fees.

- Confirm foreign transaction fees for travel.

Being aware of hidden charges helps keep banking costs low. Transparency is key to smart banking decisions.

Assessing Interest Rates And Benefits

Choosing the best online banking solution requires careful assessment of interest rates and benefits. These factors affect your savings growth, borrowing costs, and overall banking experience. Interest rates determine how much money you earn or pay. Benefits include perks that make banking easier and more rewarding. Understanding these elements helps select a bank that fits your financial needs and goals.

Savings Account Rates

Savings account rates vary widely among online banks. Higher interest rates help your money grow faster. Check the annual percentage yield (APY) offered by the bank. Even a small difference in rates can add up over time.

- Compare rates from several banks before deciding.

- Look for banks that offer compound interest, which pays interest on interest.

- Beware of minimum balance requirements that might reduce your earnings.

| Bank | APY (%) | Minimum Balance | Compounding Frequency |

|---|---|---|---|

| Bank A | 2.00 | $0 | Daily |

| Bank B | 1.75 | $500 | Monthly |

| Bank C | 2.10 | $1000 | Daily |

Choose a savings account with a high APY and flexible terms. This strategy helps maximize your returns while keeping your money accessible.

Loan And Credit Options

Online banks offer various loan and credit products. These include personal loans, mortgages, credit cards, and lines of credit. Interest rates on loans affect how much you pay over time. Lower rates save money on interest payments. Understand the terms before borrowing.

- Check the annual percentage rate (APR) for loans and credit cards.

- Look for fixed rates to avoid surprises from rising interest.

- Review repayment terms and fees carefully.

- Consider whether the bank offers pre-qualification to check rates without a hard credit pull.

| Loan Type | Typical APR Range (%) | Term Length | Fees |

|---|---|---|---|

| Personal Loan | 6.5 – 15 | 1 to 5 years | Origination fee 1%-5% |

| Mortgage | 3.0 – 7.0 | 15 to 30 years | Closing costs apply |

| Credit Card | 12 – 25 | Revolving | Annual fee varies |

Careful review of loan and credit options helps avoid high costs. Choose products that fit your budget and repayment ability.

Reward Programs

Many online banks offer reward programs with their accounts or credit cards. These programs provide cash back, points, or travel miles. Rewards add value to your banking experience. Understand how to earn and redeem rewards effectively.

- Check if rewards apply to all purchases or specific categories.

- Look for no expiration on points or miles.

- Consider if there are caps on earning rewards.

- Review any fees related to reward programs.

Here is a summary of common reward types:

| Reward Type | Benefits | Typical Restrictions |

|---|---|---|

| Cash Back | Earn a percentage of spending back as cash | May exclude certain purchases |

| Points | Redeem for merchandise, gift cards, or travel | Points may expire |

| Travel Miles | Use for flights, hotels, and travel expenses | May require partner airlines |

Select a reward program that matches your spending habits and lifestyle. This choice can enhance savings and provide enjoyable benefits.

Integration With Other Financial Tools

Choosing the best online banking solution means finding one that works well with other financial tools. Integration with these tools makes managing money easier and more effective. Banks that connect smoothly with budgeting apps, investment platforms, and payment services save time and reduce errors. This connection allows users to see a complete picture of their finances in one place.

Budgeting Apps

Many people use budgeting apps to track spending and save money. An online bank that integrates with popular budgeting apps helps users stay on top of their finances without extra effort. This integration allows automatic updates of transactions and balances into the budgeting app.

Benefits of integration with budgeting apps:

- Automatic transaction syncing.

- Real-time balance updates.

- Easy categorization of expenses.

- Alerts for budget limits.

- Goal setting and progress tracking.

For example, some banks connect with apps like Mint, YNAB (You Need A Budget), or PocketGuard. This connection means no manual entry is needed, reducing mistakes. Users can check their budgets and bank accounts in one place.

Below is a simple table showing common budgeting apps and their key features:

| Budgeting App | Key Feature | Bank Integration |

|---|---|---|

| Mint | Expense tracking and alerts | Many online banks |

| YNAB | Zero-based budgeting | Select banks only |

| PocketGuard | Spending limits and insights | Wide support |

Investment Platforms

Investment platforms let users grow their money by buying stocks, bonds, and funds. Banks that link to these platforms help users manage both everyday banking and investments easily. This connection offers a clear view of total financial health.

Key reasons to choose banks with investment platform integration:

- View bank and investment balances in one dashboard.

- Transfer money quickly between accounts.

- Track investment performance alongside savings.

- Receive personalized financial advice.

- Plan for goals like retirement or buying a home.

Popular investment platforms like Robinhood, ETRADE, and Fidelity often work with online banks. Users can link accounts and see all funds in one place. This saves time and helps avoid missed payments or transfers.

Here is a quick comparison of common features in investment platform integrations:

| Platform | Investment Types | Bank Link Features |

|---|---|---|

| Robinhood | Stocks, ETFs, Crypto | Instant transfers, portfolio overview |

| ETRADE | Stocks, Bonds, Mutual Funds | Account syncing, real-time updates |

| Fidelity | Stocks, Bonds, Retirement Funds | Linked accounts, financial planning tools |

Payment Services

Payment services handle sending and receiving money quickly and safely. Banks that integrate with popular payment systems offer more convenience. Users can pay bills, send money to friends, and shop online easily.

Advantages of payment service integration:

- Fast transfers to other users.

- Secure online and mobile payments.

- Bill pay automation.

- Access to rewards and discounts.

- Support for multiple currencies.

Common payment services include PayPal, Venmo, and Apple Pay. Banks that work with these services allow users to link accounts and perform transactions without switching apps. This saves time and keeps money management simple.

Below is a table outlining popular payment services and their key benefits:

| Payment Service | Main Benefit | Bank Compatibility |

|---|---|---|

| PayPal | Wide acceptance, buyer protection | Most online banks |

| Venmo | Peer-to-peer payments, social feed | Many US banks |

| Apple Pay | Contactless payments, security | Supported by major banks |

Customer Reviews And Reputation

Choosing the best online banking solution requires careful attention to customer reviews and reputation. These factors reveal real experiences from users and expert opinions about the bank’s services. They help identify strengths and weaknesses you might not find on the bank’s website. A good reputation shows reliability, security, and quality service, which are crucial for managing money safely online.

User Feedback

User feedback offers firsthand insights into how an online bank performs in daily use. It shows how customers feel about the bank’s mobile app, customer service, fees, and transaction speed. Reading multiple reviews helps spot common problems or praise points.

Key points to check in user feedback:

- Ease of use: Is the app or website simple and clear?

- Customer support: Are issues resolved quickly?

- Hidden fees: Are there unexpected charges?

- Transaction reliability: Do payments and transfers work smoothly?

- Security: Do users feel their money is safe?

Here is a simple table to summarize typical user feedback areas:

| Feedback Area | Positive Signs | Negative Signs |

|---|---|---|

| App Usability | Fast, intuitive, clear design | Confusing menus, slow loading |

| Customer Support | Quick replies, helpful agents | Long waits, unhelpful answers |

| Fees | Transparent fees, no surprises | Hidden or high fees |

| Security | Strong protections, no breaches | Reports of hacking or fraud |

Review sites and forums are good places to read honest user comments.

Industry Ratings

Industry ratings come from experts who study online banks carefully. These ratings use strict criteria to measure quality, safety, and performance. They help compare banks on equal grounds.

Common rating factors include:

- Financial stability: How strong and secure the bank is financially.

- Technology: Quality of the mobile app and online tools.

- Customer satisfaction: Results from surveys and feedback.

- Fees and rates: Competitiveness of charges and interest.

- Security measures: Use of encryption and fraud prevention.

Below is an example of an industry rating scorecard:

| Criteria | Rating (out of 10) |

|---|---|

| Financial Stability | 9.5 |

| Technology | 8.8 |

| Customer Satisfaction | 8.5 |

| Fees and Rates | 7.9 |

| Security | 9.2 |

Industry ratings provide a clear, expert view beyond user opinions.

Trustworthiness

Trust is the foundation of any banking relationship. Online banks must prove they protect your money and data.

Important trust factors to consider:

- Regulation: Is the bank licensed and supervised by official authorities?

- Deposit Insurance: Are deposits insured by government schemes?

- Security Protocols: Does the bank use strong encryption and multi-factor authentication?

- Transparency: Are terms and fees clear and easy to understand?

- History: How long has the bank operated without major scandals?

Trustworthy banks often display badges from regulators and security firms.

Check for:

- SSL certificates on their website (look for “https”)

- Clear privacy policies

- Positive reviews on security from users and experts

Choosing a bank with a solid reputation lowers risks and builds confidence in your online banking choice.

Credit: www.coriniumintelligence.com

Steps To Open An Online Account

Opening an online bank account is a simple and fast way to manage your money. Knowing the exact steps helps avoid delays and confusion. This guide breaks down the process into clear parts. Follow these steps carefully to open your account smoothly and start using your online banking service.

Required Documentation

Before starting your online application, gather all necessary documents. Banks need these to confirm your identity and address. Having them ready speeds up the process. Common documents include:

- Government-issued ID: Passport, driver’s license, or national ID card

- Proof of address: Utility bill, bank statement, or rental agreement (usually dated within the last 3 months)

- Social Security Number (SSN) or Tax ID: For identity verification and tax purposes

- Contact details: Valid phone number and email address

Some banks may ask for additional documents depending on your location or the account type. For example, proof of income or employment might be necessary. Check the bank’s website for a full list of required documents before applying.

| Document Type | Purpose | Example |

|---|---|---|

| ID Proof | Verify your identity | Passport, Driver’s License |

| Address Proof | Confirm your residential address | Utility Bill, Rental Agreement |

| Tax ID | For tax and legal requirements | Social Security Number |

Verification Process

The verification process confirms your identity and protects your account. It usually takes a few minutes to a couple of days. Here is how it works:

- Submit your documents through the bank’s secure online form.

- The bank reviews the documents to check their validity.

- You may receive a call, email, or text message for further confirmation.

- Some banks use video calls or selfie uploads to match your face with your ID.

- Once verified, you get access to your new online account.

Verification helps prevent fraud and keeps your money safe. Keep your documents clear and readable. Follow any instructions from the bank carefully to avoid delays.

Below is a checklist to prepare for verification:

- Clear photos or scans of your documents

- Valid phone number for contact

- Stable internet connection for video verification

- Patience during the review process

Initial Deposit

Most banks require an initial deposit to activate your online account. This amount varies but is often low. The deposit confirms your intent to use the account. You can fund it in several ways:

- Transfer from another bank account

- Debit or credit card payment

- Mobile payment apps linked to your bank

Check the minimum deposit amount on the bank’s website before applying. Some banks offer no minimum deposit, which can be helpful.

Tips for making your initial deposit:

- Use a payment method accepted by the bank

- Double-check the deposit amount

- Keep a record of the transaction for future reference

Once the deposit clears, your account becomes fully active. You can start using online banking features like transfers, bill payments, and mobile check deposits.

Frequently Asked Questions

What Features Should I Look For In Online Banking?

Look for security, user-friendly interface, low fees, fast transactions, and 24/7 customer support. Also, consider mobile app quality and integration with other financial tools.

How Do I Ensure My Online Banking Is Secure?

Use strong passwords, enable two-factor authentication, and update software regularly. Avoid public Wi-Fi for transactions and monitor account activity for suspicious actions.

Can I Switch Online Banks Easily?

Yes, switching is simple. Notify your current bank, transfer funds, update automatic payments, and inform direct deposit sources. Most banks offer guides for smooth transitions.

What Are The Benefits Of Online Banking Over Traditional Banks?

Online banking offers convenience, lower fees, faster transactions, and 24/7 access. It often provides better interest rates and easy integration with budgeting apps.

Conclusion

Choosing the best online banking solution takes time and care. Think about your needs and compare features. Security should always be a top priority. Check fees and customer support options. Make sure the bank’s app is easy to use. Read reviews from real users to learn more.

A good choice helps manage money with ease. Take small steps and stay informed. Your money deserves the best care possible.