Are you wondering how much workers compensation insurance will cost your business? Understanding the price of this essential coverage can feel confusing, especially when you’re trying to protect your employees without breaking the bank.

But knowing the real factors that influence workers comp insurance costs can help you make smarter decisions and save money. You’ll discover what drives the cost of workers compensation insurance, how to estimate your premiums, and practical tips to keep your rates low.

Keep reading to find out exactly what you need to know to protect your team and your bottom line.

Credit: www.insureon.com

Factors Affecting Workers Comp Costs

Several key factors influence the cost of workers compensation insurance. Understanding these elements helps businesses manage their expenses better. Insurance providers assess risks and calculate premiums based on specific criteria.

Costs vary widely depending on the nature of the business and its workforce. Knowing what affects these costs can guide employers in making informed decisions.

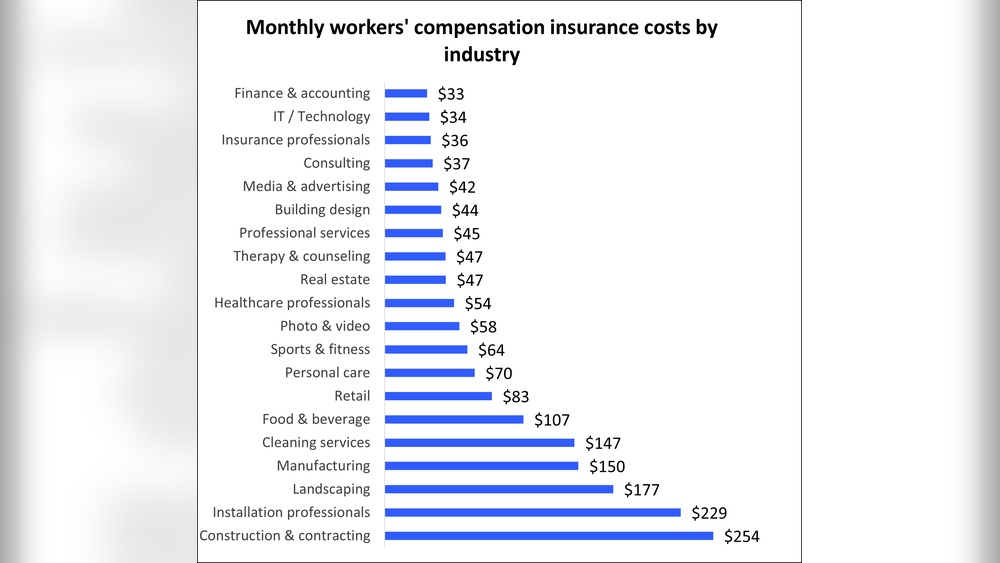

Industry And Job Classification

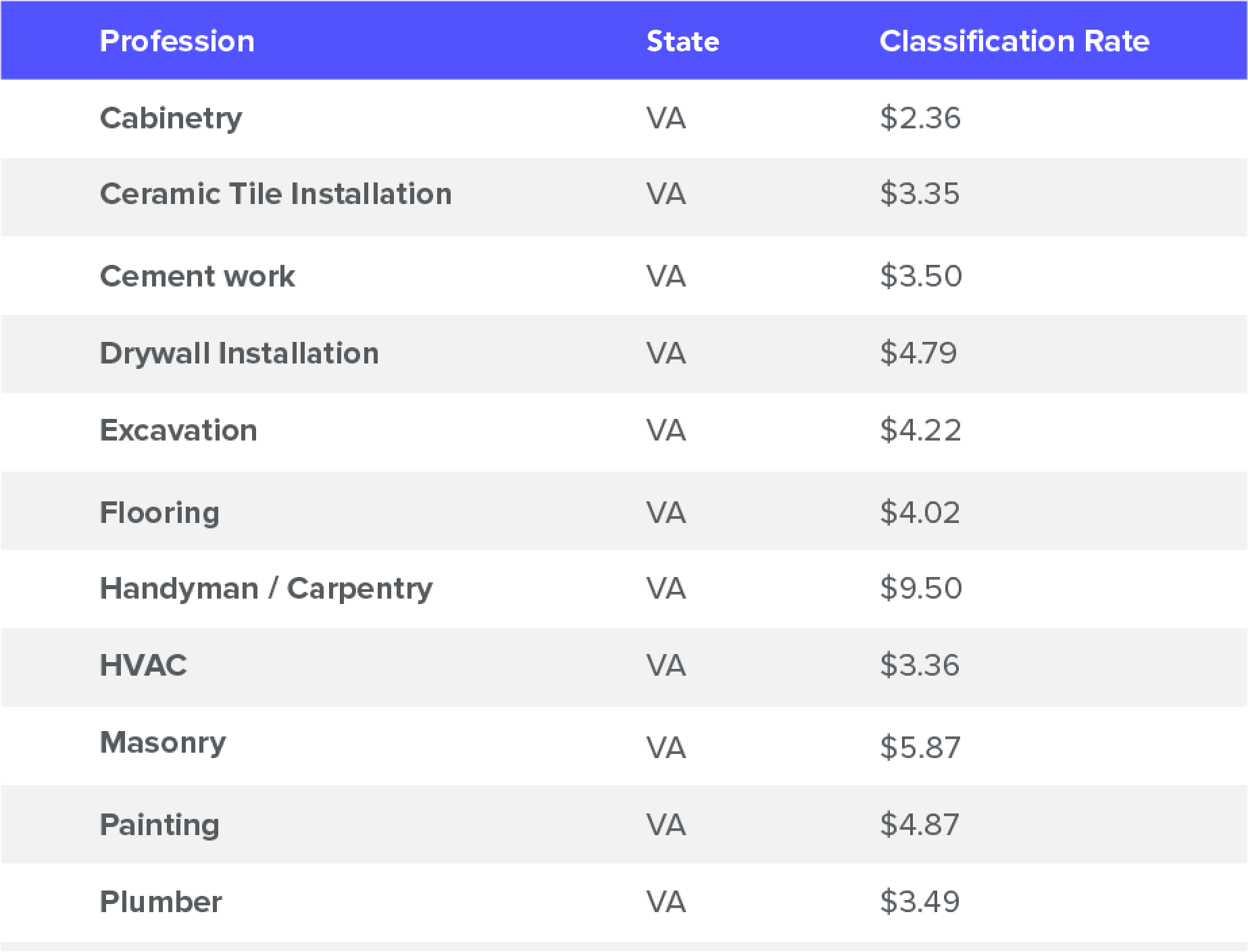

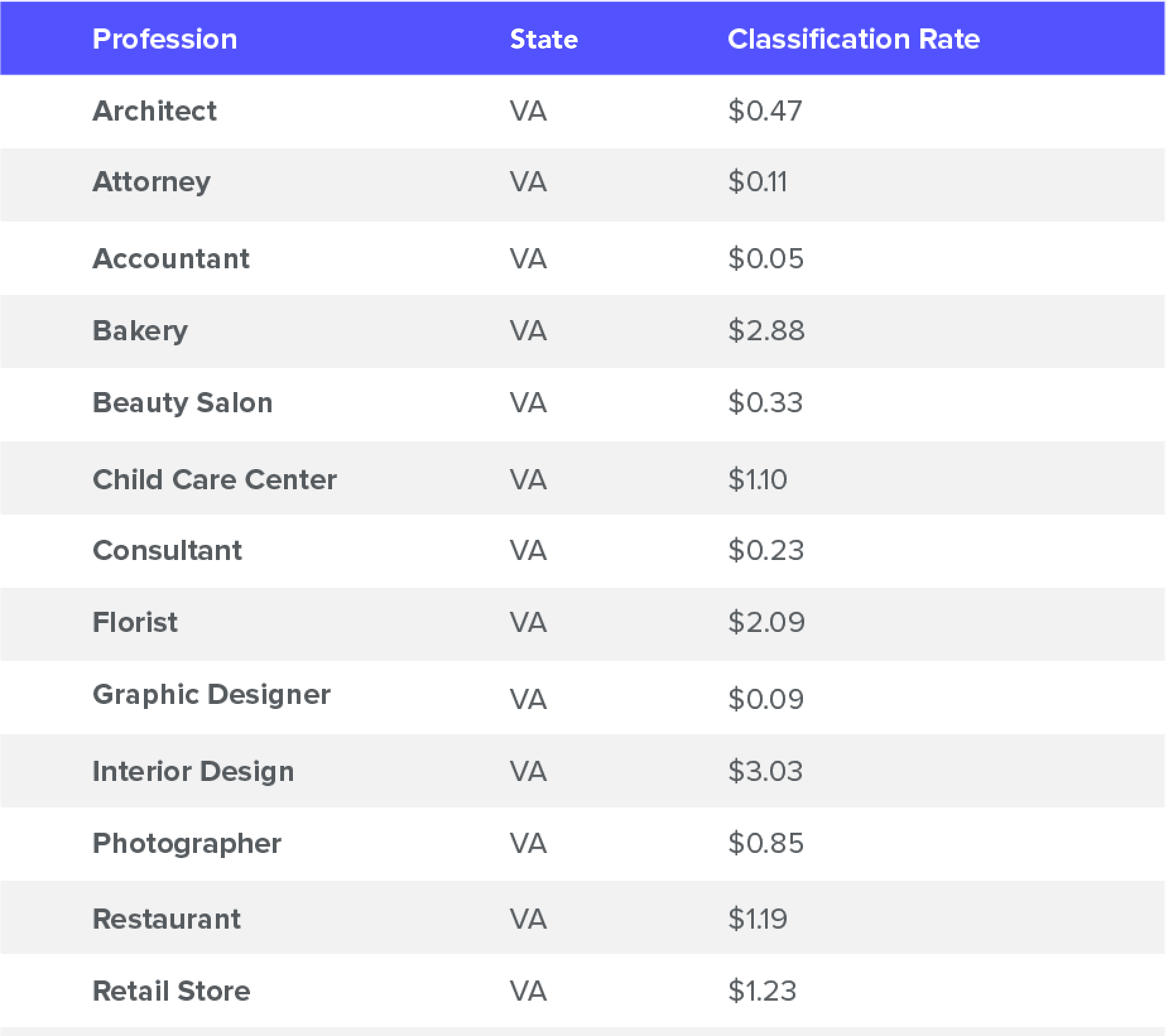

Different industries face different risks of injury. High-risk jobs, like construction, usually have higher insurance costs. Office jobs tend to cost less because they are safer. Insurance companies assign classifications based on job duties to set rates.

Payroll Size

The total amount paid to employees affects workers comp costs. Larger payrolls mean higher premiums since more wages are covered. Insurance rates are usually expressed per $100 of payroll. Businesses with higher payrolls pay more overall but may get lower rates per dollar.

Claims History

A company’s past injury claims impact insurance rates. Frequent or severe claims signal higher risk to insurers. A clean claims record often results in lower premiums. Employers should focus on workplace safety to reduce claims and costs.

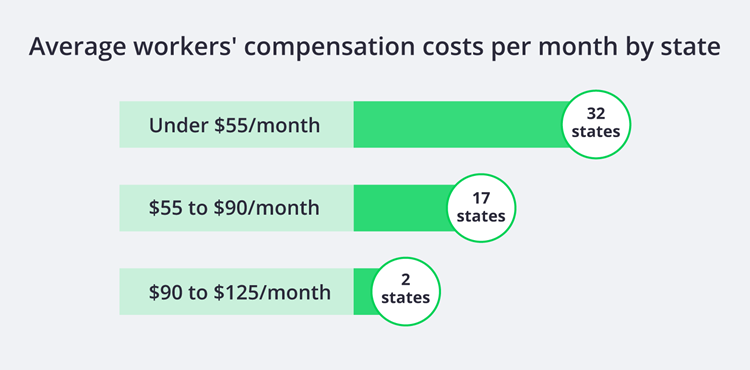

State Regulations

Workers compensation laws differ from state to state. Each state sets its own rules for coverage and pricing. Some states have higher minimum rates or stricter requirements. Businesses must follow local regulations, which affect insurance costs.

Credit: pogo.co

Calculating Your Premiums

Calculating your workers compensation insurance premiums can seem complex. Understanding the key factors helps you estimate costs more clearly. Insurance providers use specific methods to set your premium based on your business details and risk level.

This section explains the basic rate formula, the use of online calculators, and the role of the experience modification factor. These elements shape the final premium you pay.

Basic Rate Formula

The basic rate formula starts with your payroll size. Insurers assign a rate per $100 of payroll. This rate depends on your industry and job risks. Multiply your payroll by this rate to get a base premium.

This formula gives a starting point. It reflects how risky your work type is for injuries.

Using Online Calculators

Online calculators simplify premium estimates. You enter your payroll, industry, and location details. The tool applies current rates to show an estimate. Many insurance sites offer these calculators for free.

These tools provide quick insight. They help you plan your budget without waiting for a quote.

Role Of Experience Modification Factor

The experience modification factor adjusts your premium. It reflects your company’s past claims and safety record. A good safety record lowers this factor, reducing costs. A poor record increases the factor and raises premiums.

This factor rewards safe workplaces and penalizes risky ones. It ensures fair pricing based on actual experience.

Ways To Lower Premiums

Lowering workers compensation insurance premiums helps businesses save money. Small changes in workplace safety and management can reduce costs. Many employers find that investing time and effort in prevention pays off. Below are effective ways to lower your workers compensation insurance premiums.

Improving Workplace Safety

Creating a safe workplace reduces accidents and injuries. Regular safety checks identify hazards early. Using proper safety equipment protects employees. A clean and organized workspace limits risks. Safe workplaces show insurers that risks are controlled, lowering premiums.

Effective Claims Management

Handling claims quickly prevents costs from rising. Reporting injuries immediately helps track and manage claims. Work with your insurance company to resolve claims fast. Reducing claim frequency and severity lowers insurance costs. Keeping clear records supports better claims management.

Employee Training Programs

Training employees reduces accidents and mistakes. Teach workers about safety rules and proper procedures. Regular training refreshes knowledge and keeps safety top of mind. Well-trained staff avoid injuries, which cuts insurance claims. Training programs demonstrate commitment to safety for insurers.

Reviewing And Updating Classifications

Classifications affect your insurance premium rates. Ensure workers are correctly classified based on their job duties. Misclassifications can lead to higher premiums or penalties. Review classifications annually and update changes in job roles. Accurate classifications help insurers price your policy fairly.

Choosing The Right Insurance Provider

Choosing the right insurance provider is a key step in managing workers compensation insurance costs. The provider affects how much you pay and the quality of service you receive. Careful selection can save money and reduce stress during claims.

Several factors matter when selecting a provider. Price alone does not guarantee the best value. You must also consider financial strength and customer support. These elements work together to create a smooth insurance experience.

Comparing Quotes

Start by gathering quotes from multiple insurance companies. Compare prices based on the same coverage limits. Watch for hidden fees or extra charges. Lower prices may seem attractive but check what they include. A detailed comparison helps find the best deal for your needs.

Evaluating Financial Stability

Financial strength shows if an insurer can pay claims reliably. Check ratings from agencies like A.M. Best or Standard & Poor’s. Strong financial ratings mean the company can handle large claims. Avoid providers with weak financial records to prevent future problems.

Customer Service And Support

Good customer service is crucial during injury claims. Choose a provider known for quick responses and clear communication. Read reviews to learn about other customers’ experiences. Supportive service makes the claims process easier and less stressful.

Special Considerations In Texas

Texas stands out with unique rules affecting workers compensation insurance costs. Employers must understand these special factors to manage expenses well. This section highlights key points about Texas regulations, the main provider, and helpful local resources.

State-specific Regulations

Texas does not require most private employers to buy workers compensation insurance. Employers can choose to provide coverage or not. This choice impacts their legal responsibilities and risk exposure.

Texas law sets specific rules for claims, benefits, and dispute resolution. These rules affect how much insurance costs and how claims are handled. Understanding these regulations helps employers plan their coverage wisely.

Texas Mutual Insurance

Texas Mutual is the largest provider of workers compensation insurance in Texas. It operates as a nonprofit and serves many businesses statewide. Rates from Texas Mutual reflect state rules and local risk factors.

Many employers turn to Texas Mutual for reliable coverage and claims support. The insurer also offers safety programs to help reduce workplace injuries and lower costs.

Local Resources And Assistance

Texas offers many resources to help employers with workers compensation insurance. The Texas Department of Insurance provides guides and tools to compare rates and understand laws.

Local business groups and safety councils offer training and advice. These resources help employers improve workplace safety and manage insurance expenses better.

Workers Comp For Small Businesses And Self-employed

Workers compensation insurance protects small businesses and self-employed workers from financial losses due to work-related injuries or illnesses. It covers medical costs and lost wages for employees hurt on the job. Small businesses often face unique challenges with workers comp, including budget limits and diverse job roles. Understanding costs and coverage helps manage risks effectively and keeps businesses compliant with state laws.

Cost Estimates

Workers comp costs vary by industry, location, and payroll size. Small businesses usually pay lower premiums than large companies. Rates depend on job risk levels; safer jobs cost less. Typical costs range from $0.75 to $2.74 per $100 of payroll. Self-employed individuals may pay different rates based on their work type. Knowing your business class code helps estimate expenses accurately.

Coverage Options

Small businesses can choose standard or customized coverage plans. Basic plans cover medical care and wage replacement. Some insurers offer optional benefits like disability or rehabilitation services. Coverage limits depend on state requirements and business needs. Self-employed workers may select policies that protect them personally. Reviewing coverage options ensures proper protection without paying for unneeded extras.

Tips For Reducing Expenses

Improve workplace safety to lower insurance costs. Regular training and safety equipment reduce injury risks. Maintain a clean claims history by managing incidents promptly. Consider higher deductibles to reduce premium amounts. Shop around and compare quotes from different insurers. Use accurate payroll records to avoid overpaying. These steps help small businesses and self-employed save money on workers comp.

Credit: pogo.co

Frequently Asked Questions

What Factors Affect Workers Compensation Insurance Cost?

Workers compensation cost depends on industry type, payroll size, claims history, and job risk levels. Higher risks and larger payrolls increase premiums.

How Much Does Workers Comp Insurance Cost In Texas?

In Texas, average workers comp insurance costs range from $0. 75 to $2. 74 per $100 of payroll. Costs vary by business size and risk.

Can Small Businesses Afford Workers Compensation Insurance?

Yes, small businesses can find affordable workers comp policies. Premiums depend on payroll and risk, often lower than expected for small firms.

How Is Workers Compensation Insurance Cost Calculated?

Costs are calculated using payroll, job classifications, claim history, and state rates. Each factor influences the final premium for your business.

Conclusion

Workers compensation insurance costs vary by business type and location. Factors like payroll size and job risk affect your premium. Understanding these helps you plan your budget better. Choosing the right coverage protects your workers and your business. Regularly review your policy to keep costs manageable.

Stay informed to make smart insurance decisions. Protect your team without overspending.