Are you looking for a smart way to save and invest money for a child’s future? A Wells Fargo Custodial Account might be just what you need.

This special account lets you hold and manage funds on behalf of a minor, giving you control while helping build their financial foundation. Whether you want to start saving for college, a first car, or simply teach financial responsibility, understanding how a Wells Fargo custodial account works can make a big difference.

You’ll discover the key benefits, how to open one, and important things to watch out for—so you can make the best choice for your child’s financial future. Keep reading to unlock the full potential of this powerful savings tool.

Wells Fargo Custodial Account Basics

The Wells Fargo Custodial Account Basics offer a simple way to save and invest money for a child. This type of account helps adults manage funds for minors until they reach adulthood. Understanding how these accounts work can help you make better financial decisions for your child’s future.

What Is A Custodial Account

A custodial account is a financial account opened by an adult for a minor. The adult acts as the custodian and manages the account on the child’s behalf. The money in the account belongs to the minor but is controlled by the custodian. These accounts are often used to save money for education or other expenses.

Who Can Open An Account

Any adult can open a Wells Fargo custodial account for a child. The adult must provide personal information and identification. The child must be under the age of 18 or 21, depending on the state. Parents, grandparents, or guardians often open these accounts to help minors save money.

Account Ownership And Control

The custodian manages the account until the child reaches the age of majority. After that, the child gains full control of the account and its funds. The custodian cannot use the money for themselves. The funds must benefit the minor’s needs and future.

Setting Up A Wells Fargo Custodial Account

Setting up a Wells Fargo Custodial Account is a simple process that helps adults save money for a child’s future. This type of account allows a custodian to manage funds until the child reaches adulthood. Knowing the steps and requirements can make opening the account smooth and fast.

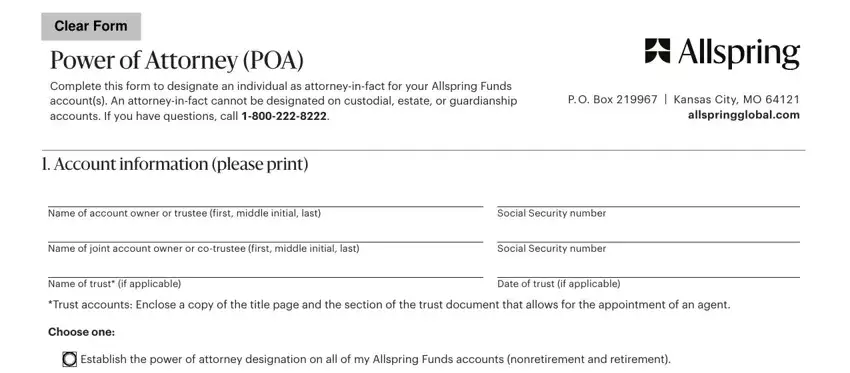

Information Needed For Opening

To open a Wells Fargo Custodial Account, gather key details for both the custodian and the child. These include full names, dates of birth, and Social Security numbers. The custodian must also provide a valid ID, such as a driver’s license. Having current contact information like addresses and phone numbers is important. Collecting all these details beforehand speeds up the application.

Online Vs. In-person Application

Wells Fargo offers two ways to apply for a custodial account: online or in person. The online method is quick and convenient, allowing users to fill out forms from home. Visiting a Wells Fargo branch lets you speak directly with a representative. This option is helpful for those who prefer personal assistance. Both methods require the same information and follow similar steps.

Linking Bank Accounts And Initial Deposit

After completing the application, linking an existing bank account is necessary to fund the custodial account. This connection allows easy transfers and management of money. Wells Fargo usually requires a minimum initial deposit to activate the account. The amount varies, so check the latest details before applying. Making this first deposit starts the saving process for the child’s benefit.

Features Of Wells Fargo Custodial Accounts

Wells Fargo Custodial Accounts offer a range of useful features for parents and guardians. These accounts help manage money for minors while providing flexibility and control. The features support saving and investing, ensuring funds grow securely over time.

Understanding these features helps decide if this account fits your needs. Below, key aspects of Wells Fargo Custodial Accounts are explained clearly.

Savings And Investment Options

Wells Fargo Custodial Accounts allow saving money safely for a child’s future. The account supports different investment choices, including stocks, bonds, and mutual funds. This variety helps grow the child’s funds steadily. Interest earnings and dividends add to the account balance over time. Custodians can tailor investments based on risk and goals.

Parental Controls And Responsibilities

The adult custodian manages the account until the minor reaches legal age. They make all financial decisions and control account activity. Custodians must act in the child’s best interest. Withdrawals must benefit the minor’s needs, such as education or health expenses. The custodian also handles tax reporting and account maintenance tasks.

Fees And Minimum Balance Requirements

Wells Fargo Custodial Accounts have clear fee structures to consider. Some accounts require a minimum balance to avoid monthly fees. Fees vary depending on account type and investment choices. Custodians should review fee details to reduce costs. Proper management helps keep more money working for the child.

Credit: www.wellsfargo.com

Benefits For Kids And Parents

Wells Fargo Custodial Account offers clear benefits for both kids and parents. It helps children learn about money and savings in a safe way. Parents can guide their children while keeping control of the funds. This account creates a foundation for good money habits early in life. It also supports planning for important future costs like education.

Teaching Financial Responsibility

Children learn how to manage money with real experience. Parents can show how to save, spend, and make smart choices. The account helps kids understand the value of money. It encourages saving and thoughtful spending. This early lesson builds confidence in handling money later.

Building Savings Early

Starting to save at a young age makes a big difference. The account helps grow money over time. Parents can add funds and teach kids about interest. Small savings grow into larger amounts with patience. This habit supports financial security as children grow.

Preparing For Future Expenses

The account prepares kids for big costs ahead. Money saved can help with college, driving, or other needs. Parents and kids can set clear goals together. This planning reduces stress when expenses come. It teaches kids to think ahead and be responsible.

Potential Downsides To Consider

Wells Fargo Custodial Accounts offer a way to save and invest for a child’s future. Still, there are some downsides to consider before opening one. Understanding these potential drawbacks helps in making a better decision. Below are key points that might affect account holders and their families.

Loss Of Control After Maturity

Once the child reaches the age of majority, usually 18 or 21, the account ownership transfers to them. At this point, the custodian loses control over the funds. The new adult can use the money for any purpose without needing permission. This loss of control may worry some parents or guardians.

Impact On Financial Aid Eligibility

Assets in a custodial account are considered the student’s property. This can reduce the amount of financial aid the student may receive. Financial aid formulas often count these assets heavily. Families should weigh this impact before funding a custodial account.

Tax Implications And Kiddie Tax

Income from a custodial account may be subject to the kiddie tax rules. This means the child’s unearned income above a certain limit is taxed at the parent’s rate. It can increase the overall tax burden. Planning for these tax rules is important to avoid surprises.

Credit: formspal.com

Comparing Wells Fargo With Other Providers

Choosing the right custodial account provider can shape a child’s financial future. Wells Fargo offers a trusted option, but many other firms compete in this space. Comparing Wells Fargo with other providers reveals key differences in account types, features, and fees. Understanding these differences helps in selecting the best fit for your needs.

Brokerage Vs. Bank Custodial Accounts

Wells Fargo combines banking and brokerage services for custodial accounts. Many other providers focus solely on brokerage or banking. Brokerage custodial accounts offer investment choices like stocks and mutual funds. Bank custodial accounts usually emphasize savings and fixed interest products. The choice depends on your goal: investment growth or safe savings.

Account Features And Flexibility

Wells Fargo’s custodial accounts provide online access and mobile banking tools. Other providers may offer more investment options or lower minimum deposits. Some brokerage firms allow automatic investing and dividend reinvestment plans. Banks often include features like debit cards or linked checking accounts. Flexibility varies widely, so compare features carefully before deciding.

Fees And Service Differences

Wells Fargo charges account maintenance and transaction fees that may be higher than online competitors. Many brokerage firms offer no-fee custodial accounts but may charge for trades. Banks might impose minimum balance fees or limit withdrawals. Service quality also differs; Wells Fargo has many branches for in-person help. Fee structures and service options should align with your priorities.

Tips For Managing Custodial Accounts

Managing a Wells Fargo custodial account requires attention and care to ensure the funds grow and are used wisely. Simple steps can help maintain the account’s health and teach valuable money skills to the child. Regular check-ins and thoughtful planning protect the investment and prepare for future ownership.

Regular Monitoring And Updates

Check the account balance and transactions often. Watch for any unusual activity. Update contact and beneficiary information if needed. Keep track of deposits and withdrawals to stay organized. Regular reviews help spot errors early and keep the account on track.

Teaching Kids About Investing

Use the custodial account as a learning tool. Explain basic investing concepts in simple words. Show how saving and investing can grow money over time. Involve children in small decisions to build confidence. This knowledge supports smart money habits in adulthood.

Planning Account Transfers At Adulthood

Prepare for the child to take control when they reach legal age. Understand Wells Fargo’s rules for transferring ownership. Discuss the transfer process with the child before they become adults. Help them plan how to use or invest the funds wisely. Early preparation avoids surprises and eases the transition.

Credit: www.yumpu.com

Frequently Asked Questions

Does Wells Fargo Offer A Custodial Account?

Yes, Wells Fargo offers custodial accounts. An adult custodian manages the account for a minor’s benefit.

Can I Open A Custodial Account Online?

Yes, you can open a custodial account online by choosing a bank or brokerage and completing their application. Provide minor’s and your details, then fund the account to start saving.

Does Wells Fargo Have Kid Accounts?

Wells Fargo offers kid accounts through Clear Access Banking and custodial accounts. An adult co-owner must open and manage the account for minors. These accounts help children learn saving and money management. Identification for both adult and child is required to open the account.

What Are The Disadvantages Of A Custodial Account?

Custodial accounts transfer control to the child at adulthood, risking fund misuse. They may affect financial aid eligibility and have limited investment options. Tax implications can also be unfavorable.

Conclusion

A Wells Fargo custodial account helps adults save money for minors. It offers a simple way to manage funds for children’s future. Opening one requires basic information about both the adult and the child. You can start this process online or in person.

This account supports teaching kids about saving and investing early. Choosing Wells Fargo means access to trusted banking services. Start planning today to secure a child’s financial path with ease.