If you’ve been asked to get SR22 insurance, you might feel overwhelmed or unsure where to start. But here’s the good news: you can handle everything quickly and easily online.

SR22 insurance online makes the whole process simple, saving you time and hassle. Whether you need to meet state requirements or get back on the road after a setback, understanding how SR22 insurance works and how to get it online puts you in control.

Keep reading to discover the key steps, top providers, and tips to secure the right SR22 coverage for your needs—without any confusion.

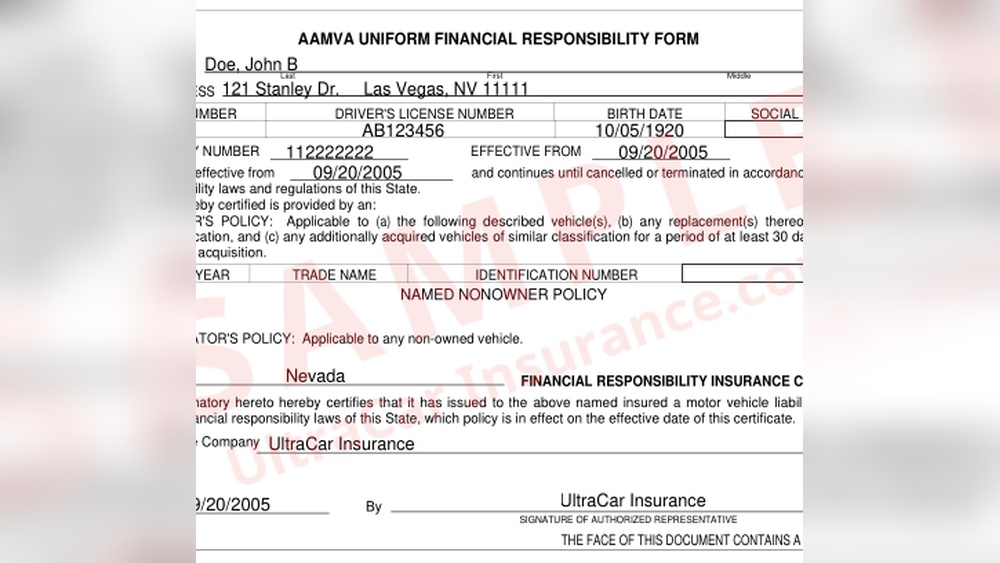

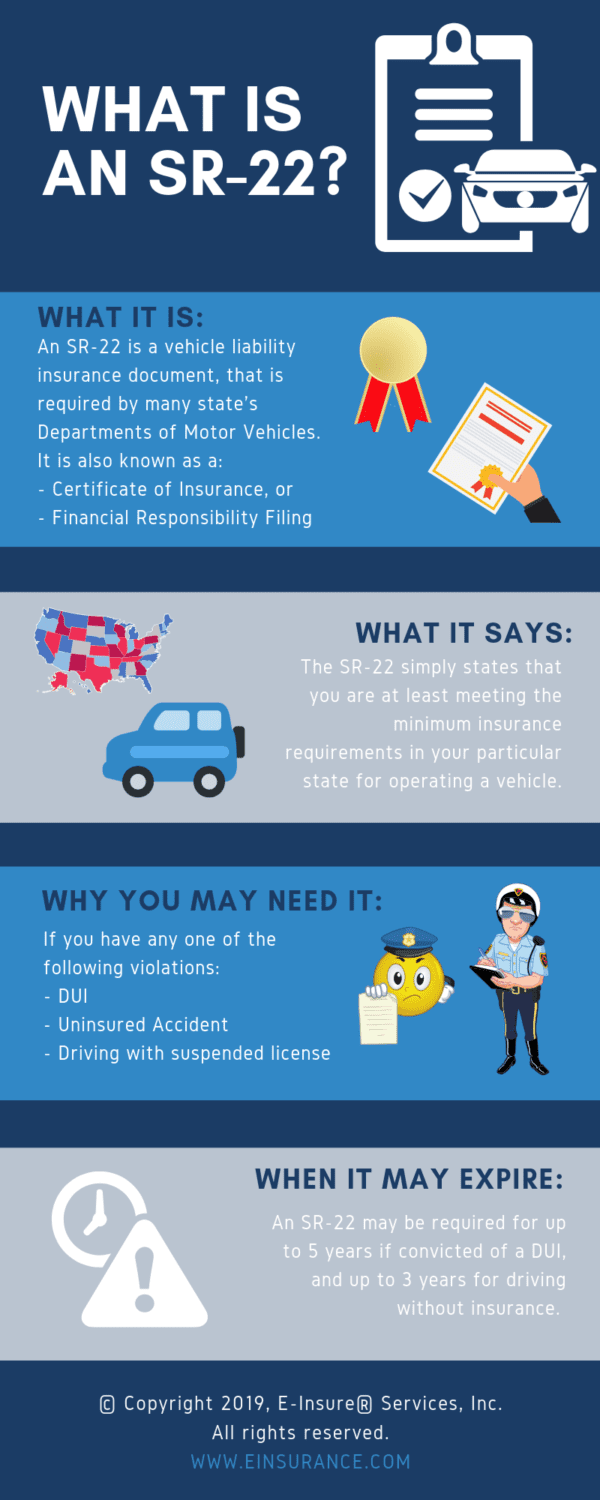

Credit: www.einsurance.com

What Is Sr22 Insurance

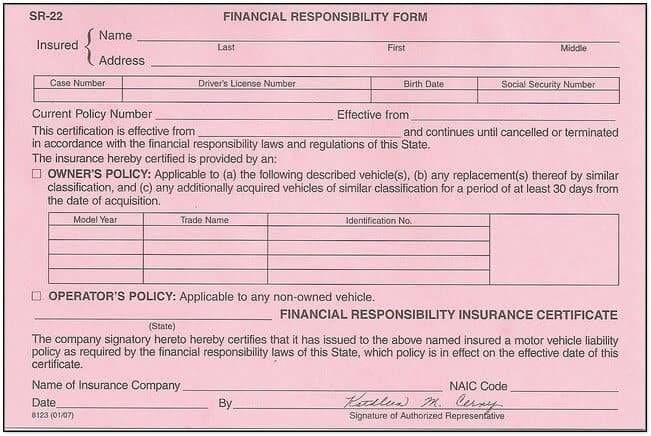

SR22 insurance is not a typical insurance policy. It is a certificate that proves you have the required car insurance. This form is filed by your insurance company with the state’s motor vehicle department. It shows you meet the minimum liability coverage required by law.

Many drivers need SR22 insurance after serious driving violations. The SR22 helps the state keep track of high-risk drivers. Without it, you may lose your driving privileges or face other penalties.

Purpose And Requirements

The main purpose of SR22 insurance is to prove financial responsibility. States require this proof after incidents like DUIs or reckless driving. This ensures drivers carry proper insurance for a set period, usually three years.

Insurance companies must file the SR22 form directly with the state. You cannot file it yourself. If you cancel your insurance, the company must notify the state, which can lead to license suspension.

Who Needs Sr22

Drivers with serious violations often need SR22 insurance. Common reasons include DUI convictions and driving without insurance. Some states require SR22 after a license suspension or revocation.

New drivers with multiple traffic offenses might also need SR22. The court or state decides if you need this certificate. It helps protect other drivers by making sure you have insurance coverage.

How To Get Sr22 Online

Getting an SR22 certificate online is faster and easier than many expect. This document proves you carry the minimum required car insurance. It is often required after serious driving violations. You can complete the entire process without leaving your home. Understanding the steps helps you apply with confidence.

Step-by-step Application

Start by finding an insurance company that offers SR22 filings. Visit their website to fill out an online application form. Provide your personal details and driving history accurately. Choose the coverage that meets your state’s minimum insurance requirements. Submit your application and wait for approval. Once approved, the insurer files the SR22 with the state. You will receive proof of the filing for your records.

Choosing The Right Provider

Select an insurance provider experienced with SR22 filings. Compare prices and coverage options from several companies. Look for a provider that files the SR22 quickly and electronically. Check customer reviews to ensure good service and support. Some insurers specialize in high-risk drivers and SR22 insurance. Pick a company that offers clear communication and easy online management.

Affordable Sr22 Quotes

Finding affordable SR22 insurance quotes is important for many drivers. SR22 insurance is often required after serious driving violations.

Getting the best price helps you meet legal needs without overspending. Comparing different companies can save money and stress.

Top Insurance Companies

Several top companies offer SR22 insurance online. Progressive provides competitive rates and easy online services.

GEICO is known for affordable SR22 quotes and good customer support. The General offers flexible plans tailored to high-risk drivers.

State Farm and Liberty Mutual also provide reliable SR22 coverage with solid financial backing. Checking each can find the best deal.

Factors Affecting Rates

Your driving history strongly influences SR22 insurance costs. More violations mean higher rates.

Age and location also impact prices. Younger drivers or those in cities often pay more.

The type of vehicle and coverage level chosen changes the final quote. Lower coverage limits usually cost less but offer less protection.

Shopping around and providing accurate information helps get better quotes quickly.

Credit: www.maine.gov

Tips For Easy Approval

Getting approved for SR22 insurance online can be simple. Following key tips speeds up the process. Understanding what insurers expect helps you meet their criteria easily.

Preparation and clear information matter. This section covers ways to improve your eligibility and common mistakes to avoid. These tips increase your chances of quick approval.

Improving Your Eligibility

Keep a clean driving record moving forward. Insurers look for recent safe driving habits. Pay all traffic tickets and fines promptly. Unpaid tickets may block your approval.

Provide accurate and complete information on your application. Double-check your details before submitting. Choose coverage limits that meet state minimums. Avoid requesting unnecessary extras that raise costs.

Compare quotes from multiple insurers. Some companies specialize in SR22 filings and offer better rates. Early application helps avoid last-minute rush and delays. Maintain steady contact with your insurer to track application status.

Common Mistakes To Avoid

Do not leave fields blank or give false information. This causes delays or denial. Avoid late payments on premiums. Timely payment keeps your SR22 active and valid.

Do not ignore state requirements for SR22 insurance. Each state has rules about coverage and filing. Missing documents or proof can stop approval. Avoid switching insurers without confirming SR22 filing continuation.

Do not underestimate the importance of communication. Respond quickly to insurer requests for documents. Lack of response can lead to application rejection. Stay organized with all paperwork related to your SR22 insurance.

Sr22 Insurance In Texas

SR22 insurance is a special proof of financial responsibility required in Texas. It shows that a driver carries the state’s minimum car insurance. Texas requires SR22 for drivers with certain violations or license suspensions.

This insurance is not a separate policy but a certificate filed by your insurer. It helps drivers regain or maintain their driving privileges in Texas. Understanding Texas rules for SR22 is important for compliance and avoiding penalties.

State-specific Rules

Texas has unique rules for SR22 insurance. Drivers must carry SR22 for a set period, usually two years. The Texas Department of Public Safety (DPS) decides the length based on the violation.

SR22 applies to violations like DUIs, reckless driving, or driving without insurance. Failure to maintain SR22 can lead to license suspension. Texas requires the insurance company to notify DPS if coverage ends early.

Filing Sr22 With Dps

Your insurance company files the SR22 form directly with the Texas DPS. This filing proves you meet Texas’s insurance requirements. You must keep your policy active during the SR22 period.

If you cancel your insurance, the company must inform DPS immediately. Texas DPS will then suspend your license. Filing SR22 is a simple process but must be done correctly.

Credit: midcolumbiainsurance.com

Benefits Of Online Sr22

Filing for SR22 insurance online offers clear advantages. It simplifies the process and saves valuable time. Managing your SR22 requirements digitally makes things easier and more efficient.

Convenience And Speed

Online SR22 lets you submit your proof of insurance fast. No need to visit an office or mail documents. You can complete everything from home using any device. This speeds up the approval and filing process. Quick submission means you get coverage sooner.

Tracking And Renewals

Online platforms help you track your SR22 status easily. You receive alerts for upcoming renewals or updates. This reduces the risk of forgetting important deadlines. Managing renewals digitally ensures continuous coverage without gaps. Staying informed is simple and hassle-free.

Frequently Asked Questions

What Is Sr22 Insurance Online?

SR22 insurance online is a digital filing proving you have required auto insurance. It’s often needed after driving violations to reinstate your license.

How Do I Get Sr22 Insurance Online?

You get SR22 insurance online by applying through an insurer’s website. Provide your details, purchase a policy, and the insurer files your SR22 electronically.

Can I Compare Sr22 Insurance Rates Online?

Yes, you can compare SR22 insurance rates online using comparison tools or insurer websites. This helps find the best price and coverage for your needs.

How Long Do I Need Sr22 Insurance Online?

Typically, SR22 insurance is required for 1 to 3 years. Duration varies by state and the reason for your SR22 filing.

Conclusion

Choosing SR22 insurance online saves time and offers convenience. Compare different providers to find the best rates. Make sure to provide accurate information during your application. Keep your SR22 filing active to avoid penalties. Stay informed about Texas insurance requirements and deadlines.

Online SR22 insurance helps you regain driving privileges faster. Act carefully and stay protected on the road.