If you’re running a business, you already know how important it is to protect yourself from unexpected risks. But have you checked how much general liability insurance could cost you?

Finding the right coverage at the right price isn’t always easy, and that’s where getting multiple general liability insurance quotes can make a huge difference. By comparing quotes, you gain the power to choose a plan that fits your unique needs and budget.

You’ll discover what affects those quotes, how to get the best rates, and why this insurance is a must-have for your business’s safety. Keep reading—your business’s future could depend on it.

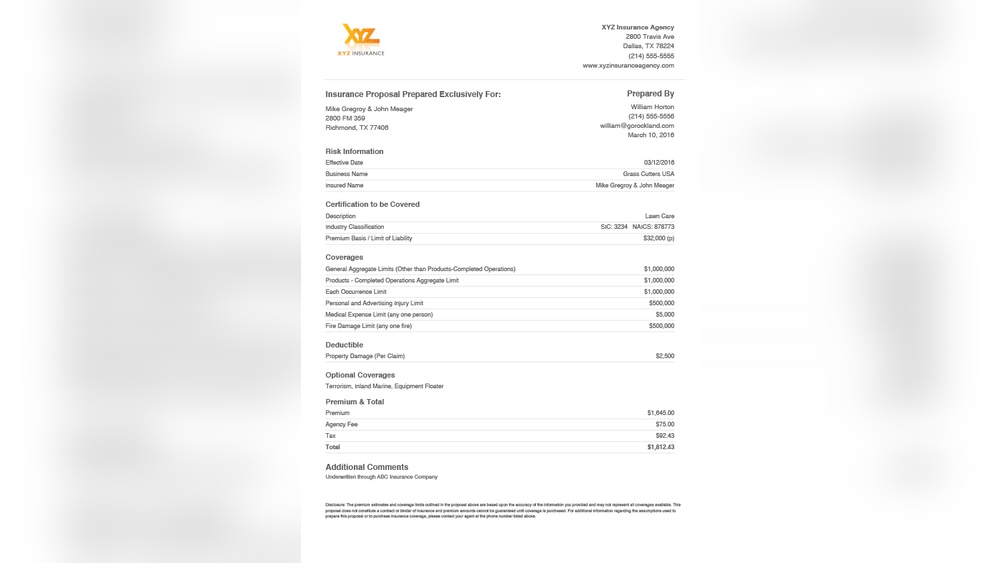

Credit: www.123formbuilder.com

How General Liability Insurance Works

General liability insurance protects businesses from financial loss. It covers claims of injury or damage caused by the business operations. The insurance steps in to pay for legal fees, settlements, or judgments. This coverage helps businesses stay safe from unexpected costs. Understanding how general liability insurance works is key to choosing the right policy.

Key Coverage Areas

General liability insurance covers bodily injury to customers or others on your property. It also covers property damage caused by your business activities. Legal defense costs are included, even if claims are false. Advertising injury, such as libel or slander, is often protected. Some policies cover medical payments for minor injuries. This insurance protects your business from many common risks.

Who Needs It

Small businesses benefit from this insurance the most. Any business interacting with customers or clients should consider it. Contractors, retailers, and service providers face many liability risks. Even home-based businesses can be vulnerable. It is essential for businesses of all sizes to have protection. Lenders and clients may require proof of coverage before working together.

Factors Affecting Quote Prices

Several key factors influence the price of general liability insurance quotes. Understanding these can help businesses anticipate their costs and manage their risks better.

Each business has unique characteristics that insurers assess. These characteristics shape the risk profile and directly affect the premium rates offered.

Industry Risk Levels

Different industries face varying levels of risk. High-risk sectors like construction or restaurants often pay more. Lower-risk industries such as consulting or retail usually have lower rates. Insurers evaluate the chance of accidents or claims in each industry.

Business Location Impact

The location of a business affects insurance costs. Areas with higher crime or accident rates may lead to higher premiums. Local laws and regulations can also influence pricing. Urban businesses often face different risks than rural ones.

Employee Count Influence

Businesses with more employees may pay higher premiums. More workers increase the chance of accidents or claims. Insurers consider employee numbers when calculating risk. Smaller teams often benefit from lower insurance costs.

Revenue Considerations

Higher revenue can mean higher insurance rates. More income usually means more business activity and exposure. Insurers use revenue to estimate the scale of operations. Larger businesses often have bigger risks to cover.

Claims History Effect

A history of past claims raises insurance costs. Frequent or severe claims suggest higher future risk. Insurers review claim records before quoting prices. A clean claims history helps keep premiums low.

Average Costs By Industry

General liability insurance costs differ widely based on the industry. Each sector faces unique risks that affect insurance pricing. Understanding average costs by industry helps businesses budget wisely. It also clarifies what to expect when requesting quotes.

Consulting And Professional Services

Consulting firms usually pay lower premiums. The average annual cost ranges near $700. Risks mostly involve advice-related claims. Physical damages or injuries are rare in this sector. Insurance providers consider it a low-risk industry.

Retail Businesses

Retail stores face moderate risks like customer injuries or property damage. Average annual premiums are about $710. Larger stores with higher foot traffic pay more. Inventory and equipment also raise the cost. Insurers weigh these factors carefully.

Restaurants And Food Services

Restaurants have higher insurance costs than many other businesses. Average premiums run around $1,350 per year. The risk of foodborne illness or accidents is higher. Kitchen fires and customer injuries increase claims. Insurance companies set rates accordingly.

Manufacturing And Production

Manufacturers often pay less than restaurants but more than consultants. Average yearly premiums hover near $620. Risks include machinery accidents and product liability. Safety measures can reduce insurance costs. Insurers assess production type and scale closely.

Ways To Lower Your Premium

Finding ways to lower your general liability insurance premium helps save money. Small changes in your policy or business practices can reduce costs. Focus on smart decisions that protect your business and budget.

Choosing The Right Coverage Limits

Select coverage limits that fit your actual business needs. Avoid paying for extra protection you do not require. Assess risks carefully and choose limits that balance safety and cost. Lower limits usually mean lower premiums but consider potential exposure.

Implementing Safety Measures

Install safety equipment and train employees regularly. Reduce workplace accidents with clear rules and proper gear. Insurance companies reward businesses that show strong safety programs. Safer businesses face fewer claims and pay less for coverage.

Bundling Policies

Combine general liability insurance with other policies like property or workers’ compensation. Insurers often offer discounts for bundled coverage. Bundling simplifies management and lowers the total premium. Check with your provider about available package deals.

Maintaining A Clean Claims Record

Avoid making frequent or small insurance claims. A clean claims history signals less risk to insurers. Over time, this can lead to premium reductions. Handle minor issues without filing claims to protect your record.

Comparing Top Insurance Providers

Choosing the right general liability insurance provider can save money and stress. Comparing top insurance companies helps find the best fit for your needs. Each company offers different coverage options and pricing. This section breaks down key providers and what they offer.

Thimble

Thimble offers flexible short-term general liability insurance. It suits small businesses and freelancers. Customers can buy coverage by the hour, day, or month. The process is fast and fully online. Rates start low, making it affordable for new businesses.

Biberk

biBERK focuses on straightforward policies for small businesses. Its quotes are competitive and clear. The company provides easy online applications and fast approvals. biBERK covers many industries, including contractors and retail shops. Their customer service is known for being helpful and responsive.

Hiscox

Hiscox specializes in small business insurance with customizable plans. It offers both online and phone support. Hiscox covers a wide range of professions, including consultants and creative agencies. The company has a strong reputation for handling claims efficiently. Pricing is competitive for the coverage provided.

Chubb

Chubb targets larger businesses and high-value clients. It offers broad coverage with high limits. The company excels in risk management and personalized service. Chubb’s policies include specialized endorsements for unique business needs. Premiums tend to be higher but reflect the extensive coverage.

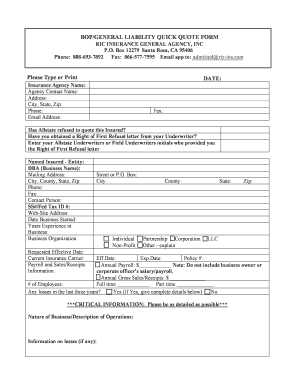

Credit: www.signnow.com

Obtaining Quotes Without Formal Business Setup

Obtaining general liability insurance quotes without a formal business setup is possible. Many individuals start their ventures without forming an official company. They still need protection from risks and liabilities. Insurance providers offer options that fit this situation. Understanding these options can help secure the right coverage early on.

Sole Proprietor Options

Sole proprietors can get general liability insurance easily. Insurance companies recognize this business structure. It requires no formal registration or complex paperwork. Quotes are based on the business activities and risk level. This insurance covers accidents, damages, or injuries related to the business. It offers peace of mind for solo entrepreneurs.

Insurance Without Llc Or License

Insurance policies do not always require an LLC or business license. Many insurers offer coverage to individuals without formal business proof. Applicants must provide details about their work and location. The insurer assesses risk and provides a suitable quote. This option suits freelancers, consultants, and home-based workers. It helps them stay protected while building their business.

Common Misconceptions About Coverage

Many business owners believe general liability insurance covers all risks. This misunderstanding can lead to costly surprises. Knowing what general liability insurance covers helps protect your business better. Clear knowledge avoids gaps in protection and unexpected expenses.

Difference Between General And Professional Liability

General liability insurance protects against physical injury and property damage claims. It covers accidents that happen on your business property or caused by your products. Professional liability insurance, also called errors and omissions insurance, covers mistakes in professional services. It protects against claims of negligence, errors, or failure to perform professional duties. These two types of insurance serve different purposes. Relying on one instead of both can leave your business vulnerable.

Coverage Gaps To Watch

General liability insurance does not cover everything. Many policies exclude damage to your own property or professional mistakes. Some policies have limits on certain claims like pollution or cyber risks. Watch for gaps in coverage related to contract disputes, employee injuries, and data breaches. Understanding these gaps helps you choose additional policies if needed. Avoid assuming that one policy covers all your business risks.

Credit: floridaallrisk.com

Frequently Asked Questions

Who Has The Cheapest General Liability Insurance?

Thimble offers some of the cheapest general liability insurance, averaging $107 monthly. Rates vary by industry, location, and business size.

What Is The Average Cost For General Liability Insurance?

The average cost for general liability insurance ranges from $400 to $1,500 annually. Rates vary by industry, location, and business size.

How Much Does A $1,000,000 Liability Insurance Policy Cost?

A $1,000,000 liability insurance policy typically costs between $400 and $1,500 annually. Rates vary by industry, location, and risk factors.

Can You Get General Liability Insurance Without An Llc?

Yes, you can get general liability insurance without an LLC. Sole proprietors and freelancers often obtain coverage.

Conclusion

General liability insurance quotes help protect your business from risks. Comparing quotes saves money and finds the best coverage. Costs depend on your industry, location, and business size. Understanding these factors helps you make smart choices. Always review policy details before deciding.

Protecting your business is important for peace of mind. Take time to choose a policy that fits your needs. This simple step can prevent costly surprises later.