Thinking about financing your next car? A Bank of America Auto Loan might be exactly what you need to drive away with confidence.

Whether you’re buying new, used, or looking to refinance, understanding how this loan works can save you time and money. You’ll discover how to secure competitive rates, what steps to follow, and tips to make the process smooth and stress-free.

Ready to find out if a Bank of America Auto Loan fits your needs? Let’s dive in and get you closer to your perfect ride.

Credit: info.bankofamerica.com

Loan Options

Bank of America offers various auto loan options to fit different needs. These loans help you finance new or used cars, refinance existing loans, or buy out a lease. The process is simple and the rates are competitive. Choose the best loan type for your situation to save money and drive your dream car.

New Car Loans

New car loans at Bank of America come with competitive interest rates. You can finance the full price or a portion of your new vehicle. The loan terms are flexible, helping you manage monthly payments easily. Bank of America works with many dealers to simplify your purchase.

Used Car Loans

Used car loans provide affordable options for pre-owned vehicles. Bank of America offers rates that reflect the vehicle’s age and condition. You can borrow to cover the cost of a reliable used car. The application process is quick and can be done online.

Refinancing Options

Refinancing your current auto loan can lower your monthly payments. Bank of America lets you replace your existing loan with better terms. You may reduce your interest rate or extend the loan period. This option can save money over time and improve your cash flow.

Lease Buyout

Lease buyout loans let you own your leased vehicle. Bank of America offers financing to pay off the lease balance. You can keep the car without a large upfront payment. This option is convenient if you want to avoid leasing again.

Credit: www.bankofamerica.com

Interest Rates

Interest rates play a crucial role in any auto loan decision. They affect your monthly payments and the total cost of the vehicle. Bank of America offers competitive rates designed to fit different budgets and credit profiles. Understanding these rates helps you plan your car purchase better.

Current Rate Ranges

Bank of America’s auto loan rates vary based on several factors. These include the loan term, the type of car, and your credit score. Rates for new cars typically start lower than rates for used vehicles. For buyers with strong credit, rates may fall closer to the lower end of the range. Loan terms usually range from 24 to 72 months, which also influences the rate you receive.

Preferred Rewards Discounts

Preferred Rewards members can enjoy special interest rate discounts. These discounts reduce your rate by a few percentage points. The amount depends on your rewards tier with Bank of America. This program rewards loyal customers and helps save money over the life of the loan. It’s a good reason to consider banking with them if you plan to finance a car.

Rate Lock Features

Bank of America offers a rate lock feature to protect you from rising rates. This means you can secure your interest rate before finalizing the loan. It gives peace of mind during the car buying process. Rate locks usually last for a set period, allowing time to complete your purchase. This feature helps avoid surprises and keeps your budget steady.

Application Process

The application process for a Bank of America auto loan is simple and clear. It helps you get the car you want with ease. You can complete the application from the comfort of your home. The steps are straightforward and user-friendly. Understanding the process can save you time and effort.

Online Application Steps

Start by visiting the Bank of America auto loans page. Click on the application link to begin. Fill in your personal information accurately. Enter details about the car you wish to buy. Provide your income and employment information. Review your entries before submitting the form. The system will quickly process your application. You will receive a decision in minutes.

Prequalification Benefits

Prequalification shows you your loan options without affecting credit scores. It helps estimate your loan amount and monthly payments. You can shop for cars with confidence. It speeds up the final approval process. Prequalification also reveals possible interest rates. It gives you a clear idea of your budget. This step is free and takes only a few minutes.

Required Documents

Have these documents ready to avoid delays. A valid government-issued ID is necessary. Proof of income, such as pay stubs, helps verify your earnings. Recent bank statements may be requested. Vehicle information, including make, model, and year, is needed. Proof of residence, like a utility bill, is often required. Keep your Social Security number handy for credit checks. Preparing these documents early makes the process smoother.

Approval Criteria

Getting approved for a Bank of America auto loan depends on several key factors. The bank reviews your financial background and the vehicle details carefully. Meeting the approval criteria can help secure a loan with competitive rates. Below are the main elements Bank of America considers before approval.

Credit Score Requirements

Bank of America prefers applicants with a good credit score. A higher score increases your chances of approval. Scores above 700 are generally viewed favorably. Lower scores might still qualify but could face higher interest rates. The bank looks for a history of on-time payments and responsible credit use.

Income Verification

The bank requires proof of steady income. This helps confirm your ability to repay the loan. Pay stubs, tax returns, or bank statements can serve as evidence. Self-employed applicants may need to provide additional documents. Consistent income reassures the lender about your financial stability.

Vehicle Eligibility

The vehicle must meet Bank of America’s guidelines. New and used cars can qualify, but certain age and mileage limits apply. The bank usually finances vehicles in good condition. Some models or vehicles with salvage titles may be excluded. Clear vehicle details and a valid purchase agreement are essential.

Loan Management

Managing your Bank of America auto loan is simple and convenient. The bank offers tools and services to help you stay in control of your loan. Understanding how to access your account, make payments, and handle payoff procedures is key to smooth loan management.

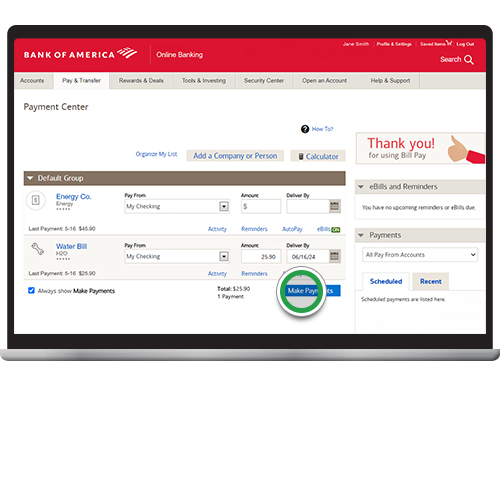

Online Account Access

Bank of America provides easy online access to your auto loan account. You can view your loan balance, payment history, and interest details anytime. The online platform is secure and user-friendly, allowing you to manage your loan from any device. Checking your loan status online helps you stay updated and avoid missed payments.

Payment Options

Several payment methods are available for your Bank of America auto loan. You can pay online through the bank’s website or mobile app. Automatic payments can be set up to avoid late fees. Payments by phone or mail are also accepted. Flexible options make it easier to keep your loan on track.

Payoff Procedures

Paying off your auto loan early is straightforward with Bank of America. You can request a payoff quote online or by phone. The quote shows the exact amount needed to clear your loan. After payment, you receive confirmation and release of lien documents. Early payoff may save you interest costs and improve your credit.

:fill(white):max_bytes(150000):strip_icc()/bofa_lo2_rgb_Digital-20d4dc2ee16d4412a0722dd5923c13e7.jpg)

Credit: www.investopedia.com

Customer Support

Bank of America offers strong customer support for auto loan borrowers. Support helps customers at every step of the loan process. Whether you need answers, assistance, or guidance, help is easy to find. The bank provides clear contact options, useful tools, and detailed information. This makes borrowing and managing your auto loan simpler and stress-free.

Contact Channels

Bank of America provides several contact methods. You can call their toll-free number for direct help. Online chat is also available for quick questions. Email support offers detailed responses when needed. Customers can visit local branches for face-to-face assistance. Each channel aims to resolve issues fast and clearly. Support is available during business hours and sometimes beyond. This ensures customers get help when they need it most.

Dealer Locator Tool

The Dealer Locator Tool helps find nearby car dealers. Enter your zip code or city to see a list of dealers. This tool saves time by showing approved dealers. It connects you with sellers who work with Bank of America loans. The tool is easy to use and accessible online. It supports a smooth car buying experience. Knowing where to go makes loan approval faster and easier.

Frequently Asked Questions

Bank of America offers a detailed FAQ section. It covers common topics like loan rates, payments, and refinancing. Customers find quick answers without needing to call. The FAQ explains steps to apply for a loan. It describes how to check your loan status online. This section helps customers understand their loan terms better. Clear and simple answers reduce confusion and save time.

Benefits And Perks

Choosing the right auto loan can make buying a car easier and less stressful. Bank of America Auto Loan offers several benefits and perks that help you save money and provide peace of mind. These features make the loan process smooth and secure.

No-fee Application

Bank of America does not charge any fees to apply for an auto loan. You can complete the application online without paying upfront costs. This saves you money and lets you explore your loan options freely. No surprises or hidden charges appear during the process.

Secure Loan Signing

The loan signing process uses strong security measures to protect your information. Bank of America ensures your personal data stays safe during the application and approval steps. This gives you confidence that your loan details remain private and secure.

Competitive Loan Terms

Bank of America offers loan terms with competitive interest rates and flexible repayment plans. These terms help lower your monthly payments and reduce overall loan costs. You can choose a loan that fits your budget and drives your financial goals forward.

Frequently Asked Questions

Is It Good To Finance A Car Through Bank Of America?

Bank of America offers competitive auto loan rates and easy online applications. Preferred Rewards members get interest discounts. It suits buyers seeking reliable financing with quick decisions and secure processing.

How Do I Access My Bank Of America Car Loan?

Access your Bank of America car loan by logging into Online Banking. Select your loan account on the Accounts Overview page to view details. You can also call the toll-free number on your statement for assistance.

How Much Is A $25,000 Car Loan For 72 Months?

A $25,000 car loan for 72 months typically costs about $400 monthly. Exact payment depends on interest rates.

What Are Bank Of America Auto Rates?

Bank of America auto loan rates vary based on credit, loan term, and vehicle type. Rates start as low as competitive market offers. Preferred Rewards clients may get discounts. Check current rates online or apply for prequalification to lock your rate quickly and securely.

Conclusion

Bank of America Auto Loans offer clear options for buying or refinancing cars. They provide competitive rates that fit many budgets. Applying online is simple and quick, with no hidden fees. Managing your loan is easy through their online banking system.

This loan can suit buyers who want straightforward terms and reliable service. Consider your needs and see if this loan matches your car plans. Choosing the right loan helps keep your finances on track. Bank of America makes the car buying process easier for many people.