If you run a business or even just want to protect yourself from unexpected mishaps, understanding general liability insurance is a must. Imagine this: someone slips inside your store or your product causes damage—without the right coverage, you could be facing costly bills and legal headaches.

But what exactly does general liability insurance cover, and how can it shield your finances? You’ll discover the simple truth about how this insurance works, why it’s essential for your peace of mind, and how it can save you from financial disaster.

Keep reading to learn how to protect what matters most to you.

What General Liability Covers

General Liability Insurance protects businesses from common risks. It covers costs tied to accidents, injuries, and damages involving third parties. Understanding what this insurance covers helps businesses stay prepared and avoid financial loss. Below are key protections offered by General Liability Insurance.

Bodily Injury Protection

This coverage pays for injuries that others suffer on your property or because of your business operations. It includes medical bills, hospital stays, and lost wages. For example, if a customer slips and falls, this insurance helps cover their medical costs.

Property Damage Coverage

This part covers damage your business causes to someone else’s property. It can include repairs or replacement of vehicles, buildings, or equipment. If your employee accidentally breaks a client’s window, this coverage handles the repair costs.

Legal Defense Costs

Legal fees can be expensive. General Liability Insurance pays for your defense if someone sues your business. This includes lawyer fees, court costs, and settlements up to your policy limits. You get help managing legal risks without huge out-of-pocket expenses.

Medical And Rehabilitation Expenses

This coverage helps pay for medical treatment and rehabilitation if someone is hurt due to your business activities. It supports recovery costs like therapy or medical devices. This ensures injured parties get proper care while protecting your business finances.

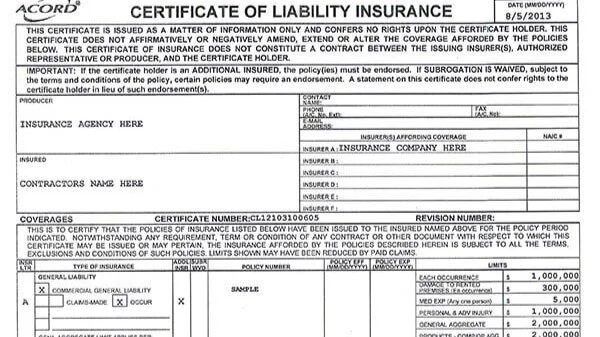

:max_bytes(150000):strip_icc()/Commercial-General-Liability-Final-51e0c0f9b27d4e409a7f49da59fbe037.jpg)

Credit: www.investopedia.com

How Liability Insurance Works

Understanding how general liability insurance works helps protect your business and personal assets. This insurance covers costs related to injuries or damage you cause to others. It steps in after an incident occurs and you are found responsible. The process involves several key steps, from the initial event to payments and your duties as the policyholder.

Incident Occurrence

An incident happens that causes injury or damage. This could be a slip-and-fall at your business or damage to someone’s property. Sometimes, a lawsuit follows the incident. The event triggers the insurance coverage, starting the claim process.

Fault Investigation

The insurance company investigates to see who caused the incident. They check facts and documents to determine fault. If you are not at fault, the claim may be denied. If you are responsible, the insurer moves to cover costs.

Claims Process

Once fault is confirmed, you or the injured party files a claim. The insurer reviews the claim details carefully. They may ask for more information or evidence. The insurer then decides how much to pay based on the policy terms.

Payments And Limits

The insurance pays for medical bills, repairs, and legal fees. Payments only go up to the coverage limits in your policy. If costs exceed those limits, you pay the extra amount. Limits protect the insurer and help you understand your financial exposure.

Policyholder Responsibilities

You must report incidents promptly to your insurer. Provide all requested information honestly and quickly. Cooperate with investigations and legal processes. Pay your premiums on time to keep coverage active. Following these steps ensures smooth claim handling.

Types Of Liability Insurance

Liability insurance protects individuals and businesses from financial losses. It covers costs linked to injuries or damages caused to others. Different types exist to match various risks and needs. Understanding these types helps in choosing the right coverage.

General Business Liability

This insurance covers common risks for businesses. It protects against claims of bodily injury and property damage. For example, if a customer slips in your store, this policy helps cover medical bills. It also pays legal fees if you face a lawsuit. Almost every business benefits from this coverage.

Auto Liability

Auto liability insurance covers damages from car accidents you cause. It pays for injuries to other drivers and passengers. It also covers damage to their vehicles or property. Most states require this insurance by law. It protects your finances from costly accident claims.

Professional Liability

Also called errors and omissions insurance, this covers mistakes in professional services. It protects against claims of negligence or poor advice. For example, a consultant or doctor may need this coverage. It pays legal fees and damages if clients sue you.

Product Liability

This insurance protects manufacturers and sellers from claims related to their products. It covers injuries or damages caused by defective products. If a product harms a customer, this policy helps pay for damages. It is essential for businesses that make or sell goods.

Benefits For Businesses In Austin, Texas

General Liability Insurance offers clear benefits for businesses in Austin, Texas. It helps protect companies from unexpected legal and financial troubles. Local businesses gain peace of mind by having coverage that meets city and state needs. This insurance also supports risk control and improves business stability.

Local Legal Requirements

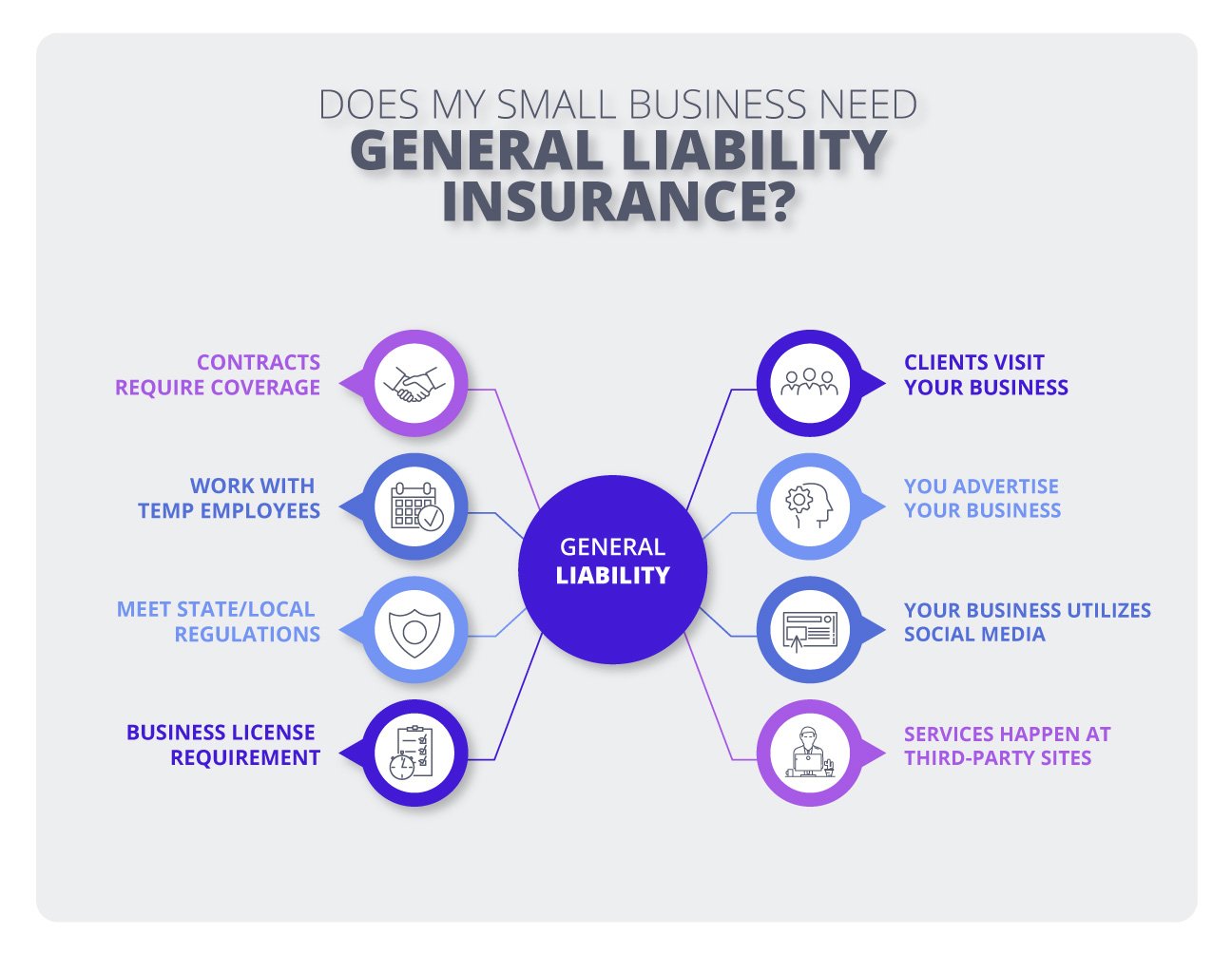

Austin businesses must follow Texas laws on liability insurance. General Liability Insurance helps meet these legal rules. Having the right coverage avoids fines and legal problems. It shows that a business respects local regulations. This builds trust with customers and government agencies.

Risk Management

General Liability Insurance reduces risks from accidents or injuries. It covers claims like property damage or bodily injury. This protection lowers the chance of big financial losses. Businesses can focus on growth without fear of costly lawsuits. Insurance companies also offer advice to improve safety practices.

Financial Security

This insurance protects business assets from damage claims. It pays for medical bills, repairs, and legal fees. Without coverage, these costs come directly from business funds. Insurance keeps companies stable during unexpected events. It prevents bankruptcy caused by large liability claims.

Competitive Advantage

Businesses with General Liability Insurance appear more reliable. Customers prefer companies that show responsibility and care. Insurance coverage can be a deciding factor in winning contracts. It enhances the business reputation in Austin’s competitive market. This advantage helps attract and keep loyal clients.

Choosing The Right Policy

Choosing the right general liability insurance policy is a critical step for any business. It ensures protection against financial losses from claims of injury or damage. Selecting the best policy means understanding your business needs and risk exposures.

A well-chosen policy offers peace of mind. It covers legal costs and damages, letting you focus on growth without worry.

Assessing Business Risks

Start by identifying risks specific to your business. Consider customer interactions, work environments, and products offered. Think about common accidents or lawsuits in your industry. Knowing these risks helps tailor your insurance coverage.

Coverage Limits And Options

Check the coverage limits carefully. Higher limits provide more protection but cost more. Look at what the policy covers, such as bodily injury, property damage, and legal fees. Some policies include extras like product liability or advertising injury. Match options to your risk level.

Working With Insurance Agencies

Choose experienced insurance agents who understand your business type. They can explain complex terms simply and help you compare policies. Good agents offer personalized advice and support during claims. Building a relationship with your agent adds value.

Cost Considerations

Balance cost with coverage needs. Cheapest policies may lack essential protections. Request quotes from multiple insurers to find competitive rates. Consider deductibles and payment plans too. Invest wisely to avoid gaps in coverage.

Common Claims And How To Avoid Them

General Liability Insurance protects businesses from many risks. Some claims happen more often than others. Knowing common claims helps prevent costly problems. Simple actions reduce risks and keep your business safe.

This section explains common claims and ways to avoid them.

Slip-and-fall Incidents

Slip-and-fall accidents cause many injury claims. Wet floors, uneven surfaces, and clutter increase risks. Keep floors clean and dry. Use warning signs for wet or slippery areas. Fix broken steps and handrails quickly. Proper lighting helps people see hazards clearly.

Property Damage Claims

Property damage happens when your business harms someone else’s property. This can include broken windows or damaged equipment. Train staff to handle items carefully. Use protective barriers around fragile things. Regularly inspect your property for risks. Address issues before they cause damage.

Defamation And Libel Issues

Defamation and libel claims arise from false statements hurting reputations. Avoid making untrue or harmful comments about others. Check facts before sharing information. Use clear and respectful communication. Educate employees about legal risks of slander and libel.

Professional Errors

Professional errors occur when mistakes cause client loss or injury. Stay updated on industry standards and best practices. Double-check work before delivery. Use clear contracts to set expectations. Train employees regularly to reduce errors and improve service quality.

Filing A Claim Step-by-step

Filing a general liability insurance claim can feel complex. Knowing each step clears confusion and speeds the process. Follow this guide to file your claim smoothly and effectively.

Reporting The Incident

Report the incident to your insurance company as soon as possible. Use their preferred contact method, such as phone or online form. Provide clear and accurate details about what happened. This initial report starts the claim process.

Documentation Needed

Gather all necessary documents to support your claim. Include photos of damages, police reports, and witness statements. Keep receipts for any related expenses. Proper documentation helps your insurer assess your claim quickly.

Working With Adjusters

An insurance adjuster will contact you to investigate the claim. They may visit the site or ask for more information. Be honest and cooperative during this process. The adjuster evaluates the damage and determines your coverage.

Resolution And Payment

Once the adjuster finishes, the insurer reviews their report. They decide if your claim is approved or denied. If approved, you receive payment based on your policy limits. Use the funds to cover damages or legal costs.

Credit: www.growgreeninsurance.com

Impact Of Liability Insurance On Business Growth

General liability insurance plays a crucial role in business growth. It protects companies from financial losses due to lawsuits or accidents. This protection allows business owners to focus on expansion and operations without fear of major risks. Liability insurance also helps businesses build credibility and meet legal and contractual obligations.

Building Customer Trust

Customers feel safer working with insured businesses. Liability insurance shows a company is responsible and prepared. This trust encourages clients to choose your services over others. It reassures customers that any accidents or damages will be covered. Trust leads to long-term relationships and repeat business.

Meeting Contract Requirements

Many contracts require proof of liability insurance. This is common in partnerships, leases, and supplier agreements. Having insurance helps businesses qualify for more contracts. It removes barriers and opens doors to new opportunities. Without insurance, many deals and projects may be lost.

Supporting Business Expansion

Liability insurance supports growth by reducing financial risks. Expanding businesses face more exposure to accidents and claims. Insurance covers legal fees and damages, preventing costly disruptions. This financial safety net allows owners to invest confidently. Growth becomes more manageable and less risky.

Protecting Business Assets

Insurance protects a business’s money and property. Lawsuits or accidents can drain resources quickly. Liability insurance pays for damages and legal costs. This protection keeps assets safe and the business stable. It ensures the company can recover and continue operating.

Credit: www.insureon.com

Frequently Asked Questions

What Is General Liability In Insurance?

General liability insurance protects businesses against claims of bodily injury, property damage, and legal costs from accidents or negligence. It covers medical expenses, repairs, and legal fees up to policy limits, helping safeguard your assets from lawsuits or damages caused to others.

How Much Is A $1,000,000 General Liability Policy?

A $1,000,000 general liability policy typically costs between $400 and $1,500 annually. Prices vary by business type, location, and risk factors.

Do I Need General Liability Insurance If I Have An Llc?

An LLC does not replace general liability insurance. This insurance protects your business from third-party claims like injuries or property damage. It helps cover legal fees and settlements. Many clients and contracts may require it, making it essential for safeguarding your assets and business reputation.

How Much General Liability Insurance Do I Need For A Small Business?

Small businesses typically need $1 million per occurrence and $2 million aggregate in general liability insurance. Coverage depends on industry risks and location. Consult an insurance agent in Austin, Texas, for tailored advice and competitive rates. This protects against bodily injury, property damage, and legal costs.

Conclusion

General liability insurance protects your business from many risks. It covers injuries, property damage, and legal costs. Without it, you risk paying large bills out of pocket. Choosing the right coverage helps keep your business safe. Always review your policy to match your needs.

This insurance gives peace of mind and financial security. Stay informed and prepared to handle unexpected events well.